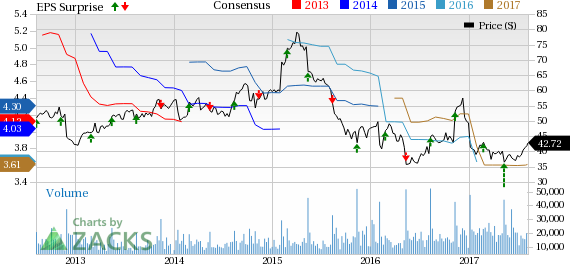

Kohl’s Corporation (NYSE:KSS) is set to report the second quarter of fiscal 2017 results on Aug 10 before the market opens. The question lingering in investors’ minds is, whether the departmental store will be able to maintain its positive earnings surprise streak in the to-be-reported quarter. We note that the company has outpaced the Zacks Consensus Estimate in all the trailing four quarters, with an average positive surprise of 21.3%. In fact, earnings have outpaced the Zacks Consensus Estimate in eight out of past 10 quarters.

Kohl’s forms part of the Retail-Wholesale sector. Per the latest Earnings Trends, we note that the above mentioned sector’s earnings growth looks disappointing. Out of the 41.5% S&P 500 companies that have reported in the sector as of Aug 4, we see that total earnings of these companies have declined 2.3% on a year-over-year basis (64.7% of the companies beat EPS estimates) while total revenue increased 8.0% (70.6% beat top-line expectations).

Let’s delve deeper how things are shaping up for this announcement.

Which Way are Estimates Treading?

Let’s look at earnings estimate revisions in order to get a clear picture of what analysts are thinking about the company right before the earnings release. The current Zacks Consensus Estimate for the quarter under review has increased 1.7% over the last seven days and is currently pegged at $1.17 per share, down 4.4% from $1.22 per share delivered in the year-ago quarter. Analysts polled by Zacks expect revenues of $4.1 billion, down 1.7% from the prior-year period.

What the Zacks Model Unveils?

Our proven model does not conclusively show that Kohl’s is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Kohl’s has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.17 per share. The company currently carries a Zacks Rank #3, which increases the predictive power of ESP. However, its ESP of 0.00% makes surprise prediction difficult.

Factors Influencing the Quarter

Kohl’s has been struggling with weak comps and a difficult retail sales scenario for the last few quarters. The company’s strategic initiative, ‘Greatness Agenda’, which was designed to increase transactions per store and sales, is also failing to deliver positive results. Though the plan, which commenced in the first quarter of 2014, has helped the company to deliver positive comps in all the four quarters of fiscal 2015, the quarterly growth rates moderated gradually but then started declining since the first quarter of fiscal 2016, posing a concern. We note that comps plummeted consecutively in the last five quarters. The company is also witnessing lower spending on apparel and accessories, dwindling store traffic, margin pressure and competition from discount retailers, which are hurting sales at department stores.

Nevertheless, Kohl’s has been making continuous efforts to improve its base business. Lately, the company has started offering more outside famous brands and cutting down on the number of in-house clothing brands it sells. The addition of Under Armour workout tights, sneakers and other gear in March was a great success and was very well-accepted among customers. It also helped to boost sales of the entire active apparel department in the first quarter despite decline in women's, children's and accessories units. Kohl's plans to start selling Clarks shoes for the back-to-school shopping season and is looking for other brands to add to store aisles. The company also plans to continue selling the best-selling of its private-label brands, such as Sonoma, Croft & Barrow and Apt. 9, in order to drive traffic.

Kohl’s has also undertaken several initiatives to reduce its inventory to boost profits. During the first quarter of fiscal 2017, the company made additional progress on its initiatives and as a result, inventory per store decreased 1%, while units per store were 5% lower. Lower inventory levels thus boost its earnings. The company continues to expect inventory to be down low to mid-single digits for the fiscal year 2017.

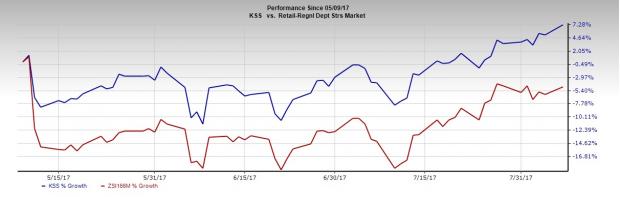

We believe these efforts are well reflected in the share prices of the company. Notably, in the last three months, the stock has moved up 7.3% in comparison to the industry and the broader sector. While the industry declined 4.7% in the last three months, the sector increased 3.0% in the said time frame.

Stocks with Favorable Combination

Stocks in the broader retail sector carrying both a positive Earnings ESP and a favorable Zacks Rank, and therefore worth considering include:

Dollar General Corporation (NYSE:DG) has an Earnings ESP of +0.93% and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sally Beauty Holdings, Inc. (NYSE:SBH) has an Earnings ESP of +2.13% and carries a Zacks Rank #2.

Whole Foods Market Inc. (NASDAQ:WFM) has an Earnings ESP of +4.35% and carries a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Dollar General Corporation (DG): Free Stock Analysis Report

Sally Beauty Holdings, Inc. (SBH): Free Stock Analysis Report

Kohl's Corporation (KSS): Free Stock Analysis Report

Whole Foods Market, Inc. (WFM): Free Stock Analysis Report

Original post

Zacks Investment Research