- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Canadian Solar Prepares To Go Private: 3 Solar Stocks To Buy

Over the past few months, a number of solar stocks have been mulling over plans to exit the public equity markets. Interestingly, a majority of them are based outside the United States. Yesterday, Canada-based Canadian Solar, Inc.’s (NASDAQ:CSIQ) CEO Shawn Qu announced plans to delist the company from the U.S. stock market.

Details of Canadian Solar’s Buyout Plans

Qu has offered to buy all of Canadian Solar’s outstanding common shares for $18.47 per share, reflecting more than a 7.1% premium over Dec 8 closing price of $17.25. The total value of this buyout is $1.07 billion. Qu is of the opinion that the deal will be beneficial since it represents roughly 10% premium to Canadian Solar’s average closing price over the last 90 days of trading.

The plan includes taking the company private into eight parts, detailing steps that include forming an acquisition vehicle to pursue the transaction and financing the deal with a combination of debt and equity capital. However, completion of the deal depends on approval from shareholders as well as the concerned regulatory authority.

Peers on the Same Path

Chinese solar panel manufacturer Trina Solar Ltd, which used to trade in the U.S. stock exchange with “TSL” ticker, started this drive of going private. In August 2016, it announced plans to go private. In March 2017, Trina Solar officially became private after completing its merger with Red Viburnum Company Limited — a wholly-owned subsidiary of Fortune Solar Holdings Limited.

In November 2017, JA Solar Holdings, Co., Ltd. (NASDAQ:JASO) — another Chinese solar company — signed a merger agreement, under which an investor consortium will purchase JA Solar in an all-cash transaction, thereby translating into an equity value of approximately $362.1 million. The transaction is expected to complete in the first quarter of 2018, based on customary closing conditions.

U.S. Solar Import Tariff Driving Privatization?

Of late, solar panel manufacturers in China have been alleged of supplying cheap panels and cells to the market, hampering the business of their U.S. counterparts. Consequently, the U.S. panel makers have been pressing the government to impose a heavy duty import tariff on international solar panels.

In this regard, the U.S. International Trade Commission recommended to levy tariffs on imported solar panels of 35% during a hearing held this October. The agency will send its proposals to President Donald Trump, who is likely to take a final call on the same next month.

It goes without saying that if implemented, such tariffs will dent the rally of the U.S. Solar industry. According to a report from Bloomberg New Energy Finance, tariffs on imported solar panels may threaten the economics of residential power systems in as many as 13 U.S. states.

Fear of losing customers in the United States, post the imposition of the tariff has most probably drove the privatization drive.

Other Drivers of Privatization

The government of China recently issued guidelines for boosting private investment in manufacturing which includes providing additional financial support to private firms. The government is encouraging private firms to invest in infrastructure projects that comprise solar energy products. This might have provided impetus to the Chinese firms to become private.

An analyst at Axiom Capital Management believes that Canadian Solar may be targeting to list itself on the Chinese stock exchange after delisting from the U.S. stock exchange, to gain from the expanding Chinese solar market. This is likely to be a viable hypothesis, which if proved to be true in coming days, will definitely benefit Canadian Solar, given the nation’s take on boosting private investment. The company has extensive business operations in China.

Moreover, a publicly trading company has to bear huge regulatory as well as procedural cost to maintain the timely filings of financial reports. Therefore, becoming a private firm means less regulatory and procedural costs, which might have been another reason why public solar firms intend to delist from the share market.

Should You Invest in Solar Stocks?

While solar stocks like Canadian Solar and JA Solar have decided to go private, other solar stocks in the non-U.S. market may also follow suit. However, this should deter investors from investing in solar stocks.

These stocks reflect strong attributes, thereby making them valuable investment choices. Even if any of these stocks are not based in the United States, buying them can be prudent since if these decide to go private, investors will gain from the share price premium of a company’s stockholders’ gain at the time of the deal.

