It has been more than a month since I last wrote an update on the Nasdaq 100. Back then, as the NDX was trading at the mid-11000s, I was looking higher based on the Elliott Wave Principle (EWP) count and technical analyses. The index topped out on Tuesday at the mid-12000s – a 7% rally since. Not too shabby a forecast, if I may say so myself.

However, with yesterday’s plunge and today’s lower open, bringing the index back to about only 500 points above last month’s reading when I published my article, one must ask the question: “Can the index still move higher?”

Based on my preferred EWP count, see Figure 1 below, the answer is yes, as long as the index can close above 12150.

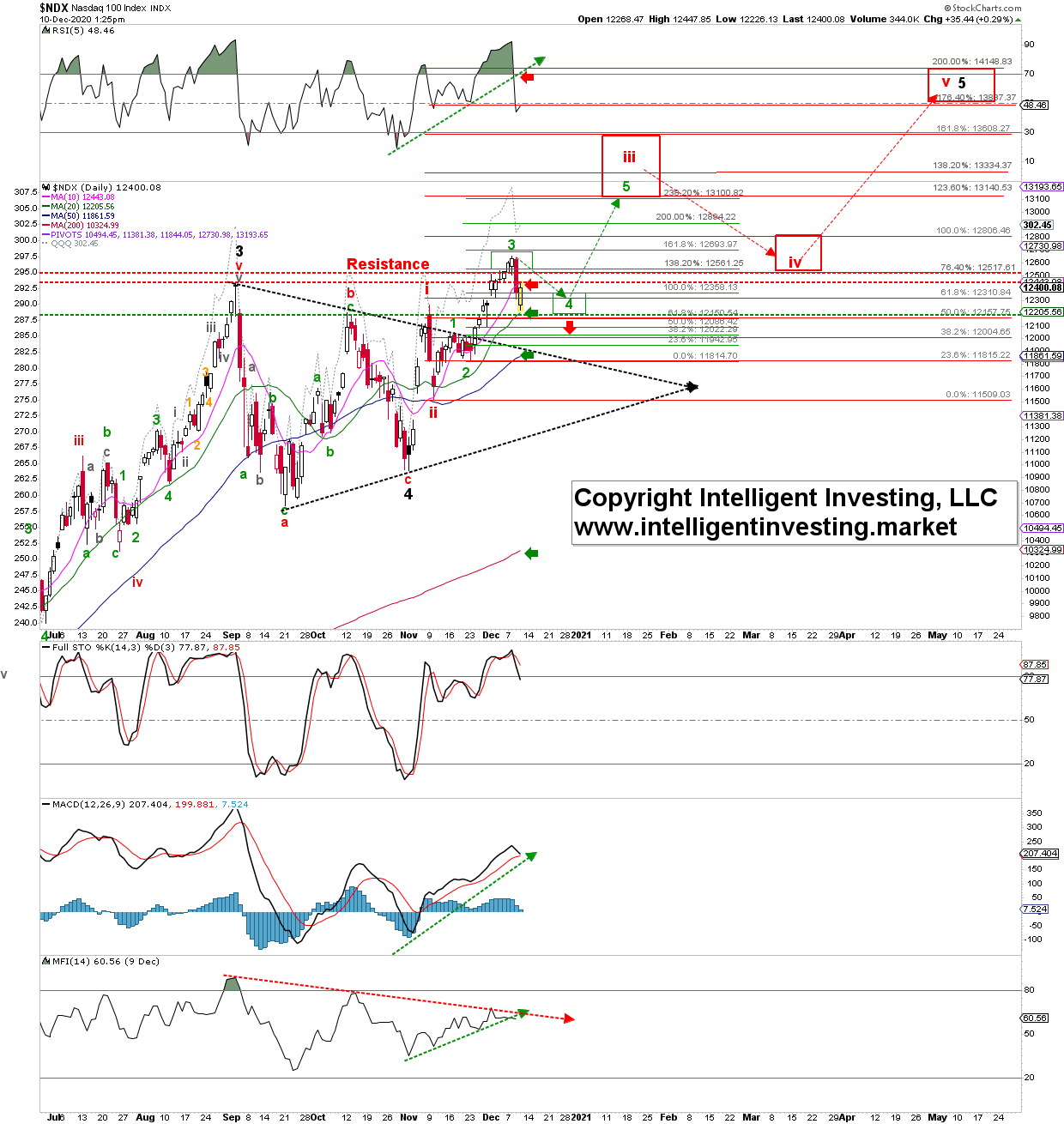

Figure 1. NDX100 daily candlestick chart with EWP count.

Why that answer?

Because the index completed (green) minor wave-3 on Tuesday, right in the ideal target zone of this third wave, which I had already shown to my premium major market members days before as a potential topping zone. Today, the index, so far, bottomed right in the ideal (green) minor-4 target zone, which I also had shown it most likely would. Thus, so far, no surprise, everything is going according to plan. The lower end of this wave-4 zone is at 12150, which also equates to the 10-day simple moving average (SMA), and if that level holds, this is, per the EWP, still a valid 4th wave low. In that case, minor wave-5 should soon commence to ideally 13140-13610. TBD.

Besides, 3rd of 3rd waves, minor-3 of (red) intermediate-iii, often have maximum strength and momentum. The extreme daily RSI5 and peak MACD readings support this, thus adding weight to the notion Tuesday’s high was only a temporary high and not an ultimate high. As September shows, markets can correct much deeper after peak technical indicator readings, so we should never take anything for granted: there are no guarantees. Hence, certain key price levels need to hold to allow the market for more upside: this is the beauty of the EWP as it allows us to determine those with great accuracy, which can be used as stop levels.

For now, the bulls have their work cut out for them: 1) hold 12150 on a closing basis, 2) overcome resistance at the 10-day SMA, and 3) move price above the horizontal resistance zone of 12440-12500. Those are the three triggers to tell us wave-5 of wave-iii is under way. If they cannot do that, then it is time to go back to the drawing table: anticipate, monitor and adjust if necessary. A loss of the 20d SMA can, namely, easily target the 50-day SMA. Until that happens, I continue to prefer to look higher.