The bull market is eight years old. I have, for much of that time, been able to dig up myriad arguments for why its end is nigh, but none of those have transpired. Indeed, the good folks at Elliott Wave International seemed wholly convinced in 2009 that the bounce in stocks would terminate at about 1,000 on the S&P 500. Only about a year or so ago, after years of beating the bearish drum, they went hog-wild bullish, and they’ve looked sensible ever since. At this very moment, they are pointing to simply more lifetime highs on the horizon.

I’ve got to say, the reasons for being bearish are getting stripped down to almost nothing. We’ve got a clean breakout of the Dow Composite……

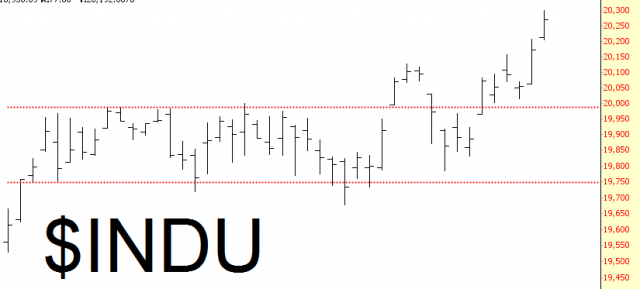

Which has itself been fueled by lifetime highs in the Dow 30 Industrials:

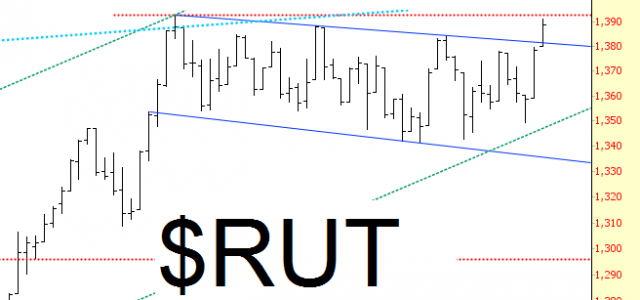

Most horrifying of all, the “flagpole risk” I described in a post earlier this month has been realized, since the small caps finally crossed above their flag pattern and are poised to join other indexes in making daily lifetime highs until further notice.

It would be easy to convince someone – – maybe even me – – that the powers that be have so mastered controlling the market, that there’s simply no such thing as a real bear market anymore. I’m not being facetious; maybe bear markets are in reality a thing of the past.

I would leave you with one last chart to ponder – – the $VIX, shown below on a monthly basis, was kept near the single digits for maybe a year and a half before the financial crisis. These days, the VIX has been cratered near these levels for going on its fifth year now.

All joking aside, I seriously wonder if we will ever see another bear market in our lifetimes. It seems they’ve been outlawed by those with a vested interest in making sure one never transpires again. To my way of thinking, there is one and ONLY one thing that could make this market fall apart, and that’s if the aforementioned folks want to yank the rug out from under Trump. It would be easy, and it would be very, very effective.