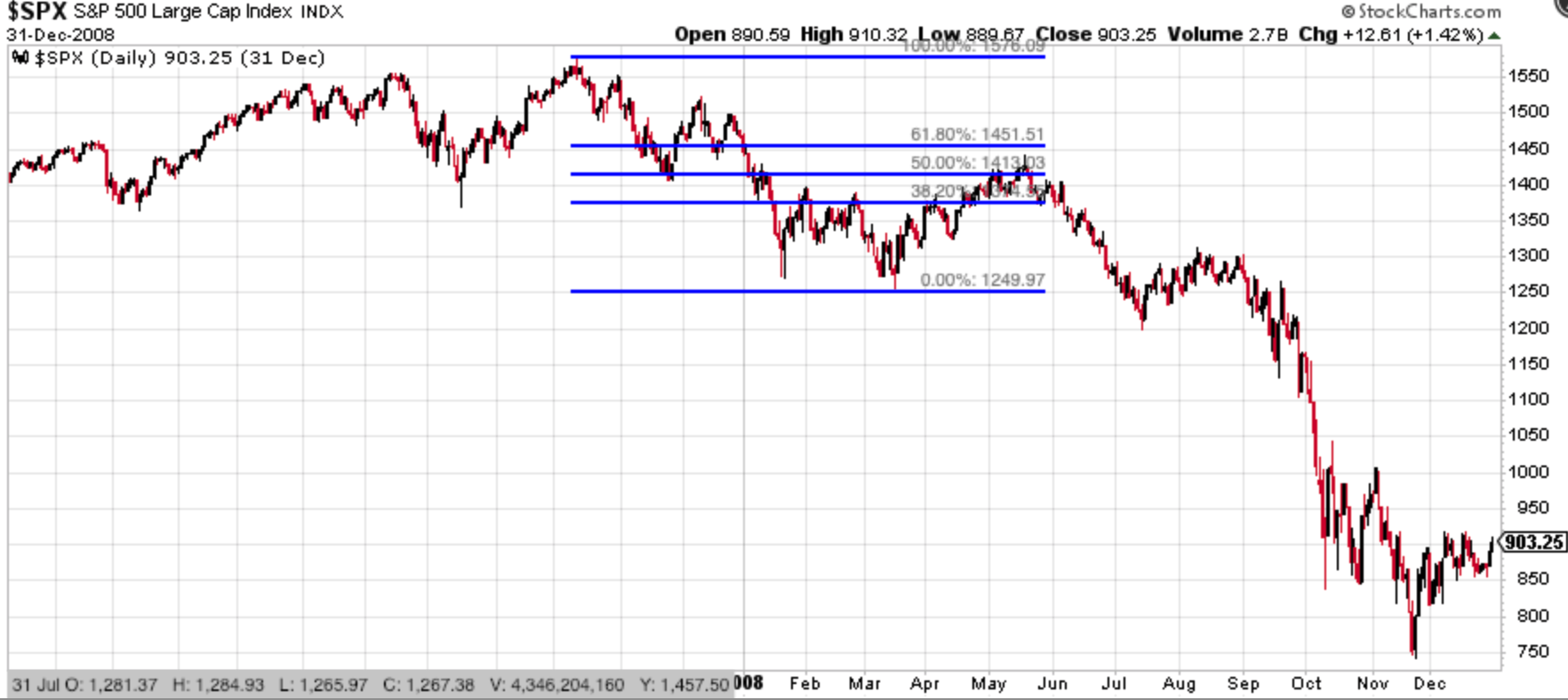

With the S&P 500 rallying 4 days in a row, it is now at its 38.2-50% resistance zone and February 2018 lows resistance. Can the stock market go straight up (medium term rally) without a pullback or retest of the December 2018 lows? Or is a pullback/retest mandatory?

Go here to understand our fundamentals-driven long term outlook.

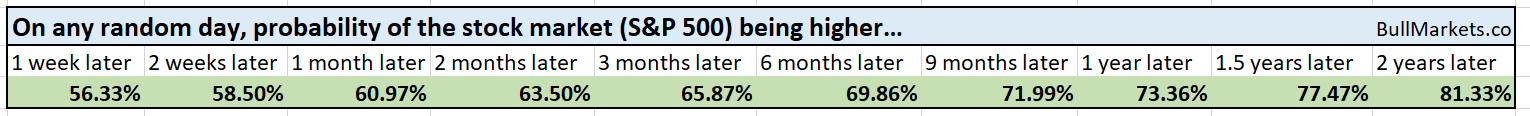

Let’s determine the stock market’s most probable medium term direction by objectively quantifying technical analysis. For reference, here’s the random probability of the U.S. stock market going up on any given day.

*Probability ≠ certainty. Past performance ≠ future performance. But if you don’t use the past as a guide, you are blindly “guessing” the future.

Can a 20% market decline go straight up without a pullback?

How common is it for approximately 20%+ market declines to go straight up to new all-time highs without a pullback along the way? By now, the whole “stocks will retest after a crash” argument has become well known.

We ask this question because if you are long right now, you need to know your downside risk. If you are short, you need to know the S&P 500’s upside risk.

Let’s look at all the 20%+ declines from 1929 – present

*When someone overlaps a chart of the S&P 500 today vs. the S&P 500 in 2008 and says “it looks just like 2008!!!”, that is a textbook case of “recency bias” and using n=1 sample size. Look at all the historical cases.

This is the S&P 500 in 2011. The S&P 500 almost retraced 50% before retesting and making a marginal new low.

This is the S&P 500 in 2008. It retraced 50% before making new lows

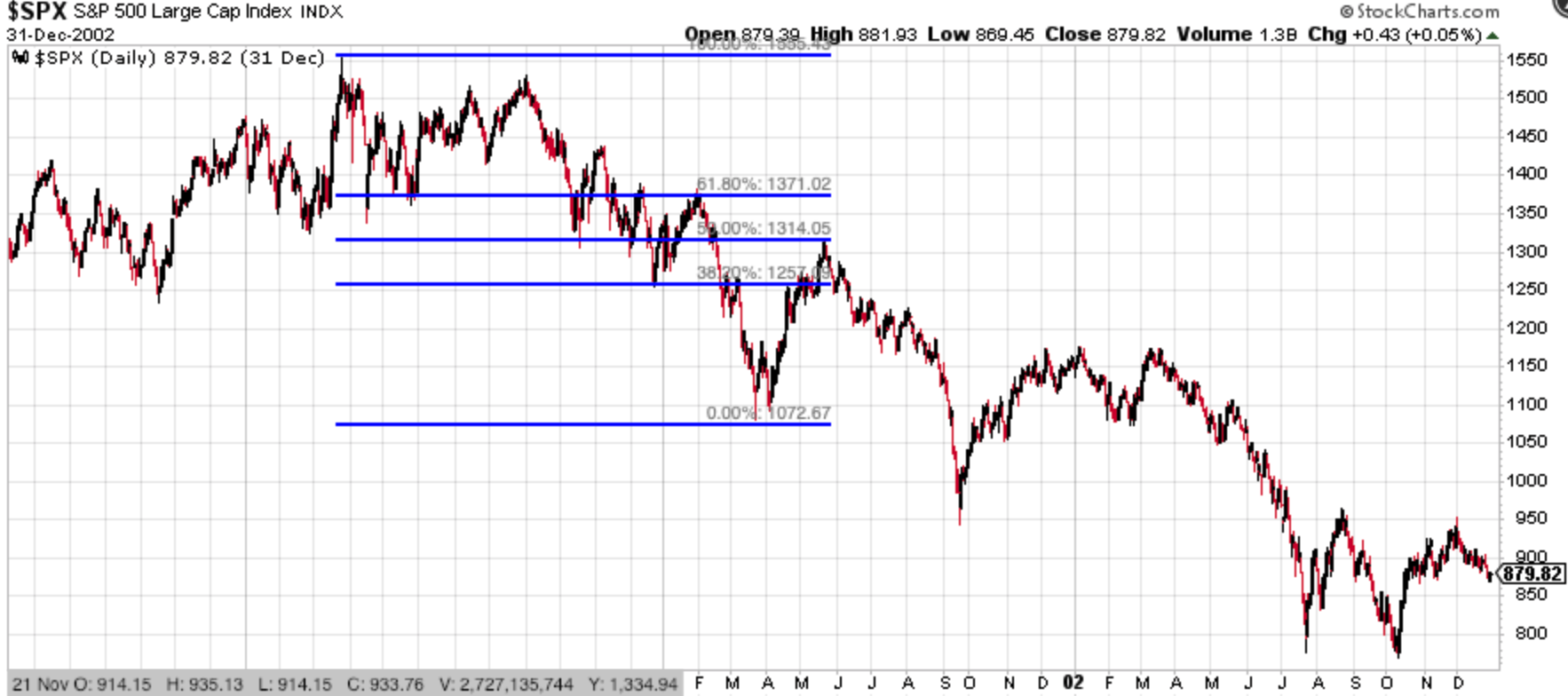

This is the S&P 500 in 2001. It retraced 50% before making new lows

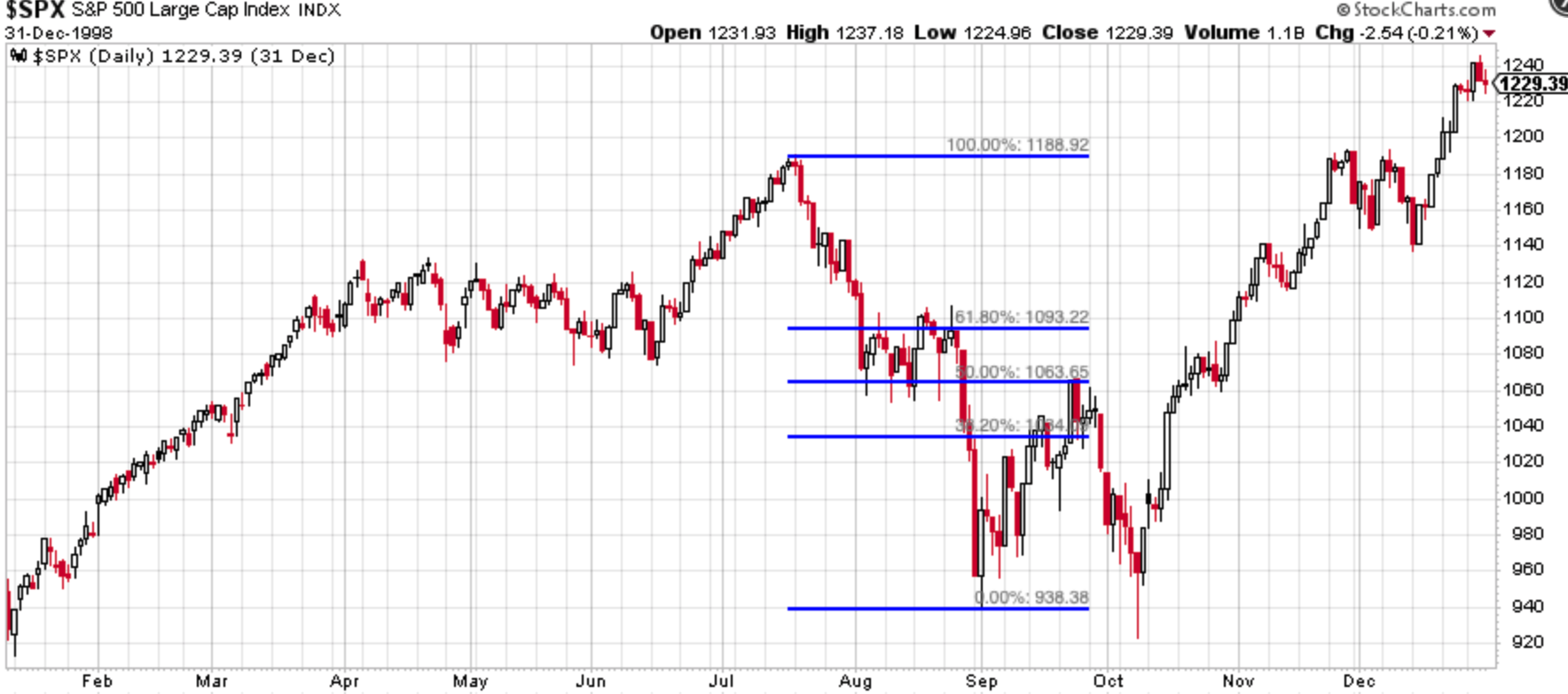

This is the S&P 500 in 1998. It retraced 50% before retesting and making a marginal low.

