Celgene Corporation (NASDAQ:CELG) announced that the FDA put a hold on several trials in the FUSION program. Partial clinical hold has been put on five trials and a full clinical hold on one trial.

The trials are evaluating Imfinzi (durvalumab), an anti-PD-L1 antibody, in combination with immunomodulatory and chemotherapy agents in blood cancers such as multiple myeloma, chronic lymphocytic leukemia and lymphoma.

The FDA has placed a hold on these trials due to risks identified in other trials for an anti-PD-1 antibody, Merck & Co.’s (NYSE:MRK) Keytruda, in patients with multiple myeloma in combination with immunomodulatory agents.

As a result, no new patients will be enroled in the trial. Nevertheless, patients enroled in the trials on partial hold and those receiving clinical benefit from the same as determined by the investigator, may remain under treatment. Patients enroled in the trial on full clinical hold will be discontinued from treatment.

We remind investors that Celgene entered into a strategic collaboration with AstraZeneca PLC's (NYSE:AZN) MedImmune in April 2015 to develop and commercialize Imfinzi for hematologic malignancies in combination with Revlimid, Pomalyst, Vidaza and others.

The trials placed on partial clinical hold are MEDI4736-MM-001, MEDI4736-MM-003, MEDI4736-MM-005, MEDI4736-NHL-001, and MEDI4736-DLBCL-001. The trial placed on full hold include MEDI4736-MM-002.

Earlier in the week, the FDA also put a partial clinical hold on Bristol-Myers Squibb Company’s (BMY) three clinical trials — CA209602 (CheckMate-602), CA209039 (CheckMate-039) and CA204142 for the same reason.

We note that in July 2017, the FDA placed a clinical hold on KEYNOTE-183, KEYNOTE-185 and KEYNOTE-023, three combination studies of Keytruda in multiple myeloma. The decision was taken following a review of data by the Data Monitoring Committee in which higher deaths were reported in the Keytruda arms of KEYNOTE-183 and KEYNOTE-185 leading to a halt in enrolment.

The news comes as a major setback as label expansion of these drugs might have boosted Celgene’s top line.

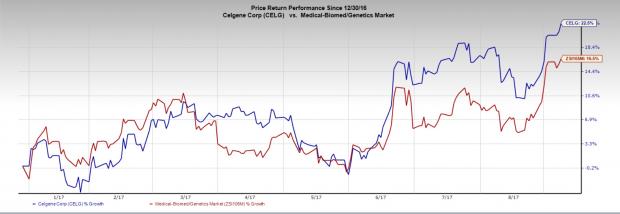

Celgene’s stock has moved up 22.5% year to date compared to the industry’s gain of 16.5%. Shares were down in pre-market trading on the news but regained ground thereafter.

Meanwhile, Celgene’s Revlimid continued to outperform driven by market share increases in newly diagnosed myeloma and in treatment duration.

Zacks Rank& Key Pick

Celgene currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the healthcare sector is Aduro Biotech, Inc. (NASDAQ:ADRO) which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro Biotech’s loss per share estimates narrowed from $1.44 to $1.32 for 2017 and from $1.33 to $1.24 for 2018 over the last 30 days. The company has topped estimates in two of the trailing four quarters with an average of 2.53%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Astrazeneca PLC (LON:AZN): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post