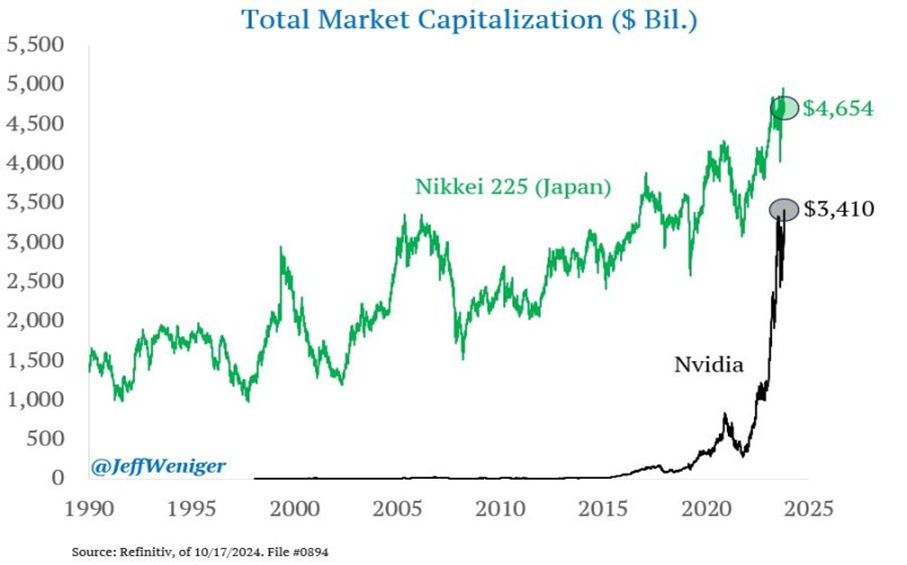

Nvidia's (NASDAQ:NVDA) explosive growth is about to hit a remarkable milestone: the tech giant, valued at $3.4 trillion, is on the verge of surpassing the entire market capitalization of Japan’s Nikkei 225.

As investors continue to rally behind the “Magnificent 7” stocks, global markets brace for the ripple effects of this potential shift — especially with central banks leaning into easing policies.

Source: Jeff Weniger

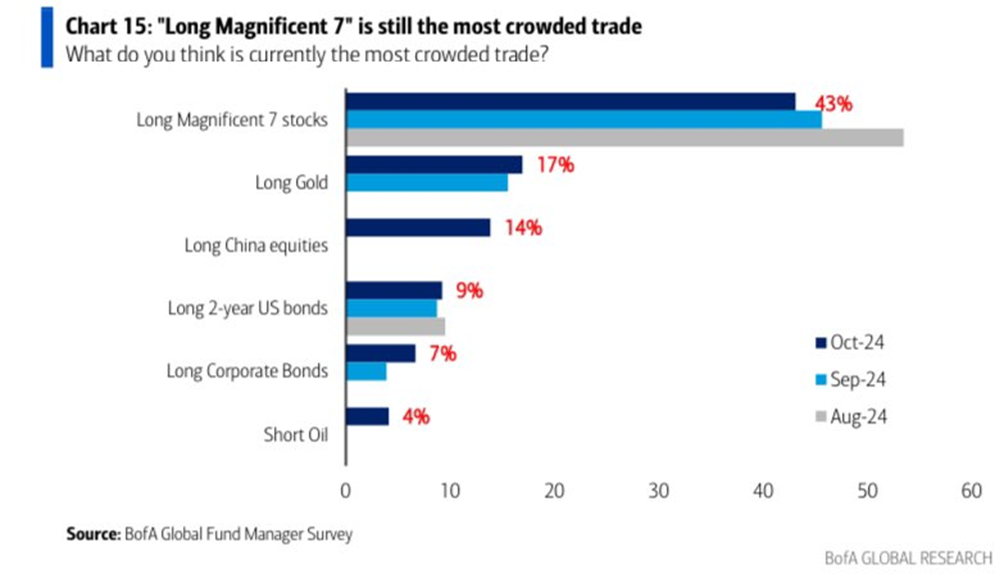

Investors Still Favor the Magnificent 7

What are investors' favorite themes? According to Bank of America's survey of fund managers, the Magnificent 7 (Nvidia, Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL), Tesla (NASDAQ:TSLA), and Meta (NASDAQ:META)) continue to be courted by Wall Street, even if the response rate (43%) is lower than in previous months (54% in August). Next in line are long positions in gold (17%) and China (14%).

