Summary

The violence in Catalonia yesterday is the story, not the vote

The Euro is close to a breakdown

Political pressures from Germany's elections to Italy's banks likely precipitated Spain's violent response.

Between the violent response of the Spanish government and the results of the referendum itself, yesterday’s events in Catalonia will have far-reaching effects on the long-term health of the European Union.

The euro (FXE) responded to yesterday’s events by promptly dropping over $0.01 in overnight trading. This further confirms the new short-term downtrend that began in September.

In my last article I talked about the far-reaching effects the German elections. I contend that a weakening of German Chancellor Angela Merkel sets the stage for increased political instability in Brussels. For that reason, I formally advised investors to go short the euro via the ProShares UltraShort Euro (NYSE:EUO) last week.

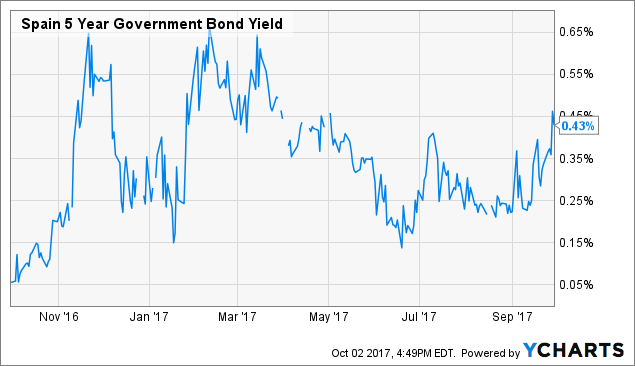

Catalonia’s intention to formally declare independence from Spain later this week is roiling European sovereign debt markets.Spain 5-Year debt was up 0.083% to close at 0.338% in early trading and continued to weaken all day. It will take a close this week above 0.4% for this to be technically significant in the long term.

The ECB asset purchasing programs have muted the risks associated with these events. Investors continue to pile into these trades at yields that do not take the risk properly into the equation.

This, to me, is a serious mis-pricing of the markets for sovereign debt which will, in the end, blow up in the ECB’s face.

Unrest Is More than a Vote

If I was surprised by yesterday’s events it was only in the scale of the brutality shown by Spanish security forces.

And that violence is what turned a projected narrow vote for secession into a complete rout against the government in Madrid. There is simply, no way to sweep this result under the rug or wish it away.

The EU will not be able to play the same games they are playing with Brexit negotiations since Spain could very well erupt into open civil war if Prime Minister Mariano Rajoy doubles down on his opposition to the vote.

This seems to be the case and that can only mean further unrest and practical steps by the Catalan government to become an independent nation.

Hiding behind the legality of the vote will only make the problem worse. But, this is exactly the tack the European Commission is taking. That the ruling by the Spanish Constitutional Court is in the European Union’s favor cannot be ignored here.

When things get to this point, the law becomes irrelevant. Because the EU backed the Spanish government because of its vested interest in keeping Spain whole, it will now lose support in other parts of Europe.

Voting Eventually Changes Everything

Catalonia is another example of the rising populist trend in Western politics. And it will continue into next year and beyond. Looking ahead, Italy goes to the polls in May. But, Italy and Spain are the current biggest headaches for the ECB as their banking systems are insolvent.

This is why ECB President Mario Draghi refuses to commit to an end of his purchasing sovereign debt across the euro-zone. He can’t. But, at some point, when the political risks rise too far, too fast, the markets are woken up from their torpor to properly assess the situation.

The violence in Catalonia yesterday will be a wake-up call to bond investors that there is a limit to what the people in charge can accomplish. Political risks in Europe are back after a few month lull, post-French elections.

Spain did everything it could to disrupt and/or stop the vote and still it was incapable of breaking the Catalan resistance.

Draghi has done everything he could have to stimulate growth and keep asset prices afloat, but it hasn’t worked.

All year I have been warning that the rising U.S. equity market is a symptom of a deeper issue related to the changes in the political landscape. Now it looks like we’re hitting that transitional moment.

The Market Reaction

Along with the rout in the euro, Spanish and Italian bonds as well as Spanish stocks today we saw the Dow Jones Industrials rise 152 points to yet another all-time high to 22,557.60.

This is not a fluke, in my opinion. This is a symptom of bigger issues just now beginning to unfold. Capital is starting to flee the trouble spots in Europe. Spain’s IBEX 35 index is now within 180 points of a major technical breakdown below the September low of 10,087.

It will then start fleeing the core economies. Coalition talks in Germany can’t start until Merkel shores up support from her CSU partners. And even if a coalition with the Greens is formed will that be stable enough to govern for five years?

In my mind, no.

Then we add the biggest factor. The Fed is determined to shrink its balance sheet and continue raising rates. The higher the stock market goes the more likely the Fed will raise rates at its next meeting.

All of these events and currents are PowerShares DB US Dollar Bullish (NYSE:UUP) positive in the long run. And that bodes poorly for the euro. Once the euro begins to break down technically the over-valued European bond markets will be put under real pressure again as currency gains from earlier this year are erased.

There is not the political will in Brussels or Madrid to change course now. The EU is headed for a very ugly period. Stay short the euro. A daily close below $1.1661 will be the initial technical signal. A close this week below that level will signal a lot more weakness in Q4.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.