The Modern Family shows confidence as more positive vaccine news came out Monday.

This time the positive news came from Moderna (NASDAQ:MRNA).

Hence after last Monday’s Pfizer (NYSE:PFE) announcement, the market thrives on hope rather than fear as the COVID cases rise and areas of the country are shutting down.

Some might think this complacency is extraordinary given the hurdles we have to get through before the vaccine is ready for public use.

For instance, both MRNA and PFE will need to create an environment for extreme cold storage and cold storage transportation in order for the vaccines to survive.

Furthermore, we still don’t have a set date when the vaccines will be ready to be released and if there will be enough to meet up with demand.

The vaccine is not the only uncertainty in focus right now.

We still have a pending election investigation along with a stimulus that has yet to be decided on.

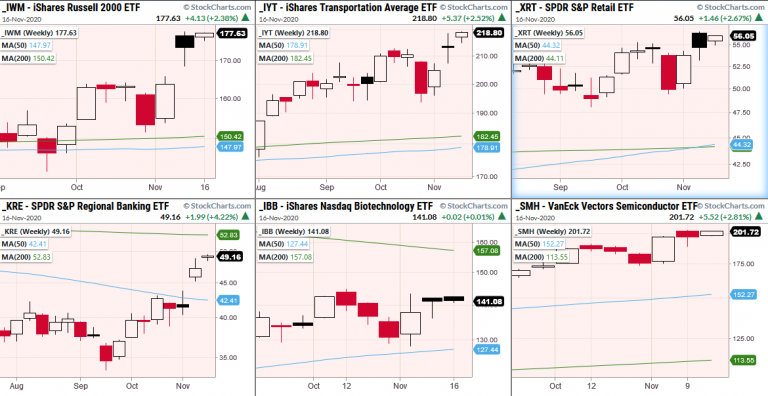

Either way, taking a look at the Economic Modern Family shows many members holding close to last week’s highs.

Russell 2000 (iShares Russell 2000 ETF (NYSE:IWM)) Transportation (NYSE:IYT)) Retail (NYSE:XRT) and Biotechnology (NASDAQ:IBB) are all less than a dollar away from last week's highs.

XRT Granny retail, while not far from making news highs, does have some rising covid cases to worry about as certain states increase restrictions from recent spikes right before a huge shopping holiday.

Currently in New Mexico, non-essential businesses are set to close for a minimum of two weeks, unless certain criteria is met.

If sales plunge across the states, Granny Retail will look for support from the next stimulus, most likely not scheduled until Valentine’s day.

On a happier note, regional banking (KRE) closed over the high from last week at 49.16

Then we have Sister Semiconductors, who looks ripe to break back out over all-time highs at 202.89.

As we have mentioned that the Russell’s, in particular, broke the election week range rule with a textbook gap higher last week, yesterday, we are nearing those highs but still trading within the range of last week.

Retail XRT, Semiconductors SMH and outside of the Family, the S&P 500 are also beginning close to last week’s highs, but inside last week’s range.

Optimism or pessimism, as price followers, look for these highs to be taken out and held, or, sellers might come back in to take advantage of current exuberance.

S&P 500 (SPY) 364.38 high to clear.

Russell 2000 (IWM) 178.10 high to clear.

Dow (DIA) Closed at all time highs.

Nasdaq (QQQ) Watching to break election range at 295.39.

KRE (Regional Banks) Closed over last week's high of 48.83. Watching to hold.

SMH (Semiconductors) Needs to clear 202.89

IYT (Transportation) Closed at all time highs.

IBB (Biotechnology) 136.12 support the 50-DMA and 143.36 Resistance.

XRT (Retail) 56.56 high to clear.