- Microsoft's recent earnings beat raised expectations for Q2

- Can the tech giant's foray into AI generate enough growth to beat forecasts?

- Let's take a closer look using InvestingPro. Members of InvestingPro get exclusive access to our research tools and data. Learn More »

Microsoft Corporation (NASDAQ:MSFT), the second most valuable company in the world, reported better-than-expected earnings for the first quarter of 2023. With revenues of $52.86 billion, the company surpassed InvestingPro's expectation of $51 billion. Additionally, the tech titan exceeded earnings per share expectations by 9.8%, reaching $2.45.  Source: InvestingPro

Source: InvestingPro

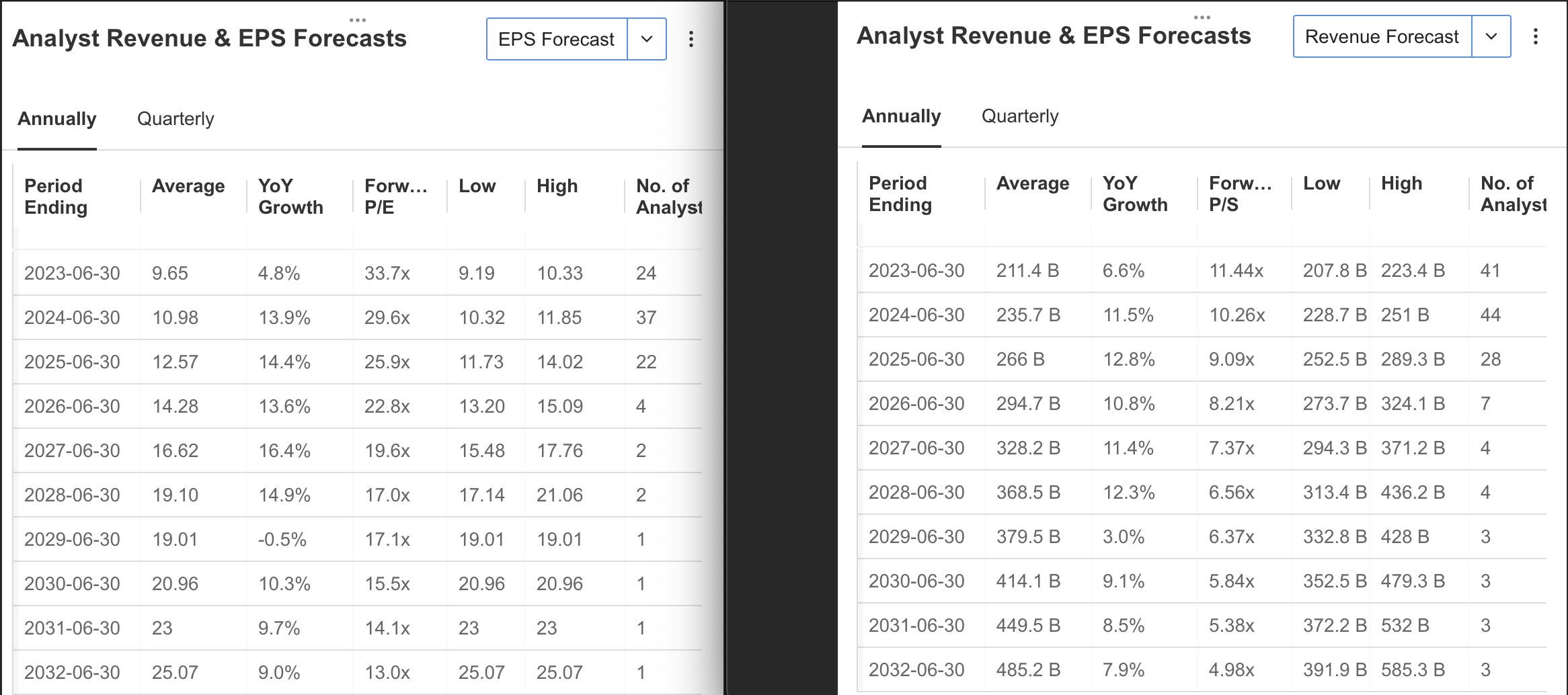

According to forecasts on InvestingPro, Microsoft's earnings per share for the last quarter, to be announced on July 25, will reach $2.56.

