Since mid-January, Large Cap stocks (i.e. the S&P 500) have been nipping at the heels of Mid Cap Stocks (i.e. Russell 2000). In 2014 many traders and market commentators pointed to the major under-performance as a big concern for the market as a whole. But it seems that notion as been left in the rear view mirror as stocks have continued to march higher and mid caps (via the iShares Russell 2000 ETF (ARCA:IWM)) have improved. The conversation has now shifted from “look how bad they are doing!” to “look how much stronger they are!” Oh how things change.

I often focus on price charts. Below is a chart of the Advance-Decline Line for the S&P 500 (top panel in red) and the S&P Mid Cap Index (bottom panel in black). While breadth for the S&P 500 has been rising right along with price, lately it has begun to put in a set of lower highs.

At the same time this is occurring, the Mid Cap A-D Line has been setting new highs, keeping its up trend alive. I’m not using this chart to make a market call, but simply to point out an interesting development taking place.

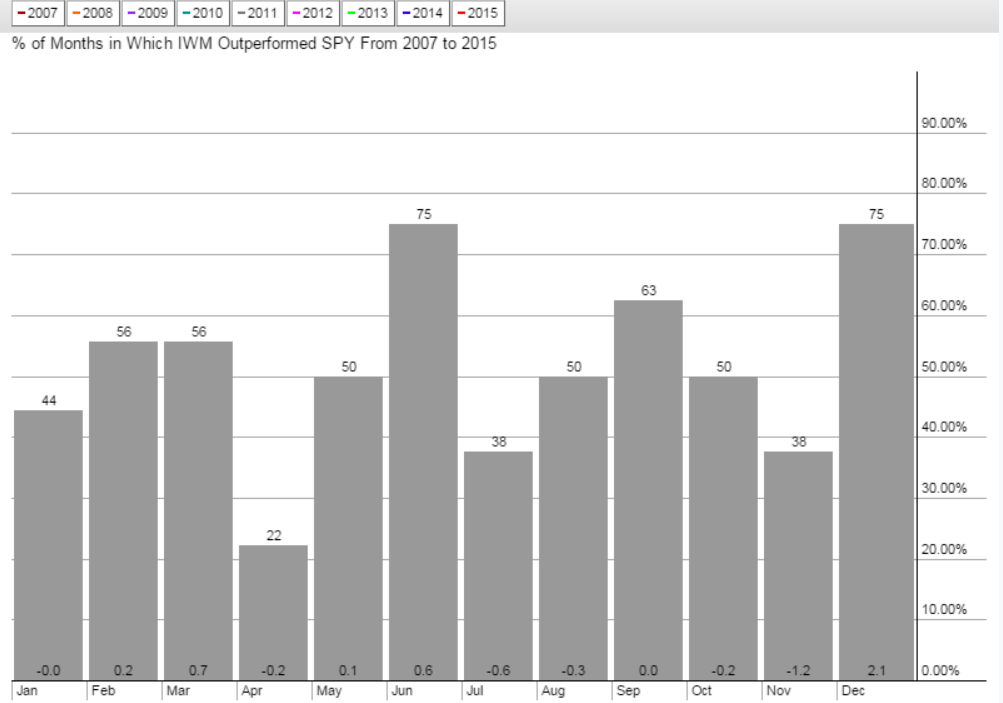

Is this occurring because it’s historically a strong time period for mid cap stocks? Actually no. April is one of the worst months for out-performance by IWM over the SPDR S&P 500 (ARCA:SPY). Since 2007, as this next chart shows, IWM has only outpaced its larger cap counterpart 22% of the time (2009 and 2010).

If the Russell 2000 can keep its party alive and continue to lead the S&P 500 during one of its historically weakest periods of time, then that would be a pretty big achievement in my eyes and one that would be tough to ignore. So far IWM has begun to lag SPY during the first week of trading in April. This means the Russell 2000 is now in a hole from which it has to dig out.

Will it be able to do it? We’ll see.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer.