Alphabet Inc (NASDAQ:GOOGL) Information Technology - Internet Software & Services | Reports April 21, After Market Closes

Key Takeaways

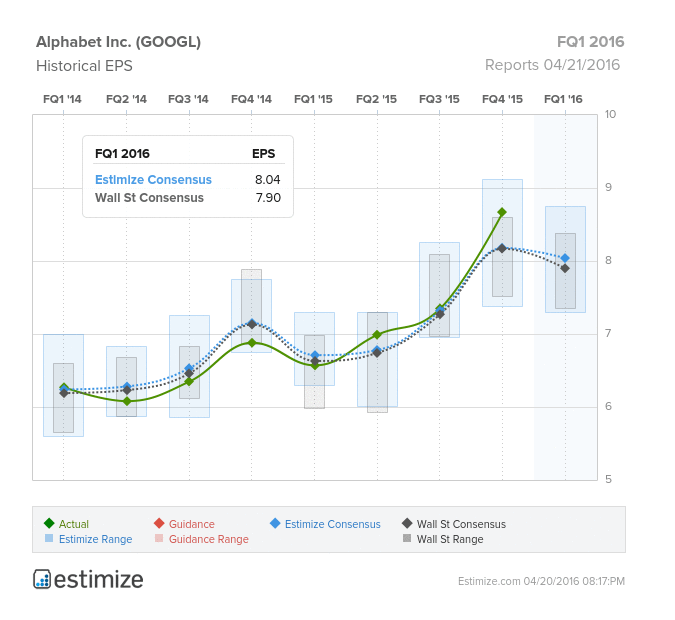

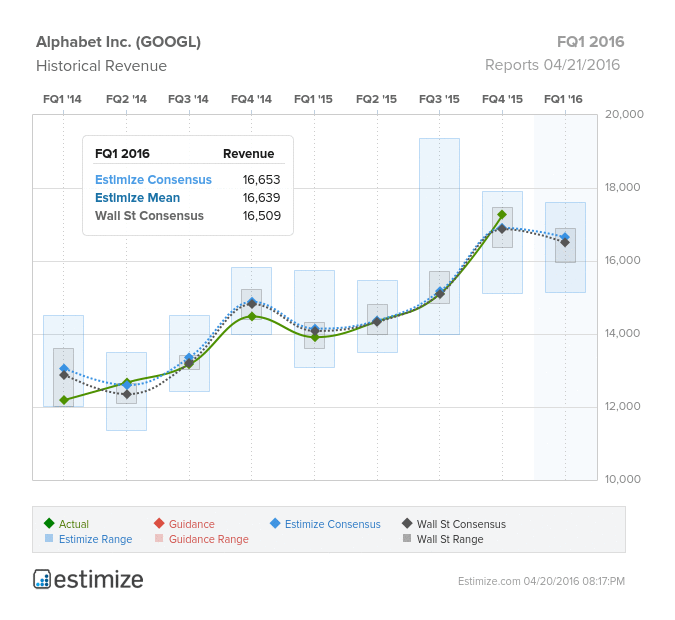

- The Estimize consensus is calling for EPS of $8.04 and revenue expectations of $16.65 billion, 12 cents greater than Wall Street on the bottom line and $140 higher in sales

- The fourth quarter release was the first to break out Alphabet’s “Other Bets” division, made up of self-driving cars, health care, Google-X and smart homes, among other things, which grew 37% YoY

- Google is well positioned in the near and long term with leading search technology, Android and Youtube

- What are you expecting for GOOGL?

Google is the second of the FANG stocks to report results this week. In its first reported quarter under Alphabet, the internet behemoth topped expectations by nearly 50 cents on the bottom and $366 million on the top. The company saw EPS increased 26% while sales were up 19%, propelling Google to a market cap higher than Apple (NASDAQ:AAPL). If Netflix’s earnings are any indication for the rest of the FANG stocks, then Alphabet is in good shape.

The Estimize consensus is calling for EPS of $8.04 and revenue expectations of $16.65 billion, 12 cents greater than Wall Street on the bottom line and $140 higher in sales. Compared to a year earlier, earnings are predicted to rise 22% on a 20% increase in revenue. Given their track record, it’s not surprising that Google is a big mover leading up and through earnings. On average the stock increases 3% through earnings and 2% 30 days post earnings.

The fourth quarter release was the first to break out Alphabet’s “Other Bets” division, made up of self-driving cars, health care, Google-X and smart homes, among other things, which grew 37% YoY. Mobile and YouTube will also be key drivers of strength in Q1 through search and programmatic advertising. Aggregate paid clicks should maintain the high growth (31%) seen in Q4, while continued weakness in CPCs are expected be offset by click volume. Investor’s will also be looking for updates on the cloud as Alphabet battles it out with Amazon Web Services for the top spot in that space.

After a year in which core margins increased and helped drive the stock up over 45%, Google has warned that the Q1 earnings will see higher operating costs while capital expenditures could rise as well. Google has invested heavily on fiber optics and cloud infrastructure to help bring projects like Project Fi to reality. Fortunately, there are few things to be sour on when it comes to Google’s short and long term prospects. As long as it is an industry leader in search and video technology, the rest is just icing on the cake.

Original post