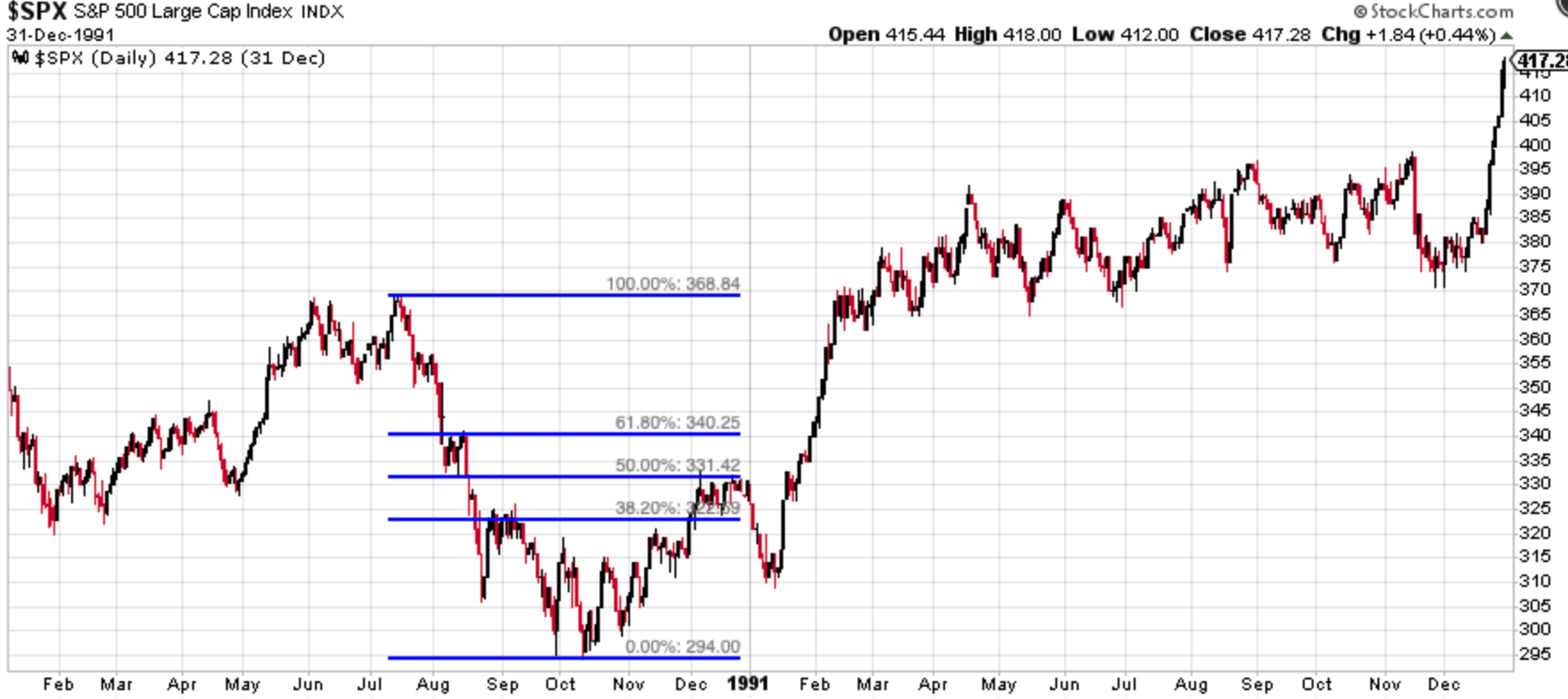

This is the S&P 500 in 1990. It retraced 50% before making a pullback (but not a retest)

This is the S&P 500 in 1987. It retraced less than 38.2% before making a retest. (This retracement was very small because the S&P 500 had fallen so much. Even an e.g. 38.2% retracement was massive in terms of %).

This is the S&P 500 in 1981. It retraced 50% before making new lows.

This is the S&P 500 in 1980. It went straight up without a single meaningful pullback

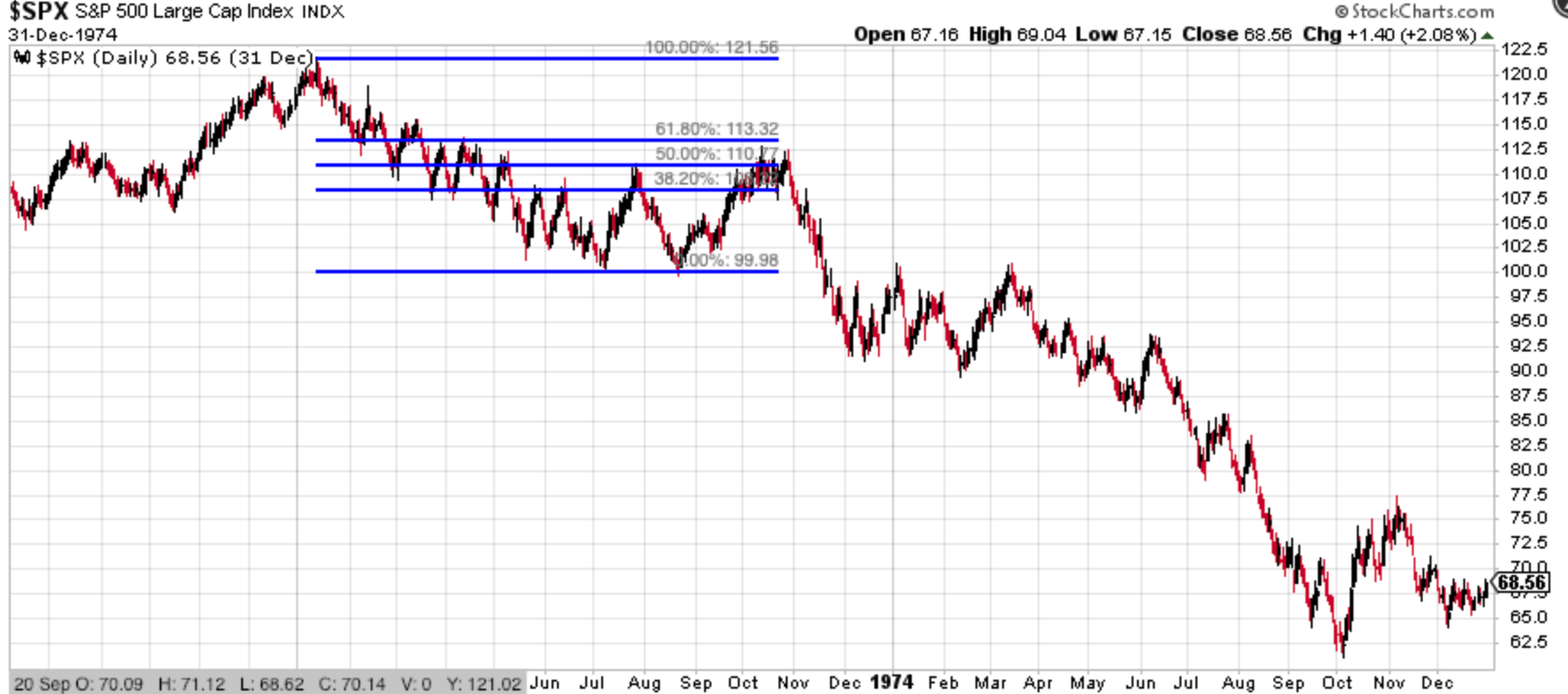

This is the S&P 500 in 1974. It retraced 50% before retesting, another 50% retracement, and then new lows.

