Having grown up in the Midwest, I remember from an early age, spending long summer days playing sports and goofing around with friends until the sun went down. Ohio has a time advantage due to its close proximity to central standard time. The sun doesn’t set during summer until well after 9:00 pm.

I grew up west of Cleveland, near the country. I vividly recall the enjoyment I felt riding thru the farming areas as the corn stalks were sprouting up. My grandmother (from the old country) loved fresh fruits and vegetables and I would drive her to the country area so she could purchase fresh fruits and vegetables directly from the farmers. I remember eating a freshly picked juicy peach that is only a gift from nature.

In the past 20 years, I have had clients who were in the heart of farm country down in Southern Ohio. I especially enjoyed driving to their meetings during the summer month. I would take the back roads that would take me directly by the corn stalks and spread out farming communities. I guess I have always equated fruits and vegetables with summer.

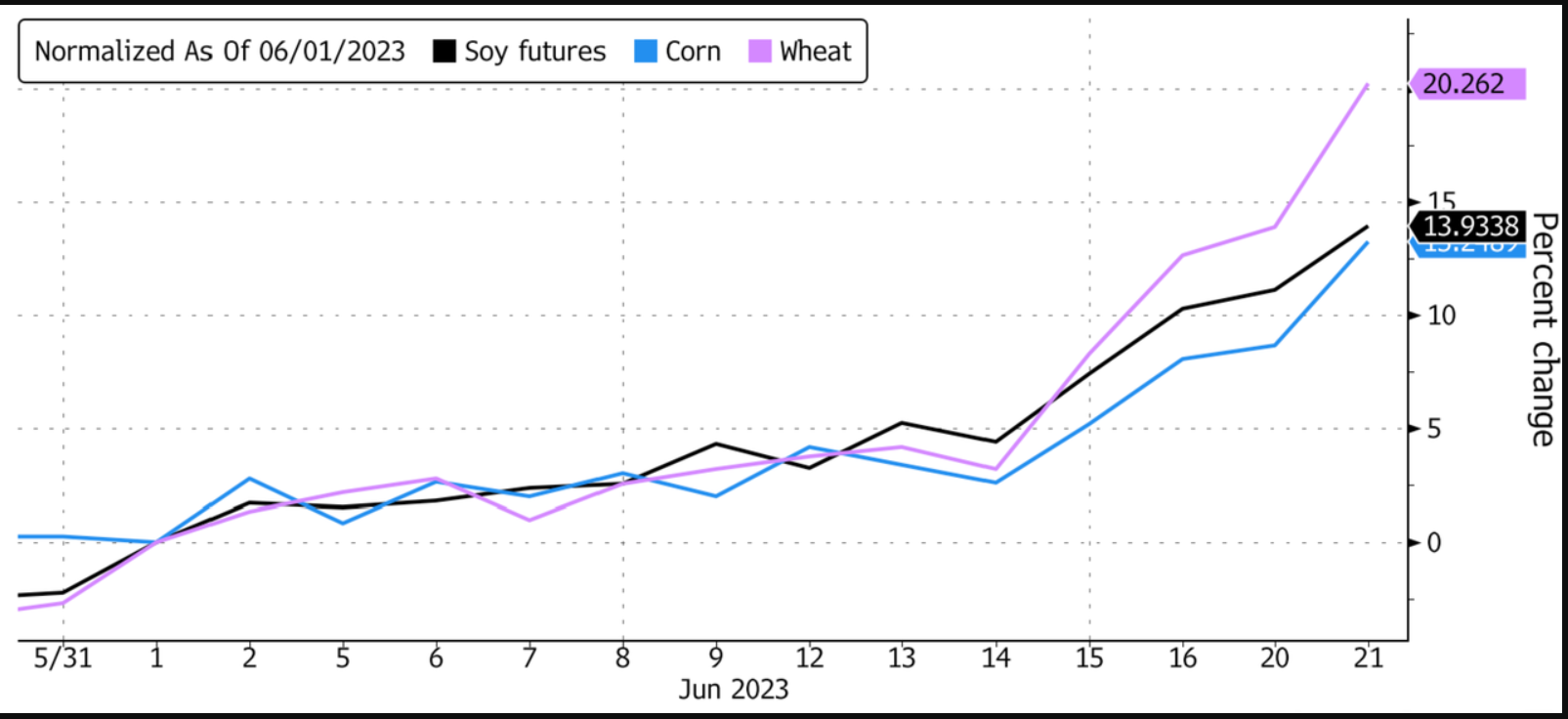

I share this with you because we are sitting on the precipice of a potential disaster. Corn, soy, and wheat prices have been soaring this past month as growing conditions across the Midwest have rapidly deteriorated due to the lack of rainfall during late May and into June. See graph below:

