Gold has been knockin’ on overhead resistance for weeks now. As I write, I don’t know how the day will end. But it sure looks like a breakout in the making.

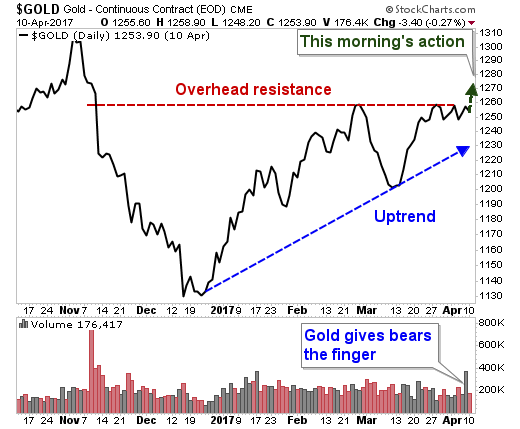

Here’s an updated version of a chart I posted last week in my column, Maps To Treasure Island.

In this chart, I’ve added today’s action on the far right. Gold touched $1,275 this morning.

Meanwhile, you can see gold’s uptrend and the overhead resistance that held it in place. Oh, how gold has wanted to trade above $1,260 for so long. KNOCK-KNOCK-KNOCK!

But each time, the bears have been able to bar the door and turn back the metal’s surge.

On Friday, gold tried to rally big. But the bears came in and sold the metal back down again. Still, the trading volume painted a very bullish picture. You might say the volume looks like gold gave bears the finger.

On Monday, the bears tried to follow through and sell off gold deeper. And it dipped. But the bears got nowhere. And bearish volume was tepid.

Then on Tuesday, we got bullish follow-through. BOOM! Gold not only knocked on heaven’s door, with apologies to Bob Dylan, it kicked it in.

So what’s behind this move? I mean, besides Peak Gold, investor demand, a new big bull gold cycle and all the things I’ve been pounding the table about for weeks.

You can thank President Trump.

See, President Trump already gave the world jitters by launching cruise missiles at Syria. Did I say jitters? It was a presidential load of righteous fury delivered by 59 Tomahawks screaming across the sky.

It made some investors more nervous than a 9-tailed cat in a room full of rocking chairs. That’s what sparked gold’s bullish move on Friday — before the bears put a lid on it.

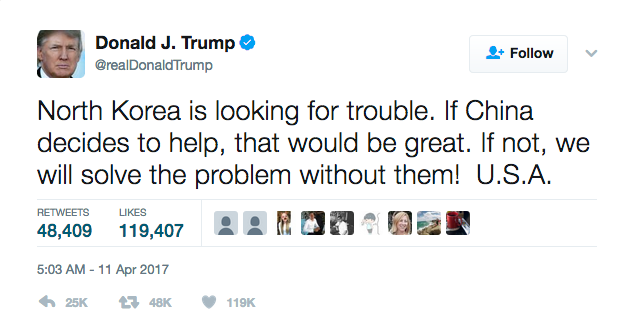

This week, President Trump thinks North Korea is a problem. And he’s willing to solve that problem, with or without China.

North Korea is a nuclear power. You can see how this makes investors around the globe nervous. And when investors get nervous, they run for gold.

The gold-plated question is, will this rally last?

I expect when the North Korea situation is resolved, one way or another, that will spark profit-taking in gold. That’s why I’m not buying the metal today.

But profit-taking could be brief. That big uptrend remains in place. So if and when we get profit-taking, that will be our next buying opportunity.

And if the door to heaven remains open, gold is done knockin’. There’s no telling how high it will go.

The SPDR Gold Trust ETF (NYSE:GLD) rose $0.26 (+0.21%) in premarket trading Wednesday. Year-to-date, GLD has gained 10.77%, versus a 4.96% rise in the benchmark S&P 500 index during the same period.

GLD currently has an ETF Daily News SMART Grade of B (Buy), and is ranked #6 of 33 ETFs in the Precious Metals ETFs category

From Sean Brodrick