- Duke Energy is a regulated utility that should see tax benefits from the Inflation Reduction Act of 2022.

- The Company is selling its Commercial Renewables segment in 2023 to become a pure-play utility, strengthen the balance sheet, reduce costs, and trim debt.

- Duke Energy shares are trading at $19.55X forward earnings with a 3.87% annual dividend yield.

Diversified energy utility Duke Energy (NYSE:DUK) stock has been resilient throughout 2022 as shares closed out the year virtually flat compared to the (-20%) drop in the S&P 500. The Company operates three divisions comprised of Electric Utilities and Infrastructure, Gas Utilities and Infrastructure, and Commercial Renewables serving over 10 million customers throughout the U.S. Duke Energy has seen residential load grow 5% above pre-COVID levels while commercial grew from new store opening and expanded data center usage.

It expected the load to grow from 1% to 2% in 2022. It also expects rate increases to get approved in the Carolinas, Florida, Ohio, and Kentucky. While there have been recent news-related setbacks, Duke Energy shares mirror the Utilities Select Sector SPDR (NYSE:XLU) and continue to be a steady investment for income investors seeking protection in a bear market.

Substation Attacks

The Company has suffered several substation shootings throughout North and South Carolina, Oregon, and Washington State since November causing blackouts and power outages. The shooter(s) were knowledgeable about the substations as they could shoot into the right transformers to create a slow leak draining the oil and buying them enough time to leave the scene.

These substations can be as large as a football field, and the transformers can be the size of a railroad car. The problem is they have to be imported to be replaced, and there is a backlog to deal with.

The two shootings at its North Carolina substation caused 45,000 customers to lose power. Over 50,000 substations throughout the U.S. operate the electrical grind with 700,000 miles of transmission lines. While transformers are vulnerable, substation attacks are alarmingly rising and have prompted a national review.

The Company has restored power to the damaged substations by Dec. 7, 2022. The Company also announced a three-year deal with Amazon.com (NASDAQ:AMZN) cloud deal to bolster its grid modernization efforts.

Bomb Cyclone of 2022

A rare bomb cyclone storm hit the U.S. on Dec. 23, 2022, that has wreaked havoc throughout the Midwest, causing thousands of canceled flights for Southwest Airlines (NYSE:LUV) and over one million people in the U.S. to lose power. Duke Energy requested that its customers conserve power along with warming temperatures, resulting in normal operations to return by Dec. 27, 2022.

Missed Earnings

On Nov. 4, 2022, Duke Energy released its fiscal Q2 2021 results for the quarter ending in September 2023. The Company reported an earnings per share (EPS) profit of $1.78, excluding non-recurring items, missing consensus analyst estimates for a profit of $1.85, by ($0.07). Revenues grew 14.6% year-over-year (YoY) to $7.97 billion versus $7.45 billion consensus analyst estimates.

Inline Guidance

Duke Energy sees fiscal full-year 2023 EPS between $5.55 to $5.75 versus $5.74 consensus analyst estimates. It expects its long-term growth rate between 5% to 7% through 2027 from the $5.65 midpoint of 2023 adjusted EPS guidance.

Sale of Commercial Renewables in Q4

The Company has completed its strategic review and will discontinue its Consumer Renewables segment operations in Q4 2022 to pursue a sale. This is for cost-cutting, strengthening of the balance sheet, and debt reduction purposes. This has been a capital-intensive business with slower EPS growth than its utility platform. The sales process if underway and the Company will announce a transaction in Q1 2023, which is expected to close by mid-year. On Nov. 21, 2022, Seaport Research Partners downgraded shares of DUK to a Sell from Neutral with a $91 price target.

Inflation Reduction Act (IRA) of 2022 Benefits

Duke Energy expects to gain tax benefits from the IRA. Its $2.5 billion to $4.5 billion of storage investments in the next 10 years will help it qualify for a 30% investment tax credit (ITC). The Company expects to continue benefits from existing nuclear production tax credits (PTC (NASDAQ:PTC)) as its Carolina nuclear plants qualify since they operated below the $43.75/MHw phase-out threshold. It's potential 13 to 17 GW of connected solar over the next decade will equal about $60 million per 1GW in annual gross PTCs. The tax credits can potentially reduce 75% of cash liability on corporate book minimum tax, adjusted for tax depreciation transferrable for monetization credits.

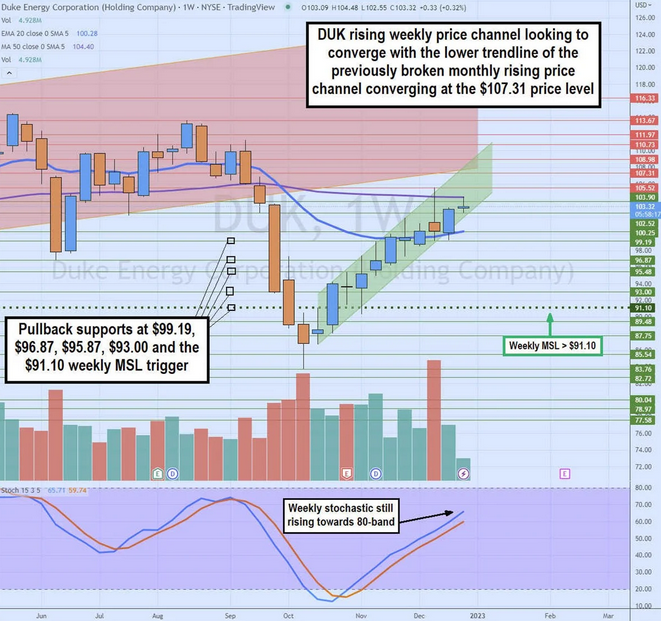

Converging Rising Price Channels

The weekly candlestick chart has a rising price channel (green) that triggered after triggering a weekly market structure (MSL) low trigger on the breakout through $91.10. The weekly 50-period moving average (MA) has flattened out as possible support at $104.40, and the weekly 20-period EMA resistance sits at $100.28.

The weekly stochastic has been rising towards the 80-band. The monthly rising price channel was originally broken on the weekly 50-period MA crossover down through the weekly 20-period EMA as shares hit a low of $83.75. DUK shares have since been climbing towards the monthly rising price channel level, which converges with the rising weekly price channel around the $107.31 area. This will either be a breakout area or a reversal area. Pullback supports sit at $99.19, $96.87, $95.87, $93.00, and $91.10 weekly MSL trigger.