This was echoed by numerous people this past week. Here is but one of the many that I read:

Corn growing conditions have been terrible in Illinois, the second-biggest corn-producing state. About 36% of the state’s crop was rated good to excellent for the week ending June 18, down 12 percentage points from the prior week. (that means 64% was rated below good).

The latest U.S. Drought Monitor Map reveals Illinois, Indiana, Iowa, Michigan, Minnesota, Missouri, Ohio and Wisconsin, often called the “Corn Belt” states, are experiencing “moderate drought to exceptional drought” The timing of the worsening drought is stressing young plants.

This weekend the region is getting some much-needed rain. Let’s hope it helps get us out of this dire situation.

What does this have to do with a Market Outlook?

Many of our longtime readers of this weekly commentary may recall that during the summer of 2022, we discussed and posted tables indicating that the cost of food (broken down from eggs to vegetables to meat) was soaring. This has been one of the more persistently nagging parts of the CPI (Consumer Price Index), and one that both Mish and I continue to believe will persist. We don’t see these inflationary pressures coming down anytime soon.

Prices of wheat futures are up 20% on the month (June), soy futures are up 14%, and corn futures are up 13%. See graph below:

The persistent elevation of food prices will undoubtedly make the Fed’s job much harder. This is why the statistics are reported as overall CPI and then ex the variable Food & Energy costs.

Try telling Americans who are finding it increasingly difficult to make ends meet that food prices are not only going to stay high but may go higher due to a shortage of corn, soy, and wheat this summer. They would tell you there is no such thing as EX- FOOD & ENERGY.

The Fed Speaks.

You may recall that we covered, in great detail, what Chairman Powell and other Fed Governors said after they SKIPPED raising rates at their recent Fed Open Market Committee (FOMC) meeting earlier this month.

As we expected, Chairman Powell’s hawkish testimony to Congress this past week was littered with references to the majority of Fed Governors believing that more interest rates are likely. The investment community finally got the message that there will BE NO RATE CUTS in 2023.

Additionally, central banks in Europe, Australia, and the UK rose rates this past week. This was on the heels of higher-than-expected readings on inflation in their countries (especially the UK, who is feeling the negative aftereffects of BREXIT).

The Resilient Markets

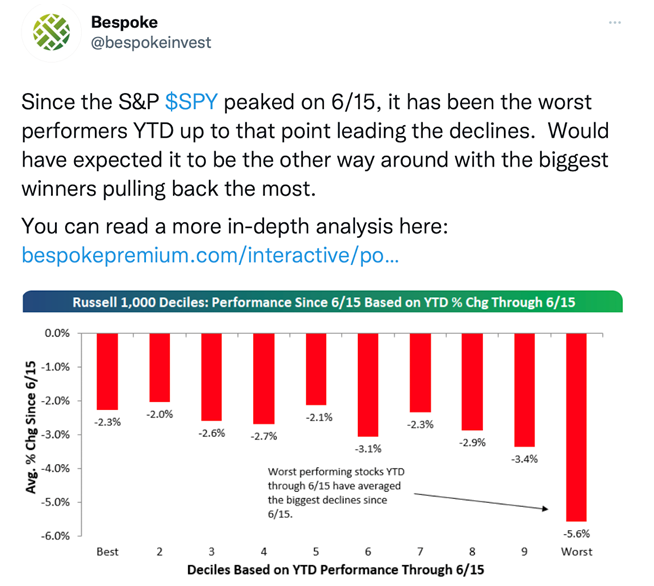

The Fed’s hawkish tone this past week took some of the wind out of the market’s forward momentum, and for the first time in many weeks, the markets closed down on the week. See graph below:

The Markets are coming off a good six-month run! Can this continue?