Herein, we have hand-picked three solar stocks that sport a Zacks Rank #1 (Strong Buy) or 2 (Buy), and are worth adding to your portfolio. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

3 Viable Bets

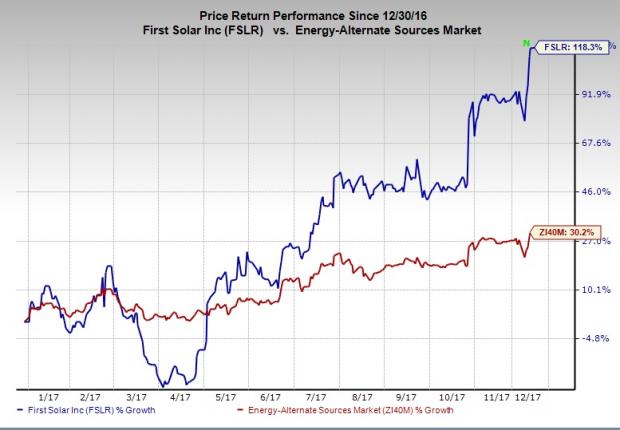

First Solar, Inc. (NASDAQ:FSLR) : Headquartered in Tempe, AZ; First Solar designs, manufactures, and sells solar electric power modules using a proprietary thin-film semiconductor technology. The company posted an average positive earnings surprise of 537.39% in trailing four quarters. Its current-year Zacks Consensus Estimate for earnings has improved by 11.3% over the last 90 days.

First Solar presently sports a Zacks Rank #1. The company’s share price has increased 118.3% on a year-to-date basis, outperforming its broader industry’s rally of 30.2%.

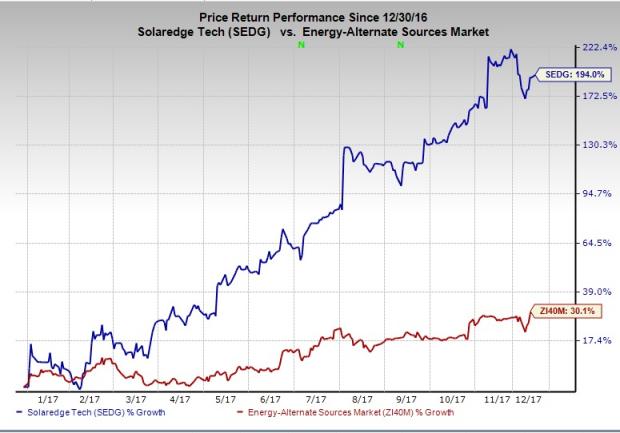

SolarEdge Technologies, Inc. (NASDAQ:SEDG) : Israel-based SolarEdge Technologies provides residential solar installations to commercial and small utility-scale solar installations. The company posted an average positive earnings surprise of 24.00% in the trailing four quarters. Its current-year Zacks Consensus Estimate has improved by 12.2% in the past 90 days.

SolarEdge Technologies currently flaunts a Zacks Rank #1.The company’s share price has increased 194% on a year-to-date basis, outperforming its broader industry’s rally of 30.2%.

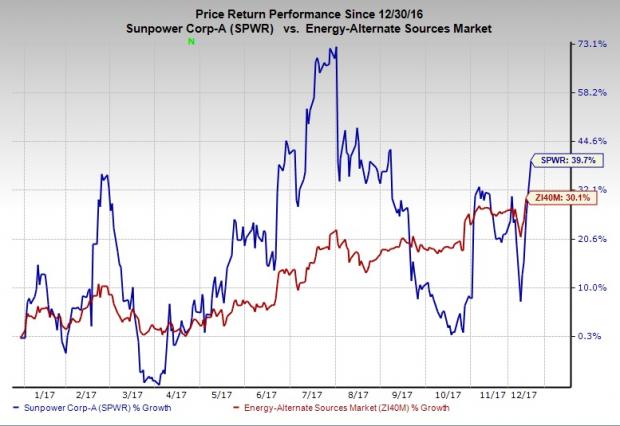

SunPower Corp. (NASDAQ:SPWR) : San Jose, CA-based SunPower Corporation designs, develops, manufactures, markets and sells high-performance solar electric power technology products, systems and services worldwide for residential, commercial and utility-scale power plant customers. The company posted an average positive earnings surprise of 45.25% in trailing four quarters. Its current-year Zacks Consensus Estimate for loss has narrowed down by 57.6% over the last 90 days.

SunPower carries a Zacks Rank #2. Its share price has increased 39.7% on a year-to-date basis, outperforming its broader industry’s rally of 30.2%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

JA Solar Holdings, Co., Ltd. (JASO): Free Stock Analysis Report

First Solar, Inc. (FSLR): Free Stock Analysis Report

SunPower Corporation (SPWR): Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG): Free Stock Analysis Report

Canadian Solar Inc. (CSIQ): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.