Chubb Limited (NYSE:CB) will release second-quarter 2017 results after the closing bell on Jul 25. Last quarter, this company delivered a 1.47% negative earnings surprise. Let’s see how things are shaping up for this announcement.

Factors Influencing this Past Quarter

Chubb is expected to have witnessed an improved top line, courtesy its strategic buyouts and organic endeavors.

Diversified product mix with narrower exposure to the property and casualty industry pricing sequence should have fueled higher premiums.

Given gradually improving rate environment, Chubb expects its quarterly investment income run rate to remain in the range of $830–$840 million.

Continued share buybacks will boost the bottom line.

However, higher loss and loss expenses, policy acquisition costs, administrative expenses and policy benefits likely have induced an increase in expenses. Exposure to catastrophe loss likely has hurt its underwriting results.

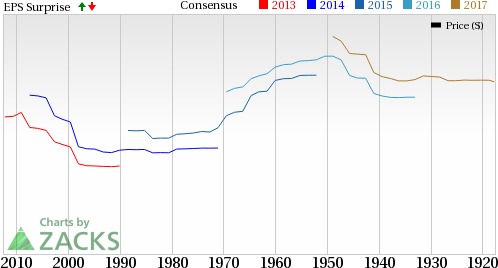

With respect to an earnings trend, the company delivered positive surprises in three of the last four quarters, with an average surprise of +5.56%.

The company’s share price has been trending up over the last few days and is currently trading at $147.00. We wait to see how the stock performs, post the earnings release.

Earnings Whispers

Our proven model does not conclusively show that Chubb is likely to beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP as well as a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. However, this is not the case here as elaborated below.

Zacks ESP: Chubb has an Earnings ESP of +0.80%. This is because the Most Accurate estimate stands at $2.51 and the Zacks Consensus Estimate at $2.49 per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Chubb has a Zacks Rank #4 (Sell).

Importantly, the Sell-rated stocks (#4 or 5) should never be considered going into an earnings announcement.

Other Stocks to Consider

Some better-ranked stocks in the P&C insurance space with the right combination of elements to come up with an earnings beat this quarter are:

W.R. Berkley Corporation (NYSE:WRB) is set to report its second-quarter earnings on Jul 25. The stock has an Earnings ESP of +2.67% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

CNA Financial Corporation (NYSE:CNA) has an Earnings ESP of +4.00% and a Zacks Rank #3. The company is set to report its second-quarter earnings on Jul 31.

The Navigators Group, Inc. (NASDAQ:NAVG) has an Earnings ESP of +5.17% and a Zacks Rank #3. The company is slated to post its second-quarter earnings on Aug 3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market. Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

D/B/A Chubb Limited New (CB): Free Stock Analysis Report

W.R. Berkley Corporation (WRB): Free Stock Analysis Report

CNA Financial Corporation (CNA): Free Stock Analysis Report

The Navigators Group, Inc. (NAVG): Free Stock Analysis Report

Original post