This is the S&P 500 in 1969. It made a very shallow retracement before making new lows. (But there were multiple 50% retracements before the S&P 500 fell -20%)

This is the S&P 500 in 1966. It retraced less than 38.2% before making marginal new lows.

This is the S&P 500 in 1962. It retraced 38.2% before retesting.

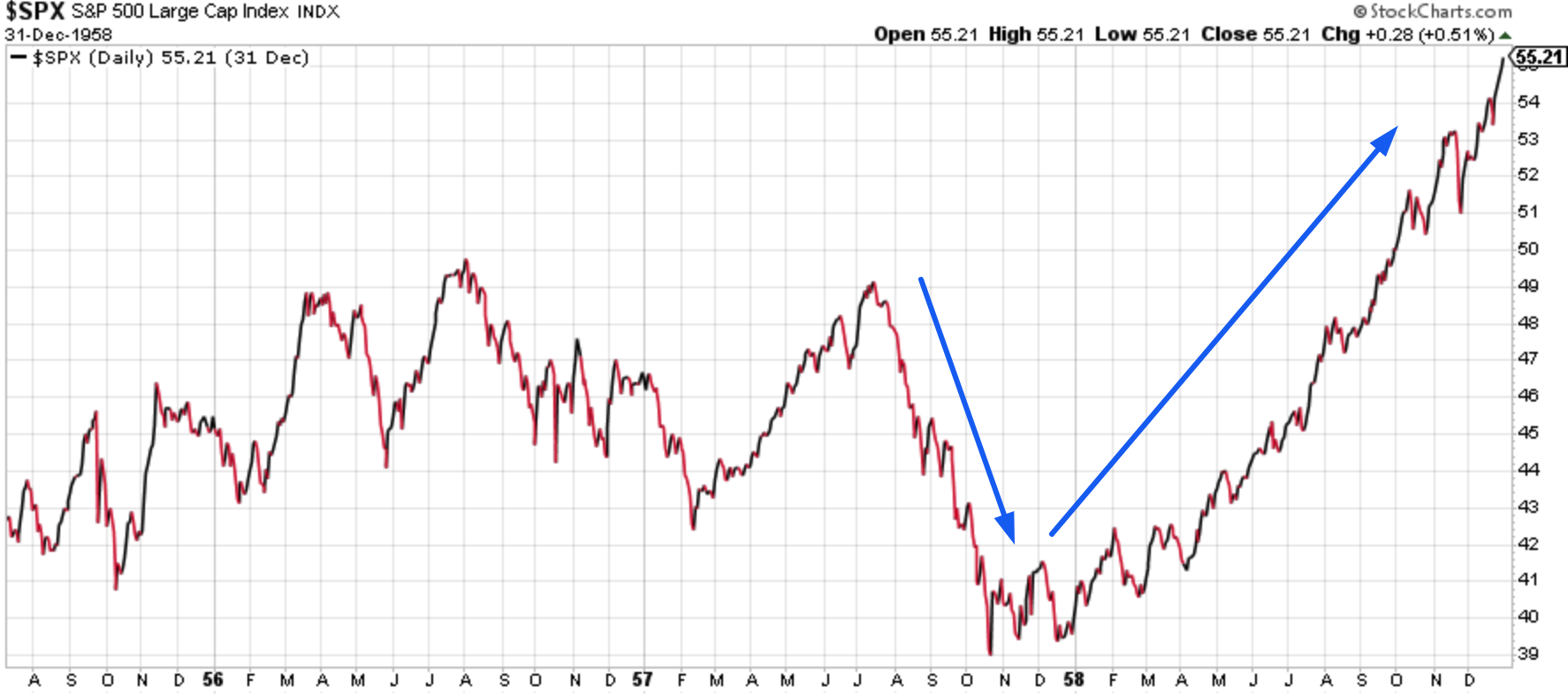

This is the S&P 500 in 1957. It went straight up without a single retracement.

This is the S&P 500 in 1937. It retraced 61.8% before cratering.

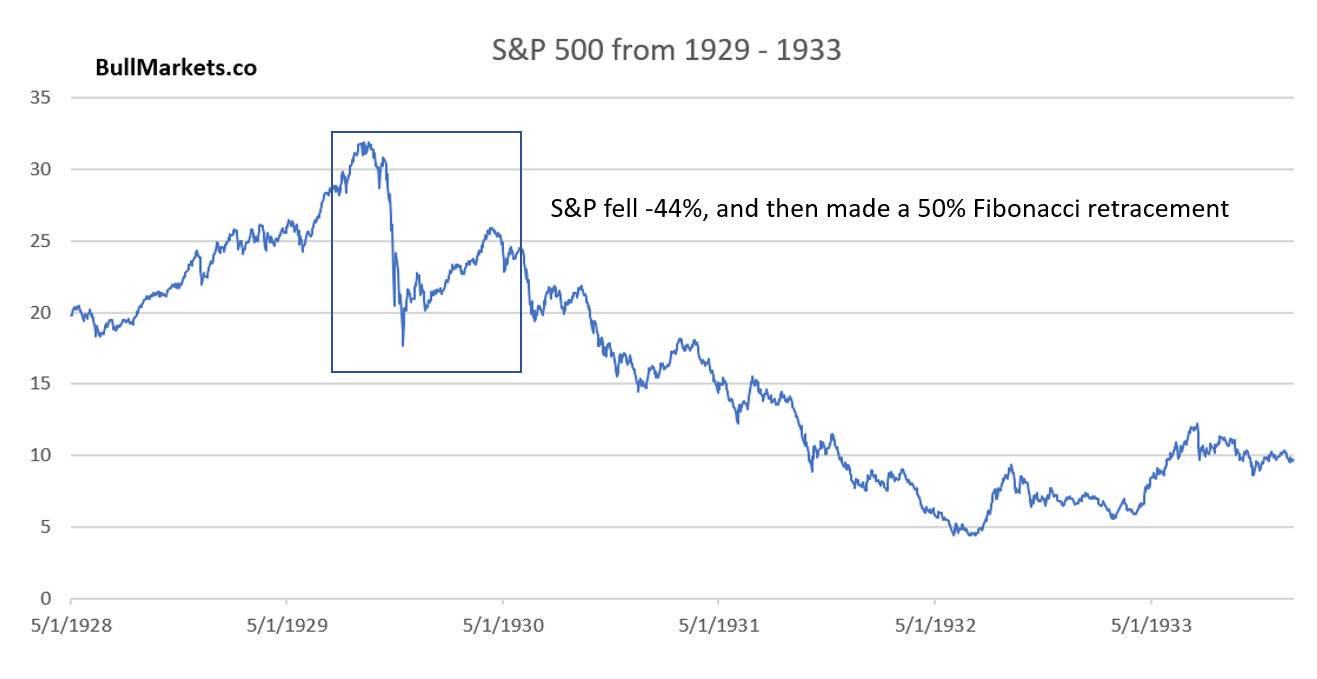

This is the S&P 500 in 1929. It retraced 50% before going on to make new lows.

