Celanese Corporation (NYSE:CE) announced that it will increase the list and off-list selling price of acetyl intermediates products. The price hike is effective immediately or as contracts permit.

The company will raise the price of Butyl Acetate in Asia (outside China) by $100/MT. Prices of MIBK and MIBC are slated to increase by 8 cents per MT each in South and North America. Acetic acid price will increase by $50/MT in Asia (outside China) while in China it will increase by ¥300/MT. Also, price of Ethyl Acetate will rise by $80/MT in Asia (outside China) and ¥550/MT in China.

Celanese is taking appropriate pricing actions amid a volatile raw material pricing environment. Pricing improvement drove margins in its Acetyl Chain unit in second-quarter 2017.

BASF SE (BASFY): Free Stock Analysis Report

Celanese Corporation (CE): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research

The company will raise the price of Butyl Acetate in Asia (outside China) by $100/MT. Prices of MIBK and MIBC are slated to increase by 8 cents per MT each in South and North America. Acetic acid price will increase by $50/MT in Asia (outside China) while in China it will increase by ¥300/MT. Also, price of Ethyl Acetate will rise by $80/MT in Asia (outside China) and ¥550/MT in China.

Celanese is taking appropriate pricing actions amid a volatile raw material pricing environment. Pricing improvement drove margins in its Acetyl Chain unit in second-quarter 2017.

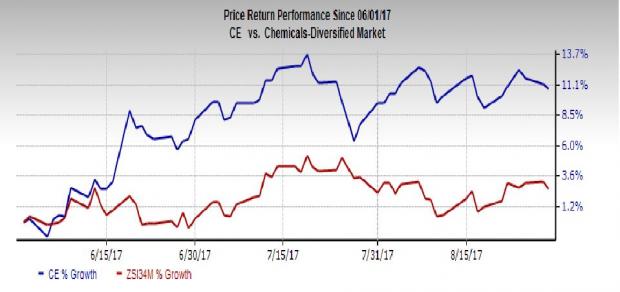

Celanese has outperformed the industry over the last three months. The company’s shares have moved up around 10.7% over this period, compared with roughly 2.6% gain recorded by the industry.

Celanese kept its earnings streak alive with a beat in second-quarter 2017. The company logged adjusted earnings of $1.79 per share for the quarter, topping the Zacks Consensus Estimate of $1.74. Celanese sees adjusted earnings per share to increase 9-11% in 2017.

Celanese’s strategic measures including cost savings through productivity actions and pricing initiatives are expected to lend support to its earnings in 2017. The company is also likely to gain from capacity expansion and growth initiatives like acquisitions. Moreover, Celanese remains focused on returning value to shareholders.

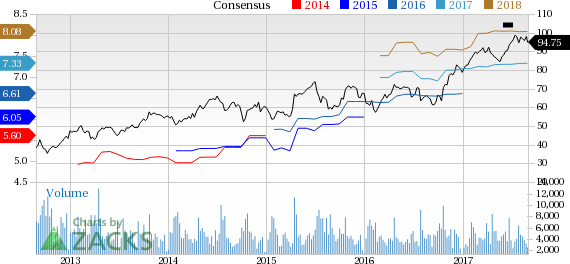

Celanese Corporation Price and Consensus

BASF SE (BASFY): Free Stock Analysis Report

Celanese Corporation (CE): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research