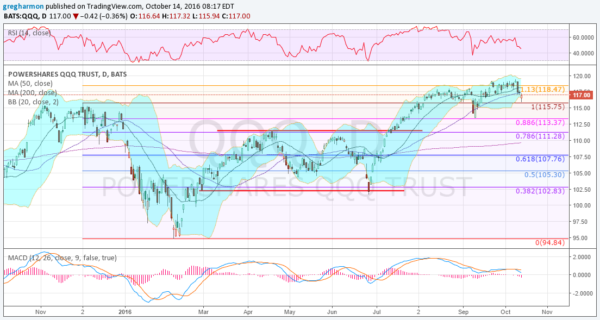

With two weeks to go in October, the Nasdaq 100 is basically unchanged over the last 12 months. Yes, it's up a bit, but if you start the clock following the gap-up on October 23, 2015, it is less than 5 points above. That is a positive but hardly a statistic to make us happy about the market. The path has not been an easy one, though, and it's that path that is worth examining to glean insights into the possible future.

There was a plateau at the end 2015, which happened under the all-time high levels from the 2000 spike. The year opened with a push lower, a first rejection at the all-time highs. It was a large draw-down, nearly 20%. Ad, then, the reversal higher, which initially lead to a lower high -- a retracement of just 78.6% of the move down. Four months in and a channel was then followed by a break-out to the upside. That break-out ran to the early 2000's highs, but could not get through.

QQQ

But this time there was not a major pullback. A short pullback to the 88.6% retracement of that early year move lower found support and quickly bounced. Then, new all-time highs were achieved. After holding at all-time highs for two weeks, there was another short pullback this week. As I write, it looks to be reversing back higher with follow through in the pre-market Friday. This sets up a higher low after a higher high at the retest of the full retracement of the early year move lower. And it also sets up a search for new all-time highs in the coming weeks.