Conclusion

- For 20% declines, the most likely target is a 50% retracement before a pullback. That pullback usually leads to a retest, but not always (see 1990). This is the S&P 500 right now

- For 25+ declines, the most likely target is a 38.2% retracement (see 1987).

- A v-shaped recovery is unlikely, but is possible. 2 of these 15 historical cases saw a V-shaped recovery (1957 and 1980)

I am particularly struck by the 1980 case.

- The 1980 case occurred 1 year before the big recession of 1981-1982. Everyone thought “this is the start of a big drop!” after the S&P 500 fell -20% in March 1980. To everyone’s surprise, the S&P 500 rallied for another 9 months before beginning a much bigger decline and recession. Sentiment is similar today. People are bearish, and everyone is looking for a retest.

- The economy has weakened throughout the 2nd half of 2018-present, but is not terrible. The most likely scenario is that the economy muddles around during the first half of 2019, and then massively deteriorates towards the end of 2019. That will cause a much bigger decline in the S&P 500 then.

No more new lows. All clear?

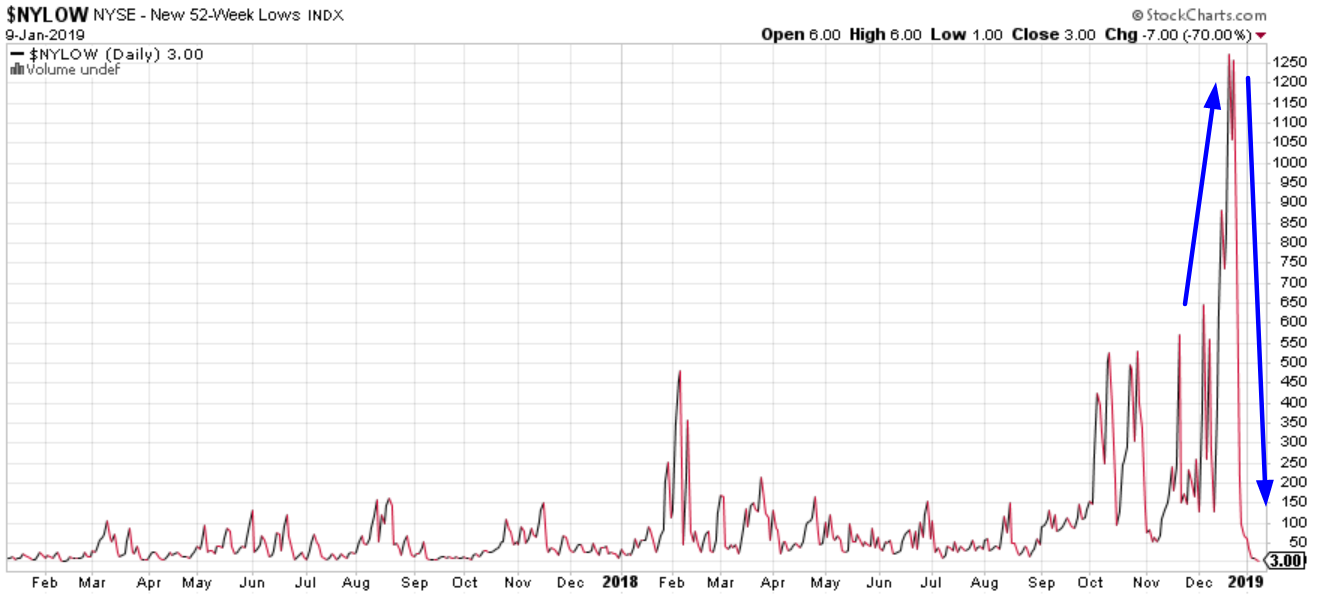

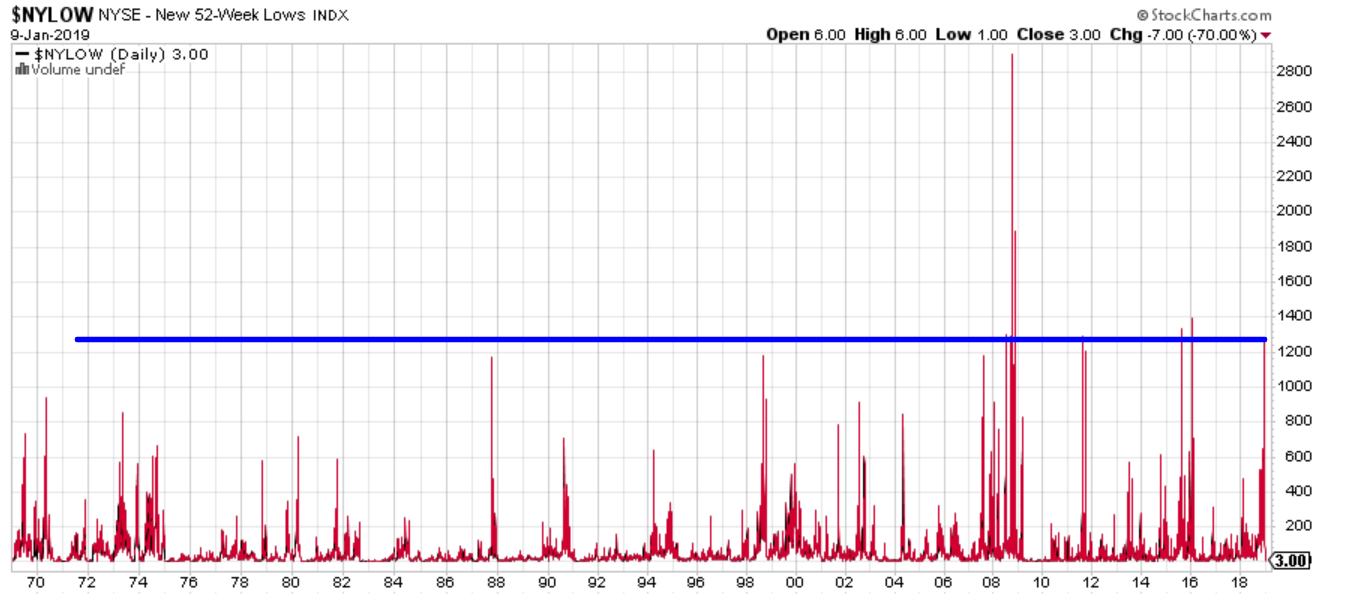

As the stock market crashed, many issues on the NYSE were making new lows. Now that the stock market is rallying vigorously, few issues on the NYSE are making new lows.