We would like to review some good graphs/charts that show just how much strength and momentum the stock market continues to have. Then we will explore what might come next.

Even though the market was down on the week, it still sits at a 52-week high. See graph below:

Interesting that the stocks doing poorly so far in 2023 are the ones leading this slight contraction this week in the markets. See graph below:

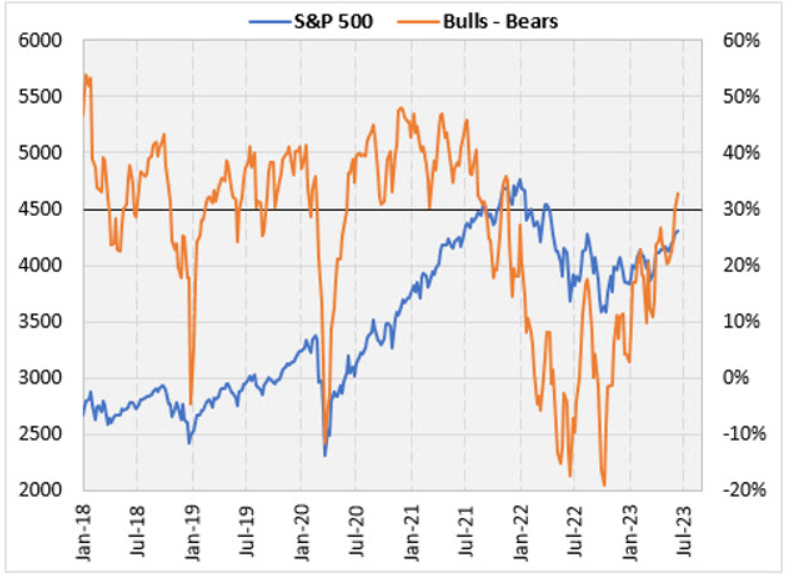

The Stock market has followed the Bull-Bear Sentiment

Over the past year, we have often cited the AAII Bullish-Bearish sentiment and how it was stuck (for a long while) in the heavy bearish camp. As shown in the graph below, the difference between the Bulls and the Bears has grown more positive over the last 6 months, and you see how it tracks with the S&P 500:

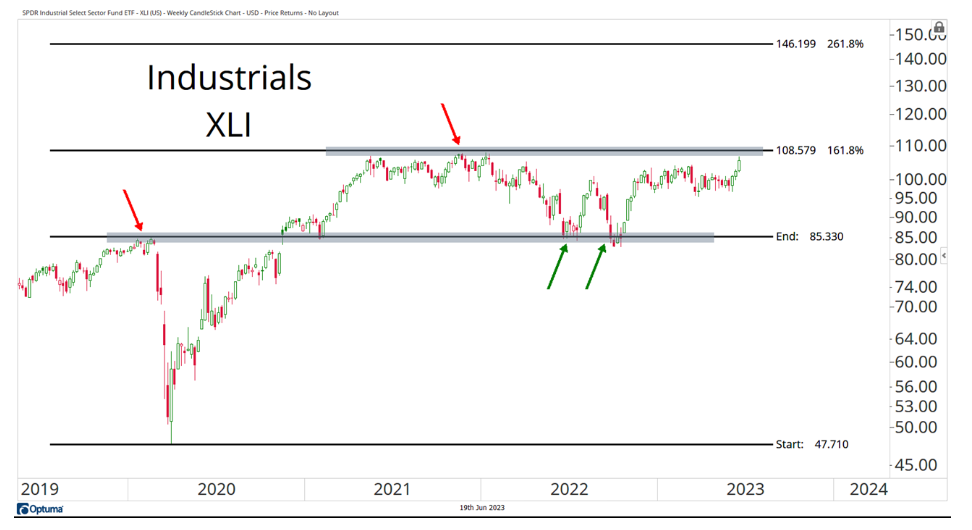

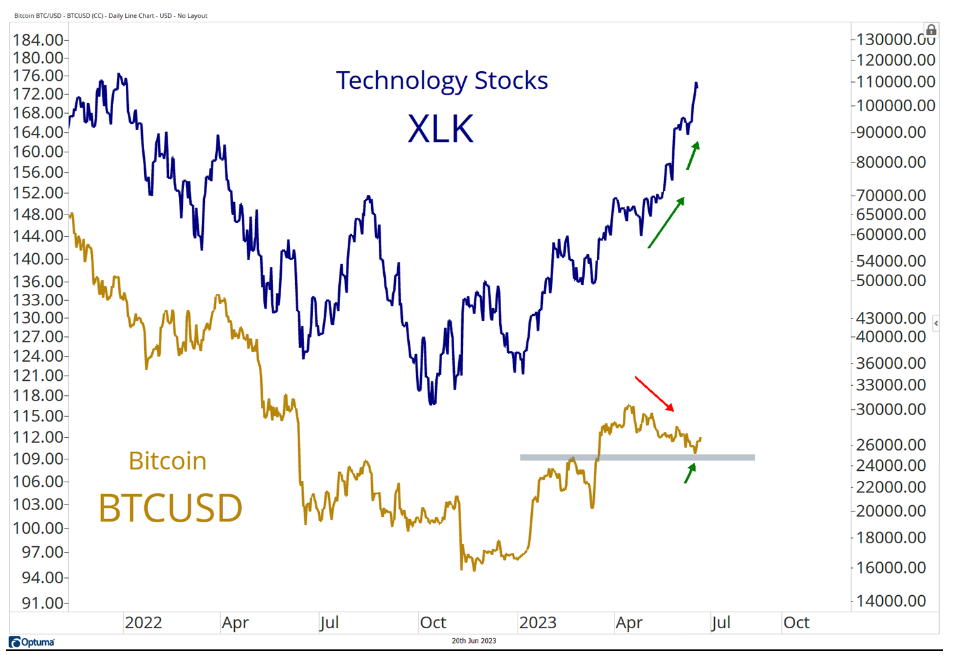

This coincides with the strength we are witnessing in areas of the market that could potentially drive it higher, namely industrials and technology. In fact, both of these areas may see new all-time highs in the near future. For those still negative, bear markets don’t typically exist when these two areas are hitting new highs. See graphs below:

Also, Bitcoin rallying this past week is positive for the stock market in that it shows speculative capital is at work. Many analysts believe that there is some correlation between Bitcoin and the Technology sector. Bitcoin finds itself above support now. See graph below:

Additional areas of strength that are important for our economy.

Another positive sign on the health of the economy (and withstanding the Fed’s unprecedented 10 rate hikes) has been semiconductors and home builders. These are also areas of the economy where shortages exist.

These are also two of the areas of the market that several of our investment strategies have been invested in since early in 2023. Remember our algorithms and quant models often identify trends before they occur. It is not surprising that our subscribers and investors have benefitted greatly from these areas so far in 2023. See the performance charts of these two Sectors below:

These are also positive indications for a healthier market. These important sectors may also provide some support for the market as it goes through the summer period which tends to be more subdued, quieter and see less volume as people are away on vacation or participating in other activities (boating, etc.).

It's still about the Large-Cap stocks.

It may surprise you to learn that through yesterday (June 23, 2023) the S&P 493 (Excludes NVDA, AAPL, TSLA, MSFT, GOOGL, META & AMZN) is now FLAT for year-to-date performance. Yes, you read that correctly. The S&P 493 ytd is at 0% performance.

The remaining 7 technology companies in the S&P 500 are up 55% year-to-date.

During market weakness on any given day, these 7 stocks also have outperformed the S&P 493. (Shows you where money flows are going).

In good days and bad days (like Friday), the market is leaning on large cap technology. Artificial Intelligence is the key in technology stocks at the moment that is fueling the future earnings growth expectations. See chart below:

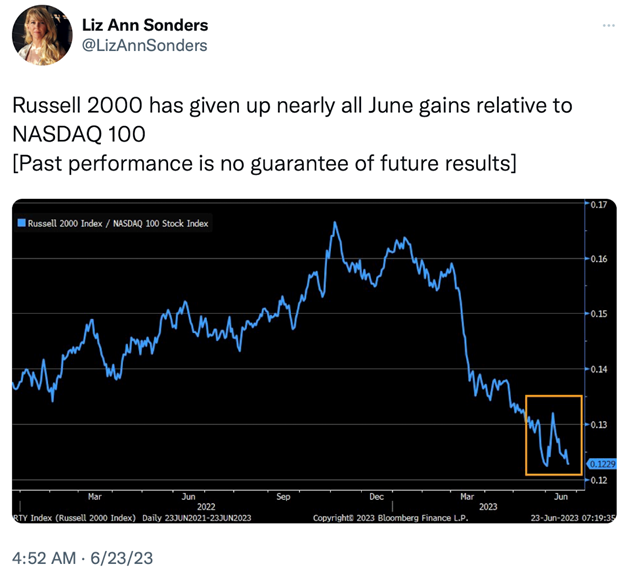

The small cap stocks (iShares Russell 2000 ETF (NYSE:IWM)-IWM) continue to lag.

This week’s market weakness was further accentuated by the smaller capitalization of the stock market. Small cap stocks caught a bid earlier in the month and investors began to cheer that maybe the soldiers were now ready to follow the Generals. This coincided with the belief that the Fed was not only going to PAUSE/SKIP, but they were likely done with any future interest rate hikes. This week’s rhetoric by Chairman Powell and other Fed Governors’ comments (see our Market Outlook from last week on this), put a STOP to that belief and has affected the smaller capitalization area of the markets.

Clearly the potential for higher interest rates weighs on these smaller companies much more and was reflected in that sector’s poor performance this past week. See graph below:

MarketGauge believes in small caps. This area of the market presents opportunities for investors to catch the wave of quality, small companies which typically have higher growth rates and whose share prices can appreciate from earnings acceleration.

The important point above is EARNINGS. This is why when we put together our SMART Small-Cap Earnings Growth separate stock investment strategy. The construction of the quant model depends heavily on the quality of earnings as well as the future projected growth rate of those earnings.

This SMART investment strategy we offer has produced back tested results 3x greater than the Russell 2000 index. In real time with real money, in 2023 this investment strategy is up double digits and exceeding the small cap index. (Please let us know if you would like information on it?)

Concerns persist.

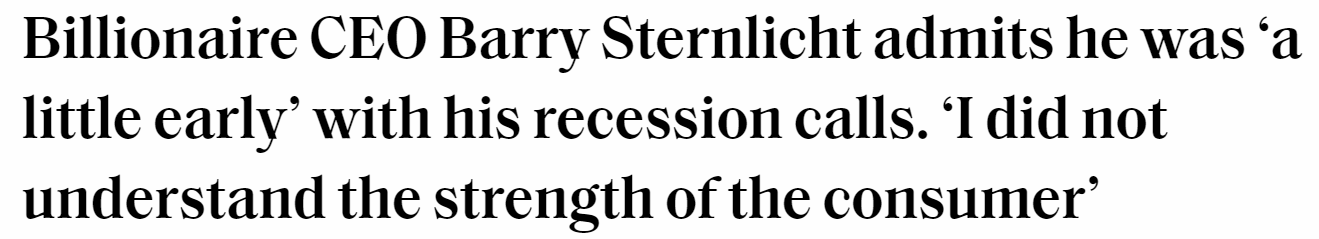

We have consistently written in this column throughout 2023 (see archives) that there are a host of economic concerns (beyond inflation) on the horizon. Many top billionaire investors and analysts have been calling for a recession. So far, most have been either wrong or still early to see this come to fruition.

As reported by FORTUNE MAGAZINE yesterday, billionaire investors like Barry Sternlicht of Starwood Capital, have come out recently to say that they got it wrong, so far:

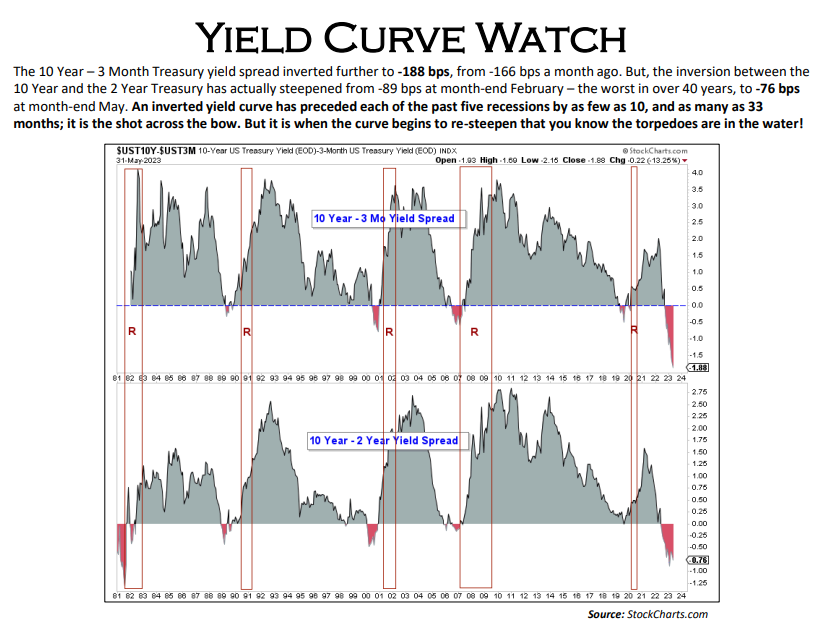

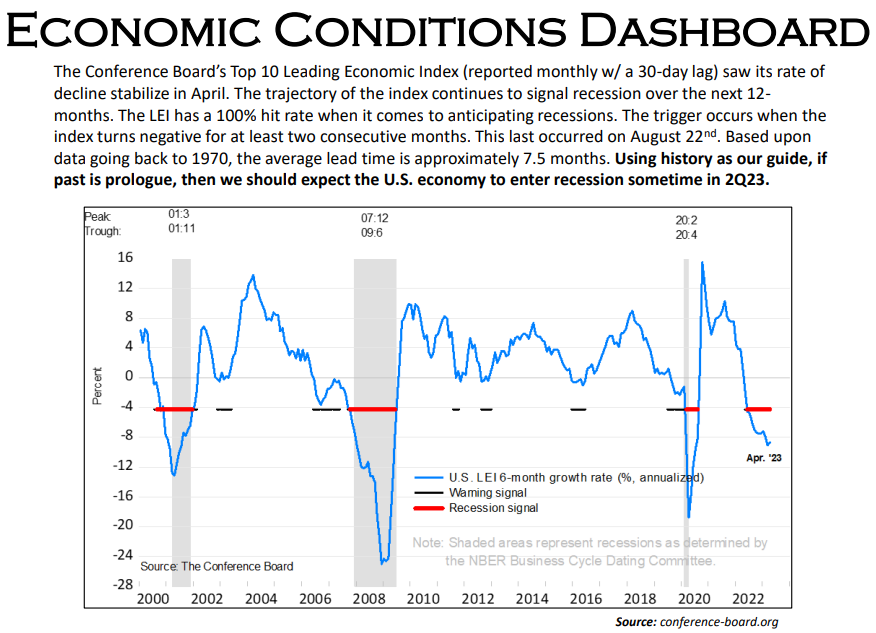

Still other influential businesspeople are calling for us to enter an earnings contraction sometime this summer. Analysts keep watching the inverted yield curve (below) and insist that it forecasts with 100% certainty future recessions.

So far, earnings have held up and are not showing the signs of weakness that many have anticipated.

On the other hand, there are plenty of signs that the Fed’s 10 interest rate hikes are having the desired effect, so far. Unfortunately, these effects are not happening fast enough and the consumer (as referenced above) as well as the labor market remain robust. This is driving up wages and helping to keep inflation higher and more persistent than the Fed’s desire.

Remember they still believe they can get inflation down to their 2% target.

We have learned that as long as people have a job and are getting good wages, they will continue to spend. That was the message echoed by Barry Sternlicht above.

