The trading floor at the CME is shutting down. There is a ceremony this week. The NYSE has been a token trading floor for years with all of the servers in NJ and the NASDAQ has never conformed to the folly that traders are needed. This leaves the CBOE Holdings Inc (NASDAQ:CBOE). It also has a lot of electronic trading.

All of this has happened in an era where technology is facilitating activity in all forms of business. It has proven to be a good thing in the markets for consumers with spreads narrowing and costs falling. And many of these exchanges have been flourishing.

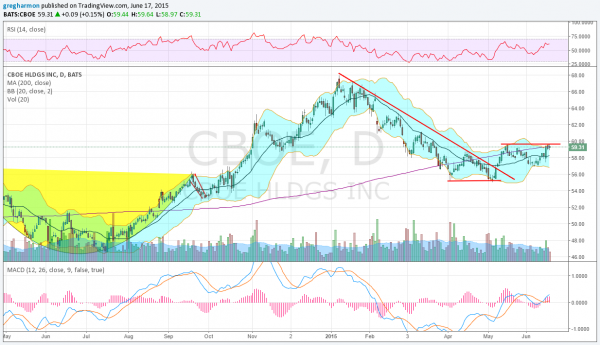

This is reflected in the chart of the CBOE above. It rose in price through the back half of 2014 to the target of the Cup and Handle at 66 before a pullback early in 2015. In early May though the price broke through the downtrending resistance and started back higher. The first step was small and then a quick shallow pullback. Now the price is back at the May high and pressing there.

The momentum indicators, RSI and MACD, are both rising and bullish supporting more upside price action. A move over the 200 day SMA would signal a move higher. And a break higher would target an initial move to 61.50 as the next step higher. A broader view would suggest a Measured Move higher to 76 eventually.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.