Is this an ALL-CLEAR sign for the U.S. stock market?

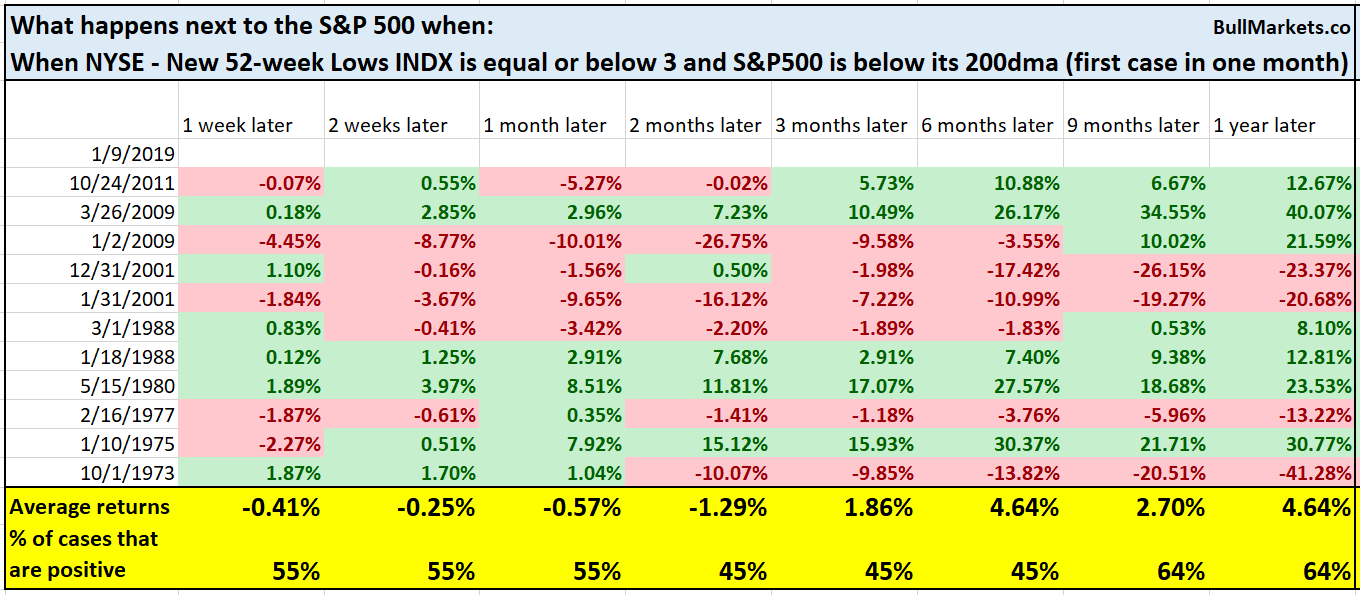

Here’s what happens next to the S&P 500 when the number of issues making new lows on the NYSE is less than or equal to 3, while the S&P 500 is below its 200 dma (i.e. downtrend).

As you can see, this is hardly an all-clear sign for the stock market. The next few months tend to be choppy.

Individual stocks reversal

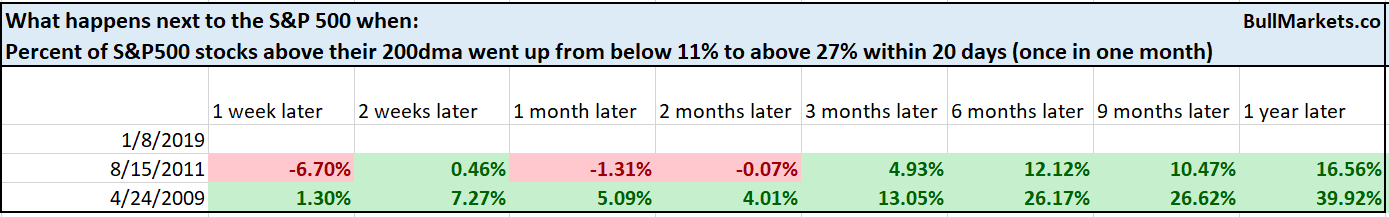

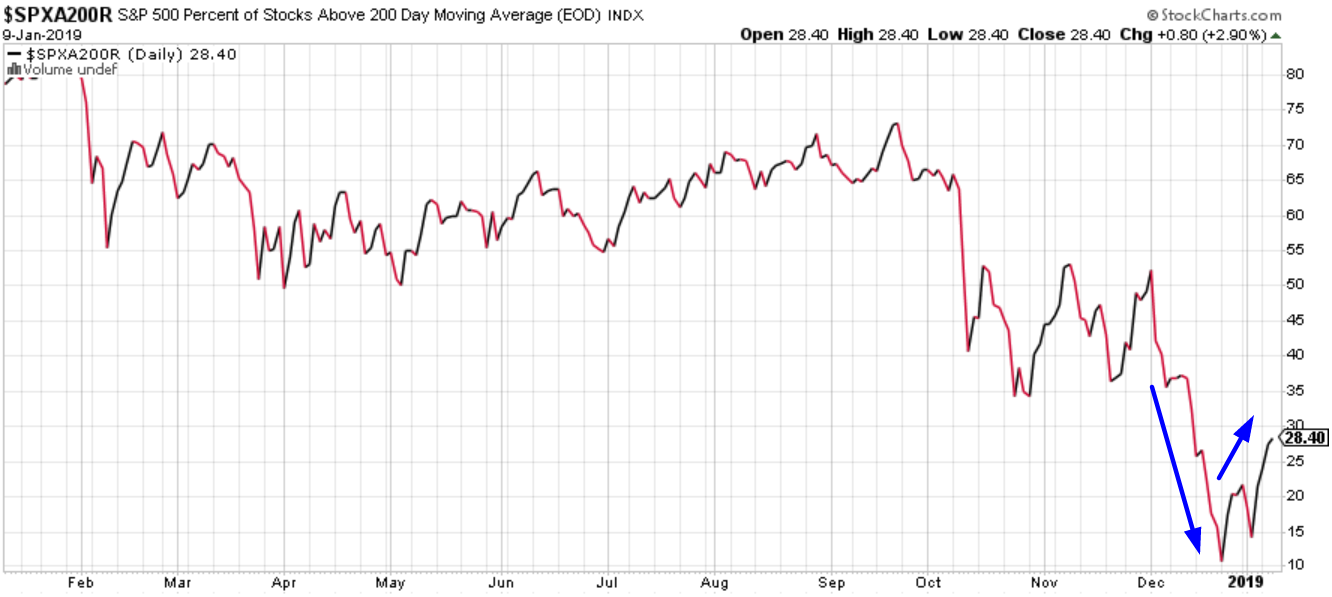

The % of S&P 500 stocks above their 200 dma has reversed, along with the S&P 500 itself. It’s quite rare to see that many S&P 500 stocks below their 200 dma (which is what happened in December 2018).