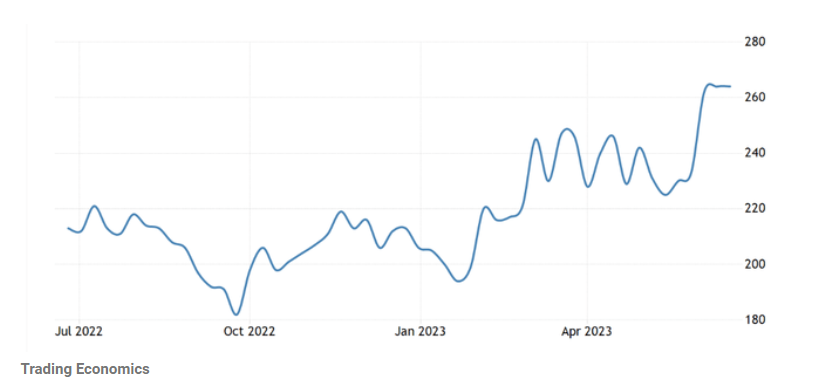

However, last year’s interest rate rises are beginning to take their toll on things like unemployment claims, retail sales, and the Leading Economic Indicators. See graphs below:

Unemployment Claims are Climbing (slowly):

Positives persist.

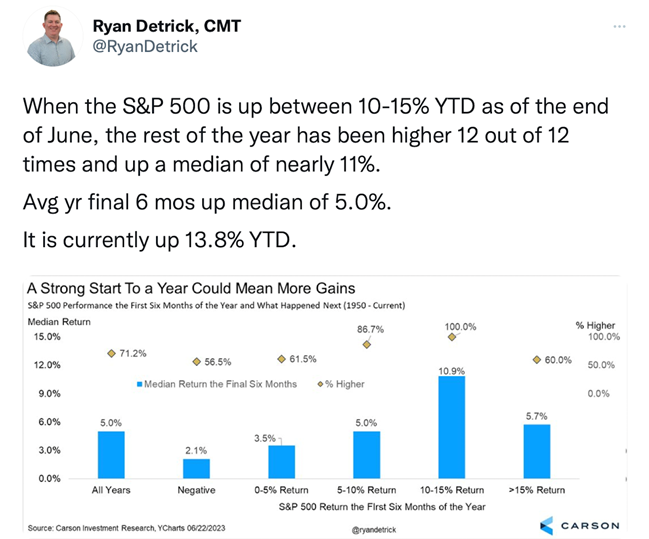

We have tried to provide a balanced view of the current economic reality. Investors have experienced a favorable investing period thus far in 2023. The market, and the economy, remain resilient. One of our favorite analysts, Ryan Detrick of the Carson Group continues to shed a positive light on what we have experienced this far in 2023 and what the next 6 months hold for investors.

His commentary (and graph) that follows is based on historical returns after a positive 6 month market return. In forecasting what the markets might do, keep in mind that he is also factoring in the Presidential Cycle which leans quite positive in the pre-election year. See commentary and table below:

We provide two thoughts to consider about the chart above. 1) The economy is slowing down and if earnings contract, then all bets are off that this chart will ring true; 2) We may still enter a recession or at least a period of slow or no growth and that will have a negative effect on the markets as well.

