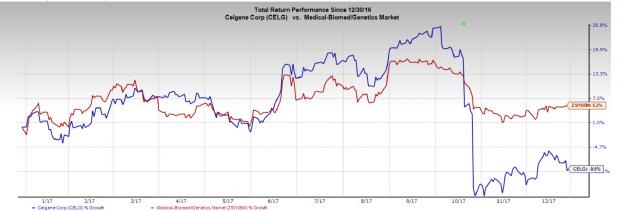

Shares of Celgene Corporation (NASDAQ:CELG) have declined 9.5% in 2017 as against the industry’s gain of 5.2%.

Celgene suffered a series of setbacks over the last few months. The company suffered a setback last week when a late stage study on its lead cancer drug Revlimid in combination with Roche Holdings’ (OTC:RHHBY) Rituxan failed.

The study evaluated Revlimid plus Rituxan (R2) followed by R2 maintenance compared with the standard of care featuring Rituxan plus chemotherapy (R-CHOP, R-bendamustine or R-VN CVP) followed by Rituxan maintenance for previously untreated follicular lymphoma.

However, the R2 treatment arm could not achieve superiority in the co-primary endpoints of complete response or unconfirmed complete response CR/CRu) at 120 weeks and in terms of progression-free survival (PFS) observed during the pre-planned analysis. None of the arms proved superior for either of the co-primary endpoints. Meanwhile, an additional analysis of the trial is underway.

Celgene’s key growth engine is Revlimid. In 2016, the drug’s worldwide sales increased 20% to $7.0 billion and contributed almost 62.1% of the total revenues. Revlimid, an oral immunomodulatory drug, is currently approved for several indications including MM, myelodysplastic syndromes and mantle cell lymphoma.

The failure of the study is disappointing. The drug’s label expansion would have boosted its sales potential. The company had expected lymphoma to increase Revlimid’s growth prospects by 2020 and beyond.

The company's portfolio also includes Pomalyst/Imnovid, Abraxane, Otezla, Istodax, Vidaza and Thalomid/Thalidomide. However, Abraxane sales are under pressure due to a highly competitive U.S. market for lung and breast cancer therapy. In this scenario, dependence on Revlimid has its inherent risks.

In addition, in October 2017, the company announced a phase III trial, REVOLVE, (CD-002) on pipeline candidate GED-0301 in Crohn’s disease and the extension trial, SUSTAIN (CD-004) were discontinued following a recommendation from the Data Monitoring Committee, which assessed overall benefit/risk during a recent interim futility analysis.

Meanwhile, the deep yet persistently slow growth of the psoriatic arthritis and psoriasis markets, especially during the entire third quarter, has led to a weak performance of Otezla. Consequently, the company also reduced its annual guidance. The challenging market conditions were driven by an increasingly restrictive PBM formulary control.

These factors will remain a hangover on the company’s shares in 2018 as well.

On a positive note, in August 2017, the company obtained an FDA approval for Idhifa for treatment of relapsed and/or refractory acute myeloid leukemia with isocitrate dehydrogenase 2 (IDH2) mutation. The drug was developed in partnership with Agios Pharmaceuticals, Inc (NASDAQ:AGIO) . We expect Celgene to look out for strategic acquisitions on the same note as bigwigs like Gilead Sciences, Inc. (NASDAQ:GILD) to aid the top line.

Zacks Rank

Celgene currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Agios Pharmaceuticals, Inc. (AGIO): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Original post

Zacks Investment Research