Here’s what happened next to the S&P 500 when the % of stocks below their 200 dma went from under 11% to above 27% within 4 weeks.

*Data from 2004 – present

Small sample size, but at least this isn’t bearish for stocks.

More breadth extremes

Breadth extremes continue to reverse as the stock market rallies.

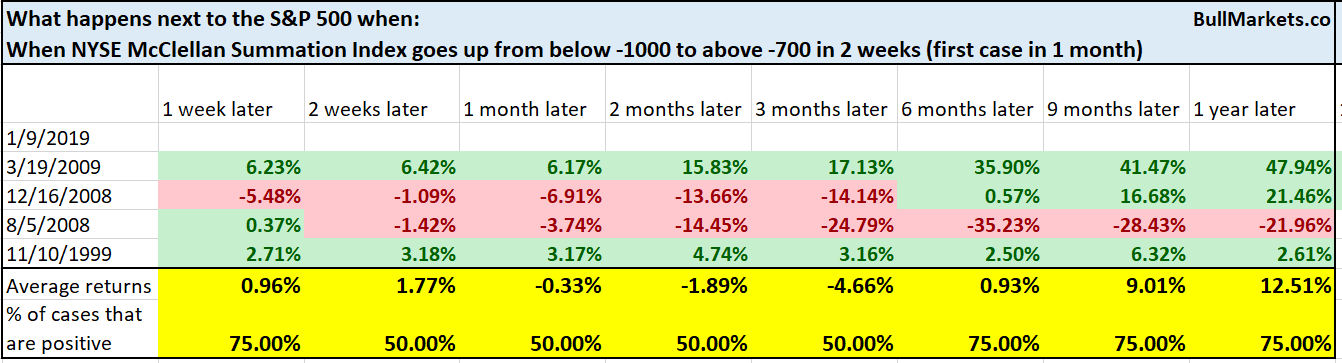

Here’s the NYSE McClellan Summation Index

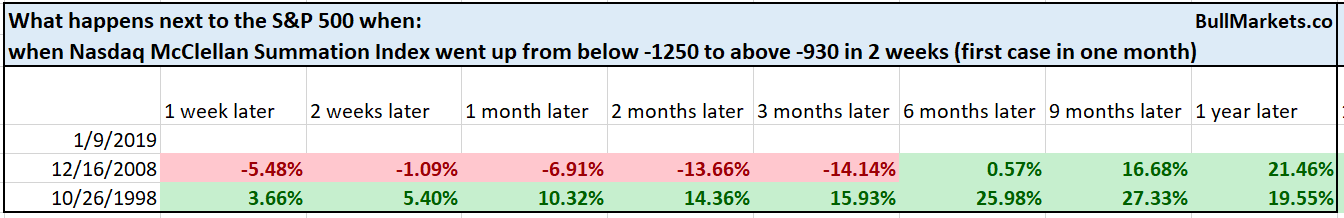

Here’s the NASDAQ McClellan Summation Index

Here’s what happened next to the S&P 500 when the NASDAQ McClellan Summation Index went from below -1250 to above -930 within 2 weeks (i.e. fast reversal).

*Data from 1998 – present

As you can see, this is rare, but was a long term bullish sign.

Here’s what happened next to the S&P 500 when the NYSE McClellan Summation Index went from below -1000 to above -700 within 2 weeks (i.e. fast reversal).

*Data from 1998 – present

Once again, not a long term bearish sign.

Defensive sector

One long term warning sign that I highlighted during Q4 2018 was the outperformance from defensive sectors like XLU (utilities ETF).

- Defensive sectors outperformed when the stock market went down.

- Defensive sectors are now underperforming when the stock market is going up.

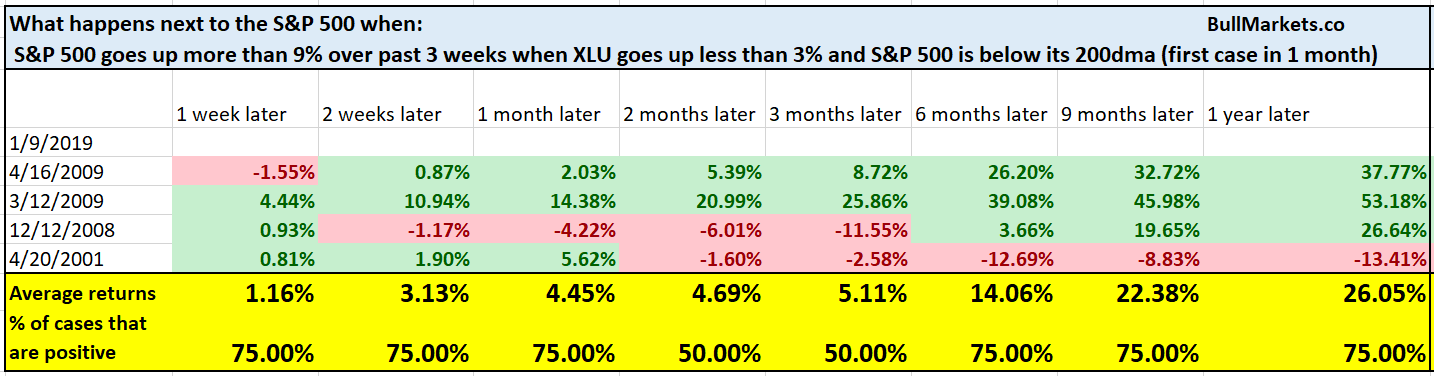

Here’s what happens next to the S&P 500 when it went up more than 9% over the past 3 weeks while XLU went up less than 3%, while the S&P 500 is below its 200 dma

*Data from 1998 – present

As you can see, this is somewhat of a long term warning sign. It either happens at the start of a -50% decline or towards the end.