Source: BofA

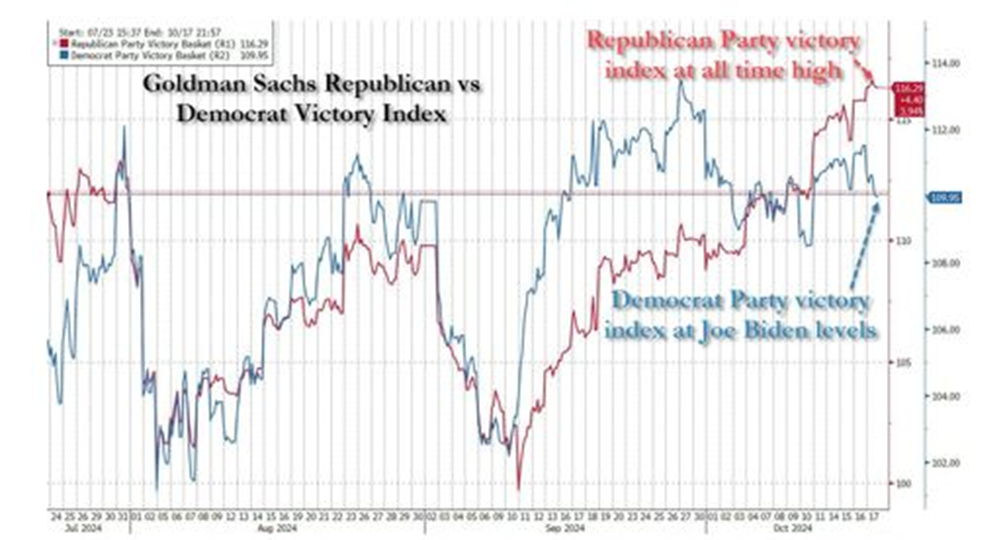

Markets Keep Betting on a Trump Victory

U.S. investment bank Goldman Sachs has created baskets of stocks designed to capitalize on the win of one of the two candidates.

As seen below, the Republican Party basket (in red) has just reached a new record high, while the Democratic Party basket is at the same level as when Joe Biden was still a candidate.

Investment bank JP Morgan also reported that hedge funds were accumulating stocks that would benefit from a Trump victory.

Source: www.zerohedge.com, Bloomberg

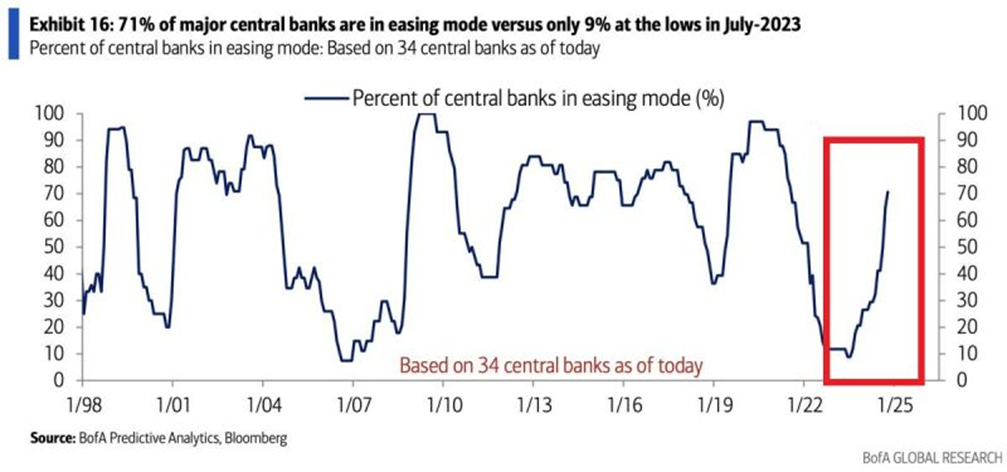

Global and Synchronised Monetary Easing to Boost Stocks?

71% of major central banks are now easing monetary policy, the highest figure since the COVID-19 crisis in 2020. This percentage also matches those of the financial crisis and the 2001 recession.

Source: BofA

Meanwhile, US Debt Reaches a New High

With the elections just weeks away, the Biden administration is spending like crazy to keep economic growth afloat. Creating millions of new government jobs requires additional debt. As the graph below shows, the pace of increase in US debt is accelerating. At this rate, we could reach $36 trillion in debt before the end of the year.

Source: Bloomberg

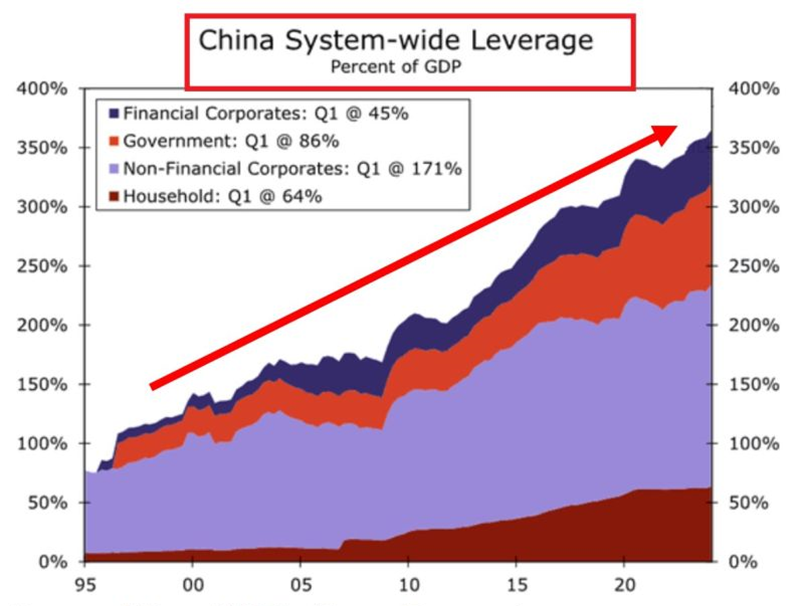

China's Massive Debt Burden

Considering all economic entities (government, companies, households), China's debt-to-GDP ratio stood at 366% in the first quarter of 2024, a record level. Since 2008, this ratio has more than doubled.

Here's how it breaks down:

- Non-financial companies: 171

- Government: 86

- Individuals: 64

- Financial companies: 45

Even with this massive debt, China does not seem to be on track to meet its 5% annual GDP growth target. How much more debt does China need to boost growth? And at what cost?

Source: Global Markets Investor, IIF, Wells Fargo