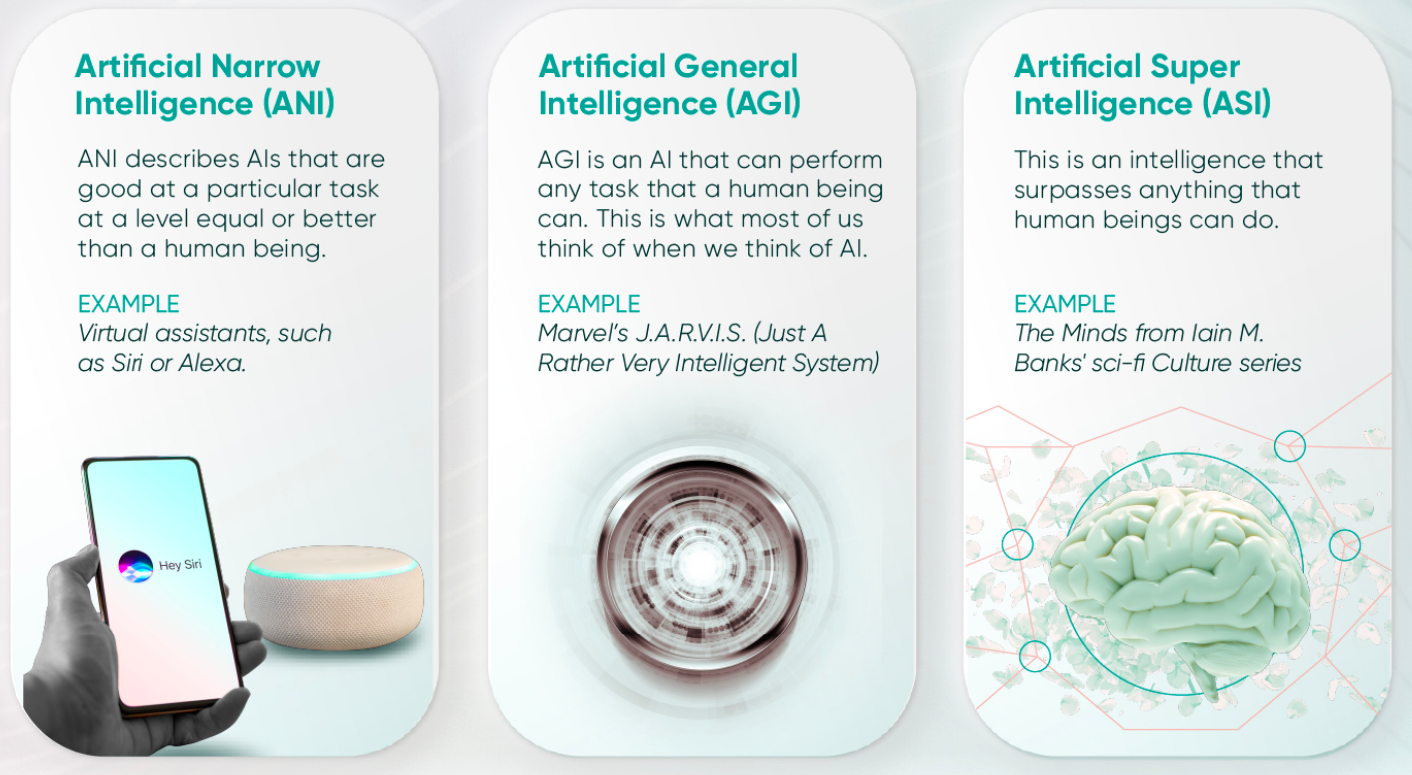

The excitement in technology stocks this year has been centered on Artificial Intelligence and many of the advances that the mega-cap big companies are making by integrating AI into their business platforms. As additional fuel to the existing excitement investors have about AI and growth stocks incorporating AI into their business models, we offer you the following brief overview of AI.

The Importance of Artificial Intelligence

We will be bombarded with continuous updates on the AI world and its dramatic impact on our economy and increasing productivity. But these discussions will not be without the fear that this technology may develop too fast , get away from us, destroy humanity and all the other reasons why we should control and regulate the technology sooner than later.

To help you understand where we are in the “AI” cycle, see the following graph below:

While most of us have had the beneficial experience of using Alexa, Siri or Google (NASDAQ:GOOGL) Assistant in our lives, most of us have not yet had the experience of going beyond that. We now firmly reside in Artificial General Intelligence (see above). The latest large language models like ChatGPT will offer everyone (who wants to be) a computer programmer.

With simple, plain-English text prompts the models will ultimately do the work of hundreds of coders-perhaps months of work, in merely seconds. But the output will only be as good as the prompts it’s given, and the data it is trained on.

With this new era of generative AI, companies, for now, that are data rich and data dependent are in a position of strength. These companies will have the data to train their own models. This will enhance their data analytics capabilities, help them make critical decisions and eventually identify new business opportunities, new products, new distribution methods and ways to increase the customer experience.

Moreover, for a society, like ours, caught in a skilled labor shortage, AI will be huge (and already is). As a recent example, CarMax (NYSE:KMX) used ChatGPT to summarize 100,000 customer reviews to include on their website, for every make, model and year of car sold. They claim it would have taken their editorial team 11 years to complete the job.

For now, who are the kings of data, who will use this technology the most?

The new kings are the same as old ones: Google (GOOG), Amazon (NASDAQ:AMZN), Facebook (NASDAQ:META) (Meta), Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT). No wonder of the 500 stocks on the S&P 500, these are 5 of the top 7 that we mentioned above.