Henry Schein, Inc. (NASDAQ:HSIC) is expected to report second-quarter 2017 results on Aug 3.

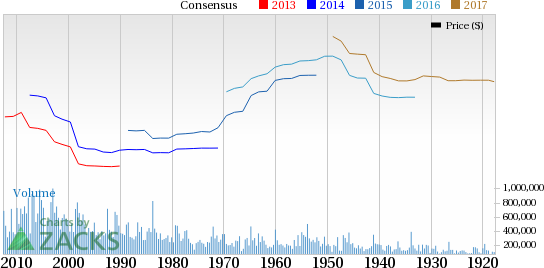

Last quarter, this renowned healthcare products and service distributor delivered a positive earnings surprise of 6.0%. Encouragingly, Henry Schein’s earnings surpassed the Zacks Consensus Estimate in all of the past four quarters, at an average of 2.81%.

Let’s see how things are shaping up prior to this announcement.

Factors at Play

Henry Schein’s first-quarter 2017 results were quite impressive, recording growth across all four segments – Dental, Animal Health, Medical and Technology and Value-Added Services. Geographically, the company gained traction in both North America and overseas markets. We expect a similar trend in the second quarter as well.

Notably, during the to-be-reported second quarter, Henry Schein Animal Health opened a new National Distribution Service Center (NDSC) in Columbus’s Brookhollow neighbourhood. This has enabled the company to be a complete solutions provider for veterinary practices across the country. We expect this to boost the top line in the yet-to-be reported quarter.

The company’s strategy to expand digital dentistry globally is also encouraging. In this regard, we note that management expects at least mid-single digit growth in North America’s dental equipment market in the second quarter. The company is currently banking on digital dentistry, which is part of its strategic plan. Henry Schein is thus busy promoting digital workflows for general dentistry as well as dental specialties.

On the flip side, Henry Schein’s year-over-year deterioration in gross and operating margin over the past few quarters due to higher cost of sales and expenses is a matter of concern.

Meanwhile, per management, solid sales in the second quarter are likely to be partially offset by the timing of Good Friday this year. Notably, this international holiday has fallen in the second quarter this year as compared to last year’s timing which was in the first quarter.

This apart, currency fluctuations and a tough competitive landscape add to our woes. Also, advent of group purchasing organizations (GPOs) in the U.S. adds to the competitiveness in the market.

Overall, the company’s reaffirmed its 2017 EPS guidance, reflecting growth of 16–18% from the year-ago period.

For the second quarter of 2017, there has been no change in estimate revision over the last 30 days. The same has been observed in the magnitude of estimate revision, with earnings estimates remaining at $1.73 over the same time frame.

Earnings Whispers

Our proven model does not conclusively show an earnings beat for Henry Schein this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. However, that is not the case here, as you will see below.

Zacks ESP: Henry Schein has an Earnings ESP of 0.00%. That is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.73. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Henry Schein’s Zacks Rank #2 increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult.

Meanwhile, we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies you may consider as our model shows that they have the right combination of elements to post an earnings beat in the upcoming quarter:

Becton, Dickinson and Company (NYSE:BDX) has an Earnings ESP of +0.41% and a Zacks Rank #2.

Thermo Fisher Scientific Inc. (NYSE:TMO) has an Earnings ESP of +0.44% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stryker Corporation (NYSE:SYK) has an Earnings ESP of +0.66% and a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Thermo Fisher Scientific Inc (TMO): Free Stock Analysis Report

Stryker Corporation (SYK): Free Stock Analysis Report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Henry Schein, Inc. (HSIC): Free Stock Analysis Report

Original post