ITT Inc. (NYSE:ITT) has managed to impress investors with solid second-quarter 2017 results, wherein its earnings beat estimates by 3.2%. The company expects to continue its earnings momentum on the back of strong productivity, business streamlining and cost containment measures. ITT Inc. raised its earnings guidance for fiscal 2017 in the last quarterly report, tangibly reflecting these growth drivers.

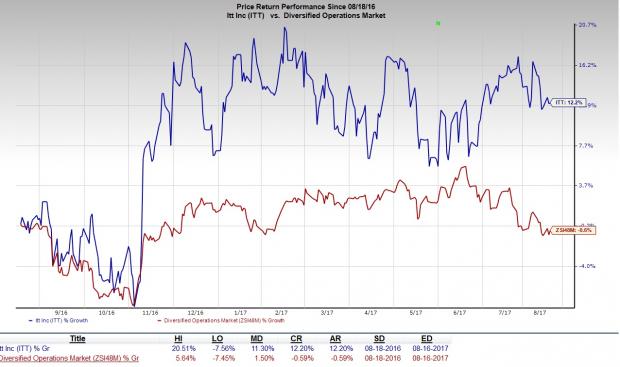

Investors have been encouraged by the company’s striking performance, and consequently, its shares have appreciated 12.2% in one year, in stark contrast to the industry’s average decline of 1%. We believe ITT Inc., which enjoys a strong foothold in an expanding automotive market which has several growth drivers working in its favor. Read on to find out the key drivers for this Zacks Rank #3 (Hold) company right now.

Factors at Play

ITT Inc. experienced healthy revenue growth in the second quarter, driven by sound performance from the Motion Technologies on the back of market growth in automotive brake pads in Europe and China, and strong sealing solutions at Wolverine. Particularly, the Motion Technologies segment saw robust execution, with organic revenue growth of 5%.

Encouraged by the overall positive performance, management raised the lower end of the previously announced revenue guidance of a decline of around 2% or increase of up to 2% to the range of 0% to 2%. Management also raised the guidance of adjusted earnings to the band of $2.40–$2.50 per share from the previous estimate of $2.28–$2.48.

In light of the strong momentum and raised guidance, analysts have become increasingly bullish on the company in recent times. The Zacks Consensus Estimate for 2017 earnings has trended up over the past couple of months, from $2.42 to $2.46, on the back of six upward estimate revisions versus none lower.

ITT Inc.’s focus on business streamlining, cost controls and efficiency continue to prove beneficial to its financial performance. The integration of its Interconnect Solutions and Control Technologies businesses into the Connect and Control Technologies segment is expected to deepen its focus on target markets, streamline operations and leverage shared infrastructure and end markets. Its simplified operational framework will help unlock growth opportunities and drive long-term growth in the global aerospace and industrial markets.

We are highly optimistic about ITT Inc.’s market expansion strategies which are expected to act as key drivers of growth for 2017. Going forward, the company expects its rail and auto businesses to act as major growth drivers, fueled by an increase in acquisitions and growth in the aftermarket brake pad business.

However, the company faces risks from uncertainty in the global macroeconomic environment, especially weakness in industrial markets. Also, pricing pressure on large projects and lesser petrochemical and mining project activity are anticipated to aggravate the decline in the petrochemical business in North America and China.

Moreover, the year-over-year decline in total revenue and organic revenues both at the Industrial Process and Connect and Control Technologies segments remains a matter of concern. The decline in revenue at the Industrial Process was primarily attributable a lesser number of oil and gas projects in North America, Asia and Latin America. Revenues in the Connect and Control Technologies segment fell primarily due to decline in demand in commercial aerospace and restrictions on sales of military-specification connectors.

Considering the growth drivers and the risks that the company faces, we have a Zacks Rank #3 (Hold) on ITT Inc.

Stocks to Consider

Some better-ranked stocks worth considering are Federal Signal Corporation (NYSE:FSS) , Honeywell International Inc. (NYSE:HON) and EMCOR Group, Inc. (NYSE:EME) each of them carrying Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Federal Signal Corporation has a positive average earnings surprise of 9.5% for the trailing four quarters, having surpassed estimates thrice.

Honeywell International managed to beat estimates thrice in the trailing four quarters, for a positive earnings surprise of 2%.

EMCOR Group has a positive average earnings surprise of 11.7% for the trailing four quarters, having surpassed estimates thrice.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

EMCOR Group, Inc. (EME): Free Stock Analysis Report

ITT Inc. (ITT): Free Stock Analysis Report

Honeywell International Inc. (HON): Free Stock Analysis Report

Federal Signal Corporation (FSS): Free Stock Analysis Report

Original post

Zacks Investment Research