Furthermore, the average estimate for company revenue stands at $55.42 billion. Looking ahead, analysts maintain projections for continued growth in earnings per share, while revenue is expected to rebound after a slowdown in the third quarter.

On an annual basis, the software giant is anticipated to achieve annual growth rates exceeding 10% from 2024 to 2028, based on revenue forecasts.

Source: InvestingPro

Source: InvestingPro

Given the high expectations, what must the tech giant do to surpass them?

The answer is simple: Ride the AI wave.

Microsoft's AI Foray

Microsoft's expectations of continued significant revenue growth in the coming periods revolve around its investments in the artificial intelligence sector.

In the last quarter, Microsoft made headlines with a multi-billion dollar investment in OpenAI. The company plans to leverage artificial intelligence in enhancing Microsoft 365 software and the new version of the Bing search engine.

By investing $1 billion in OpenAI back in 2019, ahead of many industry players, Microsoft showcased its forward-thinking approach.

The race in artificial intelligence heated up in November 2022 with OpenAI's launch of ChatGPT, prompting Microsoft to further strengthen its position by investing a substantial $10 billion in OpenAI.

As a result, Microsoft has bolstered its presence in the artificial intelligence field, surpassing its main competitor Alphabet (NASDAQ:GOOGL) in terms of market positioning.

Microsoft's revenue distribution is dominated by the smart cloud segment, contributing significantly to its overall revenue. The productivity and business process segment also shows consistent quarterly and annual growth.

However, the personal computing segment experienced a decline of nearly 10% in the last quarter. This can be attributed to lower sales of hardware products and reduced gaming revenue.

On a positive note, Microsoft's potential acquisition of Activision Blizzard (NASDAQ:ATVI) could further enhance its position in the gaming segment.

Additionally, integrating artificial intelligence technology into the Bing application holds the potential for rapid revenue growth.