So many extremes

It’s rare to see so many extremes this early into the stock market’s decline. These extremes usually happen after the S&P 500 falls -30%, -40%, or -50%. That’s why the breadth indicators are continuously long term bullish (i.e. next 1-2 years).

There is reason to suspect that breadth extremes are not as useful as they used to be. As ETFs gain popularity, it will become easier and easier for the market to register breadth extremes. So when a breadth extreme occurred at the end of bear market in the past, it might occur in the middle of a bear market today.

Meanwhile, the stock market’s internals continue to flash warning signs. These warning signs are not necessarily long term bearish as they sometimes provide false signals.

This model turned long term bearish

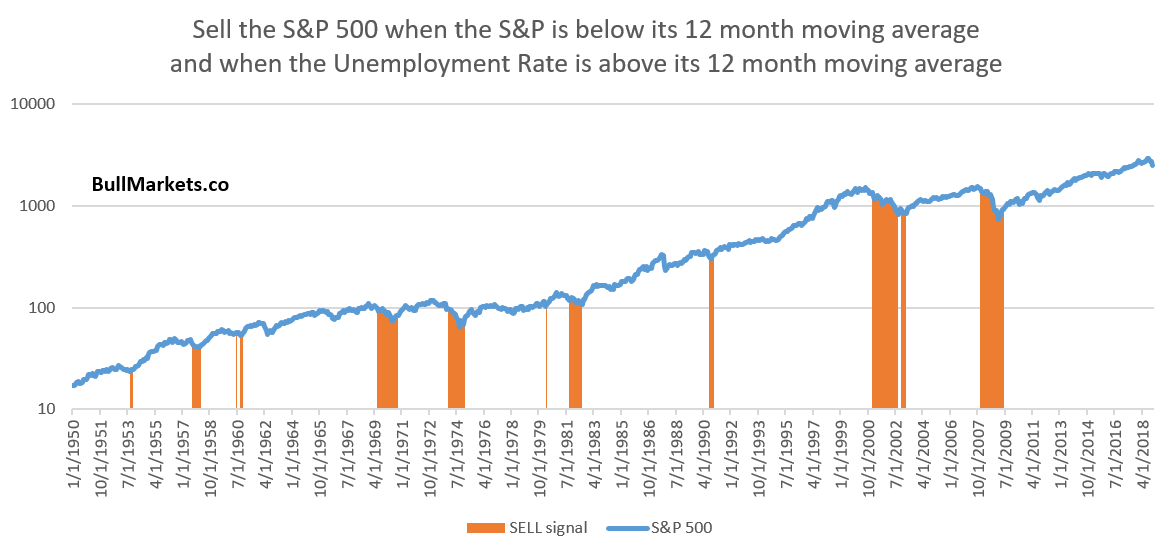

There’s a fairly popular trend following model called the Unemployment Rate Model

Buy and hold the S&P 500 500, unless…

The S&P 500 falls below its 12 month moving average, and the Unemployment Rate rises above its 12 month moving average.

*We don’t use this model because its returns are inferior to our Initial Claims Model.

For the first time since 2008-2009, this model has turned long term bearish. The S&P 500 is below its 12 month moving average and the Unemployment Rate is slightly above its 12 month moving average.

Click here for yesterday’s market study

Conclusion

Here is our discretionary market outlook:

- The U.S. stock market’s long term risk:reward is no longer bullish. This doesn’t necessarily mean that the bull market is over. We’re merely talking about long term risk:reward. Long term risk:reward is more important than trying to predict exact tops and bottoms.

- The medium term direction is still bullish (i.e. trend for the next 6 months). However, if this is the start of a bear market, bear market rallies typically last 3 months. They are shorter in duration.

- The stock market’s short term has a slight bearish lean. Focus on the medium-long term because the short term is extremely hard to predict.

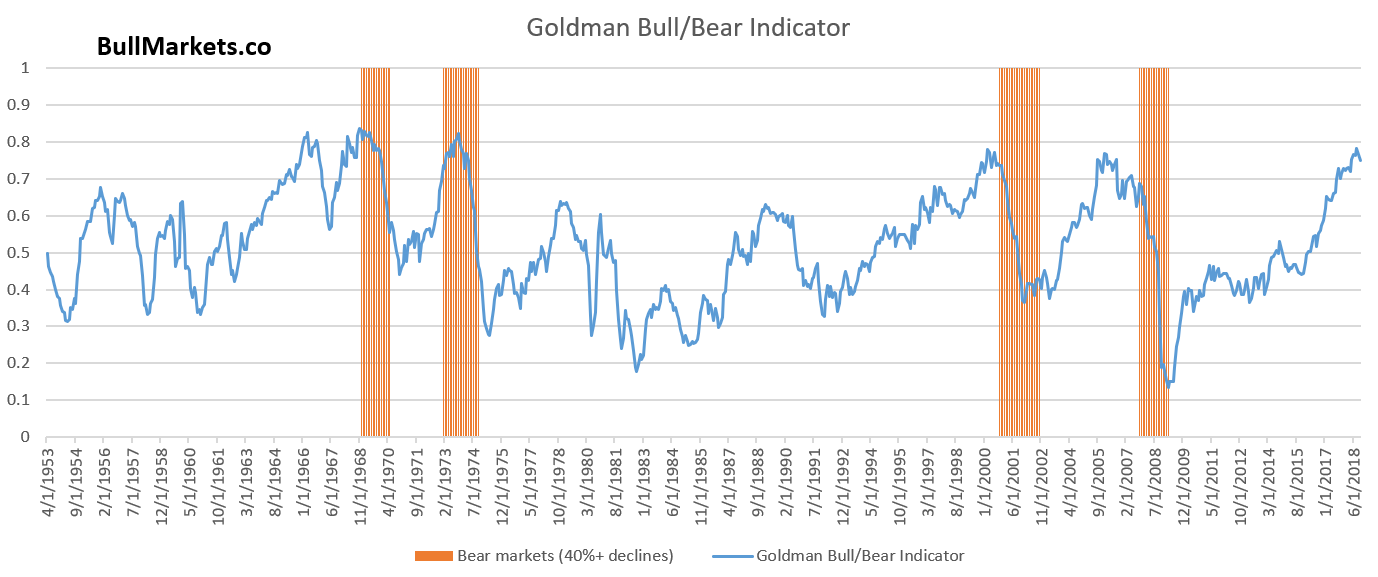

Goldman Sachs’ Bull/Bear Indicator demonstrates that while the bull market’s top isn’t necessarily in, risk:reward does favor long term bears.

Our discretionary outlook is not a reflection of how we’re trading the markets right now. We trade based on our quantitative trading models.