Summary

• A sudden bear market presents opportunities for global asset allocators

• Valuations are in a historically favorable range for equities

• Commodities may rebound, fixed income to falter?

Stocks on sale? We never know for sure, but markets are not efficient at all times, and that yields investment opportunities around the world. Recency bias and herd mentality are two behavioral traits humans are prone to which cause us to shun investment strategies that have not produced strong returns of late. Couple attractive valuations with poor sentiment across the foreign equity universe, and there is likely a convincing case to be made for favorable future returns in this vast opportunity set.

U.S. stocks make up 57% of theMSCI All-Country World Equity Index. Foreign developed markets are 31% and emerging markets complete the pie at 12%. Sharp outperformance among U.S. large cap growth stocks in the last 10+ years has increased the U.S. weighting in the ACWI, but the weighting tends to be mean-reverting over long periods. A decade of outsized gains out of the United States has left those equity indices relatively stretched on valuation while foreign stocks have been largely flat since the October 2007 peak.

The cyclically-adjusted price-to-earnings ratio over the last 10 years, or the PE10, is near the lowest levels since the 1980s across international developed and emerging market equities. Taking a step back from the data - I work in the United States, and anecdotally, there is not much love for anything other than the standard S&P 500 index fund right now. As long-term investors, we love to see this combination of low valuations and despondency.

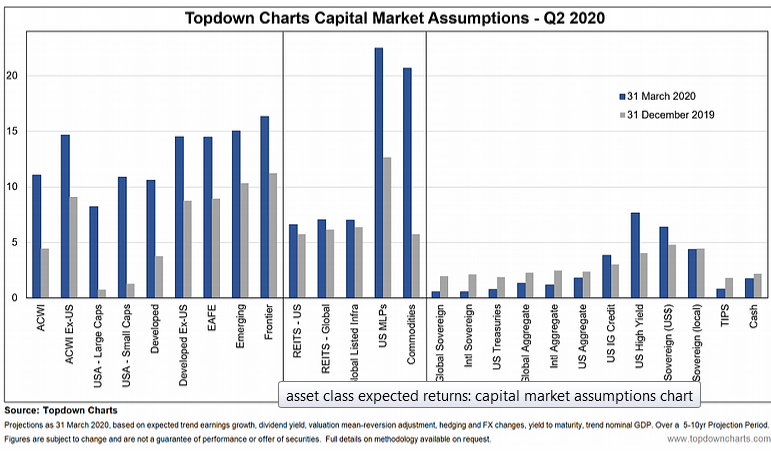

Below is a table of our expected return projections (from the Quarterly Strategy Pack).

No doubt the first quarter was a rough one for equity investors. This happens. It’s normal. While the move from all-time highs in the ACWI to a 35% decline was remarkable swift, it nevertheless arose significant investment opportunities. Our model now projects a solid 11% compounded annual growth rate (CAGR) over the coming 5-10 years for global stocks. The gains are likely to be focused in non-U.S. equities—with prospective 14-16% CAGRs across the developed and emerging market universe.

We were sour on U.S. markets at the turn of the year given valuations, but a bear market removed some of the frothiness in the States, so our total return expectations for USA large and small caps have come up.

For alternative investments and commodities, we expect a reflationary type of environment following immense global stimulus due to the COVID-19 carnage to be a boon to dollar-denominated hard assets. The 2003-2007 and 2009-2011 periods were very strong for commodities, and we see similar themes developing now. MLPs, primarily oil & gas master limited partnerships, is another area that was slaughtered in recent years. Many MLPs now trade has extremely low valuations. A rebound in commodity prices should allow this left-for-dead niche to be resurrected.

What do we want to avoid? Interest-rate sensitive bonds. The current yield of a bond is the best indicator of its future return. Negative rates around the world and all-time low yields among U.S. Treasuries sets the stage for weak returns. Rising inflation would be insult to injury for bond investors as well. There are some opportunities across the high yield space and in emerging market debt, but that also involves taking more credit risk. The current risk:reward profile likely points to just owning comparable equity securities.

An analyst at Topdown Charts, I am also a university finance instructor in the United States. I tell my students that they should pray for a prolonged bear market so they can invest at attractive valuations during their working years. Their prayers were perhaps somewhat answered as 35-40% declines across virtually all equity indices don’t happen too often. The data suggests it is a good time to be a global equity investor.