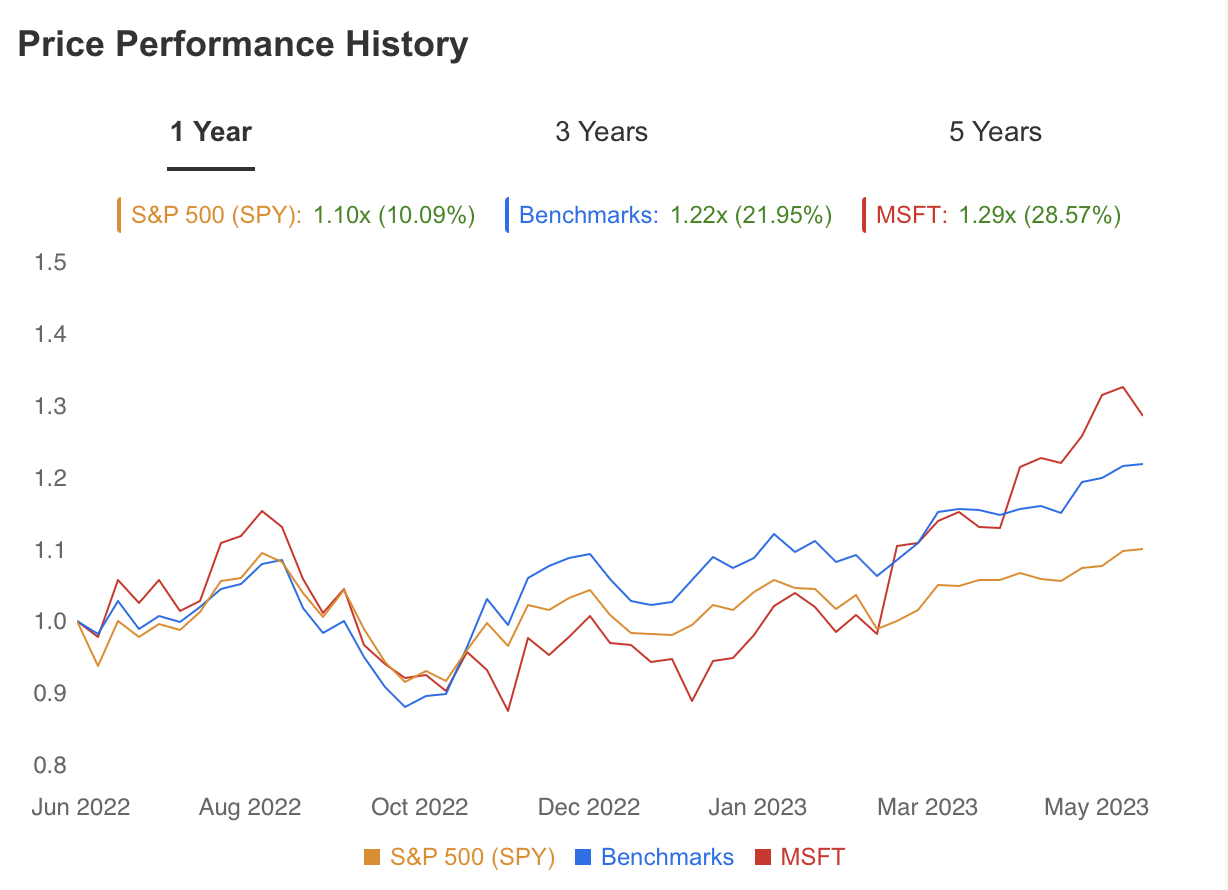

Considering these developments, Microsoft demonstrates strong growth potential. Notably, the stock has outperformed the technology sector and the S&P 500 over the past year, particularly after the first quarter. Source: InvestingPro

Source: InvestingPro

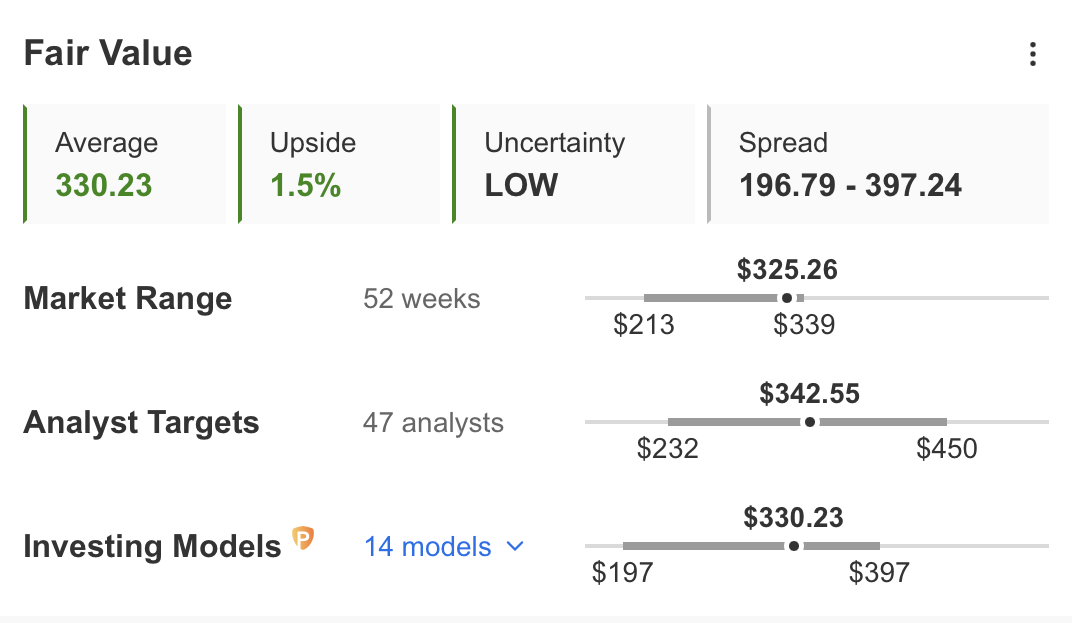

Based on InvestingPro models, the fair value of Microsoft's stock is $330. On the other hand, 47 analysts' estimates average slightly higher, at around $342 per share. Source: InvestingPro

