Greek vote could go either way

Greece’s latest bailout plan will be put to its own parliament later today following a day of negotiations and heated debate. Alexis Tsipras, in an interview on Greek state TV, told the country that he had “a knife at my neck” when making the decision to agree to creditor’s demands on Monday morning.

It needed no more spice but the vote on the measures in Greece has been given a massive pinch of righteousness by the IMF. An IMF report arguing that Greece’s debt dynamics are unsustainable without debt relief “far beyond” what Europe has been willing to consider was leaked yesterday. The report argues that without measures to cut the amount of debt, and with the hit to Greek GDP that the past five months have ensured, Greek debt-to-GDP would hit 200% – it started the Global Financial Crisis at 127%.

You would be a brave person to say that these comments will not come up in the plenary session in Greece today. While the committee debate is set to start this morning and finish by 4pm we are not expecting the Greek parliament to start debating the measures until 8pm BST and without doubt, the debate will go long into the night. I think that the measures will pass but we must remember that markets have a bad record in calling the intentions of the Greek parliament.

Euro traded quietly yesterday with market participants still unwilling to pledge funds to a long or a short position. I would think that we would see similar trade today as traders sit on their hands.

Carney restarts rate rise chatter

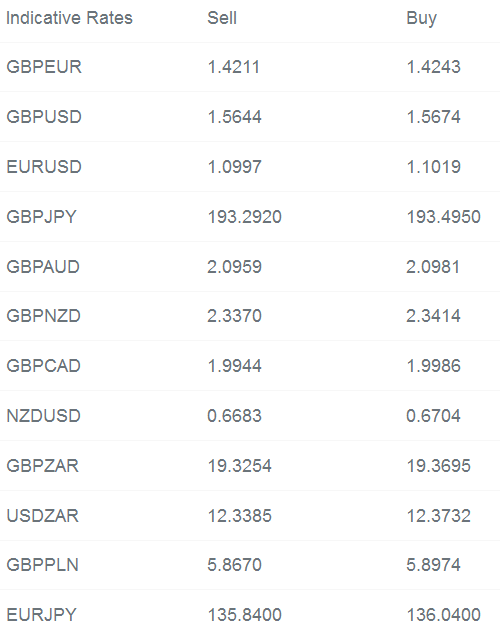

Sterling traders were busy yesterday however as the pound leapt higher as Mark Carney fuelled fires that a Bank of England rate rise is not too far away. Last June Mark Carney said rates could rise sooner than expected in his Mansion House speech, while yesterday in testimony to the Treasury Select Committee he said that “time for an increase is moving closer”. Sterling ran higher, the yields on UK debt rose and the FTSE 100 lost ground. I’m still thinking we see a rate rise in March 2016 but a strong pound is not going to help the inflation picture especially given the issues in Europe.

CPI in the UK fell back to 0% in June it was shown yesterday. Today’s wage and jobs data could easily provide sterling with another fillip given their improvements in the past 18 months. GBP/EUR is close to the highest level since 2007 this morning as a result.

Fed Chair testimony and Bank of Canada due

Elsewhere, Fed Chair Janet Yellen is due to give her semi-annual testimony to the lawmakers on the state of the US economy. Yesterday’s poor retail sales and falling business confidence numbers will cast a cloud over her testimony but we expect to see her plug her typical “data-dependent” line with risks to a more hawkish overall assessment of the prospects for a Fed Funds rate rise. She takes the stage at 3pm London time.

Finally the Bank of Canada rate decision is due today. We expect no change given the weakness in the CAD that recent falls in oil prices have provided. The announcement is also due at 3pm.