One of my favorite quotes about closed-end funds (CEFs) comes from Richard Thaler. When writing about why investors bought some CEFs for more than they’re worth, he simply said: “There are idiots,” and that this was “the only satisfactory answer to this … puzzle.”

That, er, very direct, quote comes to mind now because these days, it’s actually pretty easy to pick up CEFs (which yield around 7%, on average) trading at nice discounts to net asset value (NAV, or the value of their underlying holdings). There are literally hundreds of examples, some of them extreme.

The most discounted equity CEF trades at a whopping 26.7% discount as I write this. Ten funds in total have discounts over 20%, while 75% have discounts over 10%. That’s a lot of assets selling for less than they’re really worth.

And the funny thing is, these discounts are available at a time when CEFs themselves aren’t particularly cheap; in fact, historically speaking, they’re pricey.

Source: CEF Insider

With a 3.6% average discount, CEFs are about 29% more expensive than they typically are. This shows that sometimes markets get things right, especially after they spend a lot of time getting things wrong. That seems to be the situation in CEFs right now, and it’s a good environment for us, because CEFs as a whole are showing strength—and buying bargain-priced CEFs in a market like that is a recipe for upside.

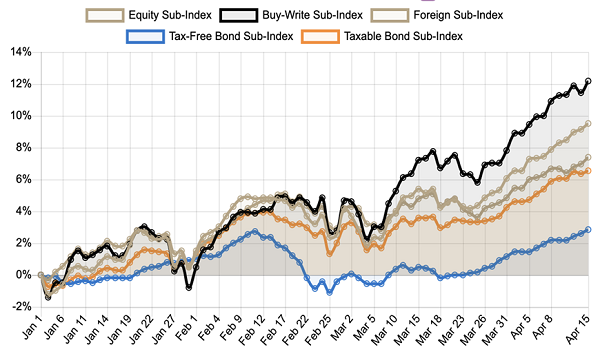

A quick look at the indexes we track through our CEF Insider Index Tracker Tool shows us that there’s a good reason for CEFs to trade more dearly than they have in a long while.

Source: CEF Insider

CEFs Are Soaring

The blue line above is the weakest performer, with just a 2.9% total return year to date. That’s to be expected, as this index covers municipal bonds, a lower-volatility asset class that tends to go up less—and down less—than other investments.

But the Buy-Write Sub Index (in black), which covers CEFs that hold stocks and write options against those stocks, is up over 12%. This is thanks to a combination of greater volatility in recent weeks (thanks to stocks seesawing up and down) and the stock market’s longer-term trend upwards. Both drive up profits for these funds.

And it isn’t just in profits that these funds win out; it’s in dividends, too. The average covered-call fund yields an outsized 8.1% today—more than six times as much as the S&P 500, giving investors a big income stream at the same time.

The Best of the Best

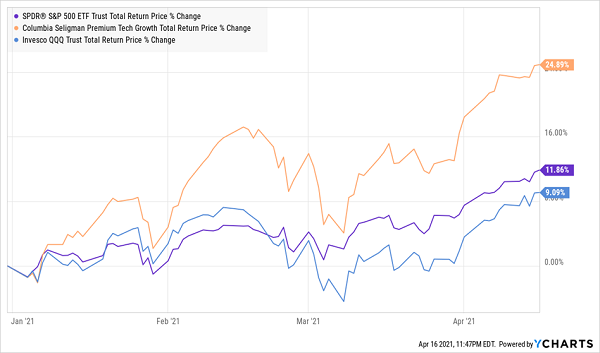

Now that I’ve shown you the best category of CEFs for 2021, let me show you the top-performing fund inside that category: the Columbia Seligman Premium Technology Growth Fund (NYSE:STK), which, as the name suggests, holds tech stocks, including leaders like Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL) and Broadcom (NASDAQ:AVGO). Year to date, STK has posted an impressive 25% total return, beating both the S&P 500 and the tech-focused NASDAQ 100:

STK Beats the Indexes (Handily)

And, of course, STK sells call options on its portfolio to generate extra income, which it hands to us in the form of its 4.3%-yielding dividend. (That’s a bit below the yield on the average covered-call CEF, due to the fact that the fund’s price has soared.)

Despite the common “wisdom” that you can’t beat low-cost passive index funds, STK is doing exactly that—and it’s paying a dividend that nearly triples up the payout on the typical S&P 500 stock, too.

Finally, if STK sounds familiar, it’s because I’ve covered this fund a number of times in my articles on Contrarian Outlook when I named it as one of five CEFs “set to roar into 2021”. From the chart above, it seems like it is roaring indeed, and it’s definitely a fund any CEF investor should have their eye on.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."