Parker-Hannifin Corporation (NYSE:PH) witnessed an outstanding fiscal 2017, with impressive earnings beats and healthy top-line growth. As a matter of fact, the company reported its eighth consecutive earnings beat in the fourth quarter of 2017 results which came in earlier this month.

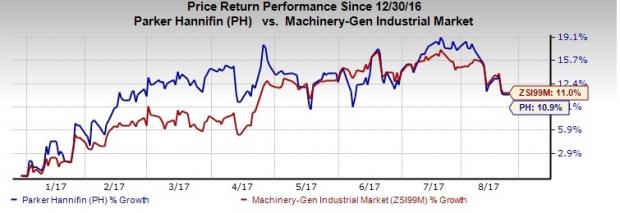

Buoyed by the competency of the revamped Win Strategy and its strategic acquisitions, Parker-Hannifin is bullish about delivering its fundamental financial goals for fiscal 2018. Year to date, the stock has returned 10.9%, in line with the industry’s average gain of 11.1%.

Analysts are favoring the stock over the last two months, as the Zacks Consensus Estimate for fiscal 2018 earnings edged up over the same time frame from $8.90 to $9.05, supported by nine upward estimate revisions versus zero downward movement.

Let’s delve deeper into the key growth factors that might drive the Zacks Rank #3 (Hold) stock for the upcoming year and few deterrents that might play spoilsport.

The Catalysts

Parker-Hannifin’s overarching Win Strategy has proven to be its most resilient growth driver. The company is currently implementing the latest version of its core business system – “Win Strategy”. Though the modified version is based on originally outlined principles, new goals were included to boost speed and performance.

The new strategies include focus on engaging people, improving customer experience, optimizing profitable growth and financial performance. In fact, the company believes that these goals can help deliver a compound annual growth rate in earnings per share of 8% over the coming five years. Parker-Hannifin is also targeting segment operating margins of 17%.

In addition, Parker-Hannifin continues to benefit from its extensive distribution network, which sells to the more lucrative MRO markets. Robust distribution sales have helped it in reaching out to smaller OEMs. We believe that the company’s strong aftermarket sales are likely to raise its bottom line and margins for fiscal 2018 and beyond.

In addition, Parker-Hannifin’s strategic buyouts has constantly broadened its market presence and boosted its core revenue growth. For instance, the CLARCOR buyout has strengthened the company’s filtration product suite, thus boosting recurring revenue growth. Also, other bolt-on acquisitions completed over the past two years, namely, Jäger Automobil-Technik GmbH, Jäger Automotive Polska President Engineering Group Limited and Helac Corporation are expected to supplement top-line growth going forward.

The Concerns

Parker-Hannifin has been experiencing sluggishness in its key natural resources market that includes oil and gas, agriculture, mining and construction equipment. This weakness exerts a lot of pressure on the company’s distributors who are engaged in the oil and gas business. The company projects more softness in emerging markets and its distribution channel in the quarters ahead. This apart, Parker-Hannifin’s diverse geographic presence is exposed to currency headwinds.

Parker-Hannifin can face negative impact if prices of raw materials are not favorable. Over the past few quarters, the company has been affected by an increase in prices for core materials like steel, aluminum, castings and nickel, among others. Such price hikes can significantly weigh on the company’s profits and margins. The company also witnessed substantial rise in the prices of steel and aluminum of late and the trend is expected to continue.

Stocks to Consider

Some better-ranked stocks in the sector are AGCO Corporation (NYSE:AGCO) , Belden Inc (NYSE:BDC) and Barnes Group, Inc. (NYSE:B) . While AGCO sports a Zacks Rank #1 (Strong Buy), Belden and Barnes Group carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO managed to beat earnings every time in the trailing four quarters. It has an impressive positive average surprise of 39.7%.

Belden has a positive average earnings surprise of 3.3% for the last four quarters, having bearten estimates all through.

Barnes Group has excellent earnings beat history, having surpassed estimates every time over the trailing four quarters. It has a positive average surprise of 11.6%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars. But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Belden Inc (BDC): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Original post

Zacks Investment Research