Source: InvestingPro

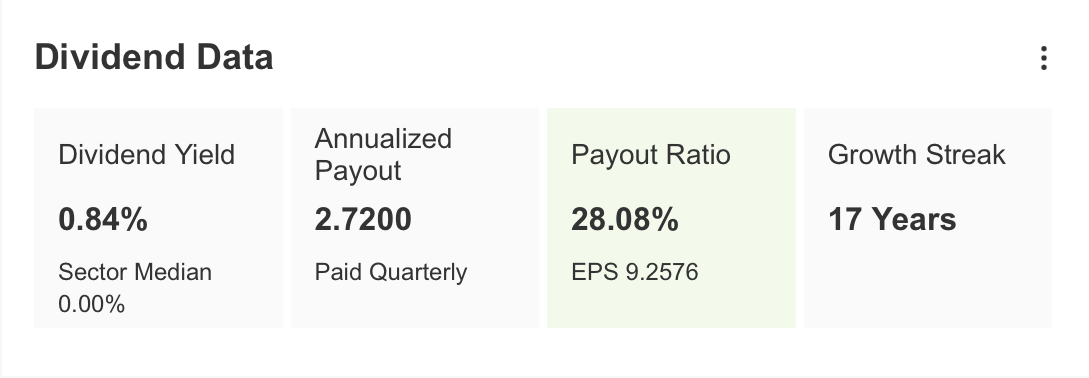

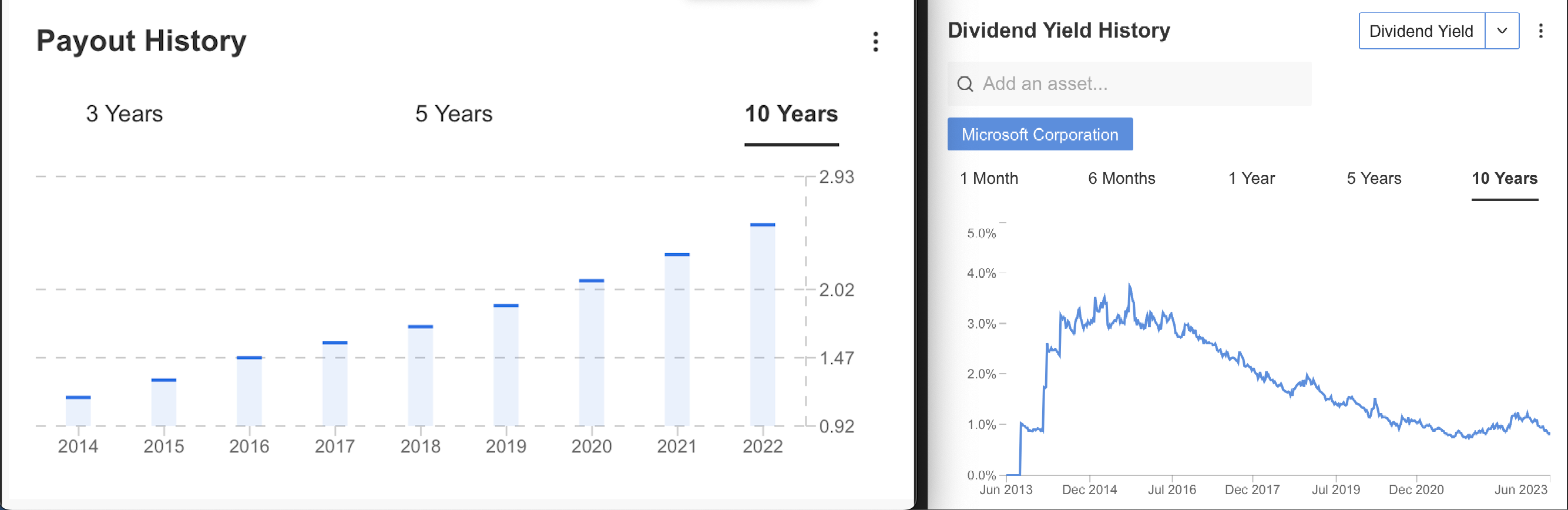

Microsoft has raised its dividend for 17 consecutive years, as highlighted on InvestingPro. However, it is worth noting that the current dividend yield stands at 0.84% and has trended down over time.  Source: InvestingPro

Source: InvestingPro

Source: InvestingPro

Source: InvestingPro

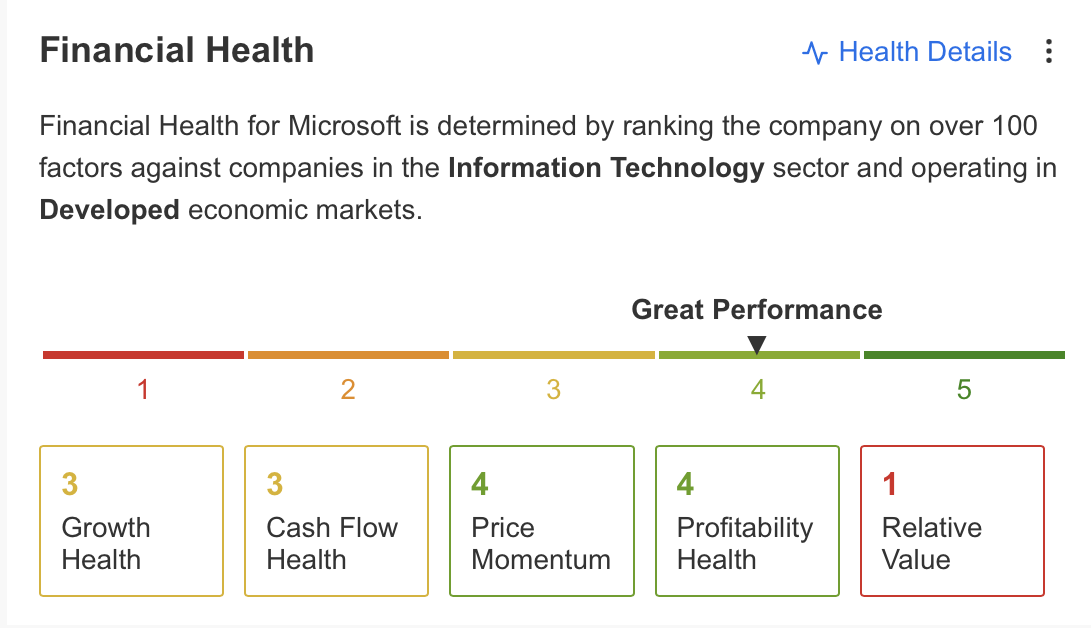

Regarding the company's financial health, InvestingPro highlights its profitability, price momentum, and strong growth and cash flow performance. However, there is one drawback: its relative value.

On a positive note, Microsoft maintains a healthy cash flow that covers interest expenses adequately. The company has shown strong performance in the past three months, with a stable share price.

Analysts also hold a positive outlook on Microsoft. However, Microsoft's price/earnings ratio, which exceeds the sector average, can be considered a disadvantage.

Additionally, the recent revenue growth decline serves as a warning signal for Microsoft. Source: InvestingPro

Source: InvestingPro

Conclusion

Microsoft's proactive adoption of technological innovations has driven its financial results and inspired confidence in its medium and long-term growth.

The company's substantial investments in artificial intelligence are expected to significantly contribute to its profits as they start benefiting its various segments. This positions Microsoft favorably for future growth.

InvestingPro tools assist savvy investors in analyzing stocks. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

Start your InvestingPro free 7-day trial now!

***

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are evaluated from different perspectives and are extremely risky, so the investment decision and the associated risk is the investor's.