Campbell Soup Company (NYSE:CPB) posted fourth-quarter fiscal 2017 results, wherein both earnings and sales came below the Zacks Consensus Estimate, with sales marking its third straight miss. Management blamed the murky quarter on a difficult scenario in the packaged food industry, where sales remained soft due to consumers changing food preferences, evolving shopping trends and a tough retail environment.

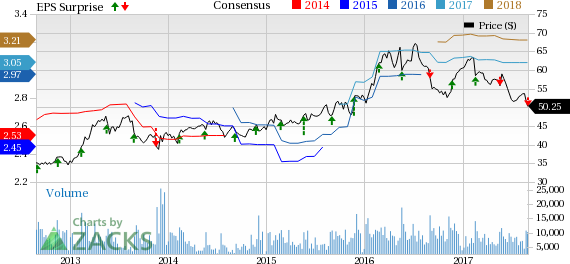

Nevertheless, the company’s stringent focus on cost-savings initiates fueled year-over-year growth in the bottom line as well as adjusted EBIT. However, the lower-than-expected results and not so encouraging outlook for fiscal 2018 sent shares of the company down by nearly 5% in the pre-market trading session. While Campbell has lost 10.7% in a year, it has fared better than the industry’s 12.4% decline.

Q4 in Details

Adjusted earnings of 52 cents per share jumped 13% year over year, though it fell short of the Zacks Consensus Estimate of 55 cents. Including one-time items, Campbell reported earnings of $1.04 per share, against a loss of 26 cents recorded in the year-ago quarter.

Net sales of $1,664 million slipped 1% and also lagged the Zacks Consensus Estimate of $1,689 million, mainly owing to soft organic sales. Organic sales dipped 1% on account of lower volumes.

Nonetheless, the company’s adjusted gross margin grew 80 basis points to 36.9%, thus reverting to its expansion trend after last quarter’s downside. The gross margin growth was mainly accountable to productivity enhancements and benefits from cost-curtailing efforts, somewhat negated by cost inflation and escalated supply chain expenses.

Moreover, adjusted EBIT for the quarter advanced 11% to $282 million, thanks to reduced marketing and selling costs, and improved gross margin. This was somewhat marred by soft sales.

Segment Analysis

Campbell reports its results under three segments, namely, Americas Simple Meals and Beverages, Global Biscuits and Snacks, and Campbell Fresh.

Americas Simple Meals and Beverages: In fourth-quarter fiscal 2017, sales at the division dipped 3% year over year to $815 million, on account of softness in V8 beverages and soup sales. During the quarter, sales for U.S. soup dropped 4%, on account of a drop in broth, ready-to-serve soups and condensed soups.

Global Biscuits and Snacks: Sales at this division remained flat at $624 million, as Pepperidge Farm snacks strength across Australia was countered by weakness in Indonesia.

Campbell Fresh: Sales at this segment climbed 1% to $225 million on the back of greater Garden Fresh Gourmet sales, along with strength across carrots and carrot ingredients. This was partially offset by soft sales of Bolthouse Farms refrigerated beverages, which continued being hurt by supply constraints.

Financials

Campbell ended the quarter with cash and cash equivalents of $319 million, long-term debt of $2,499 million and total shareholders’ equity of $1,645 million. Further, the company generated $1,291 million as cash flow from operations during fiscal 2017.

Fiscal 2018 Outlook

Management remains impressed with some key achievements of fiscal 2017. These include raising the company’s multi-year cost-savings goal to $450 million by 2020. The company also anticipates significant gains from its pending buyout of Pacific Foods. Finally, Campbell remains focused on getting its C-Fresh division back to growth path, by solving the problems related to capacity constraints. With solid focus on cost savings and its core strategic imperatives, Campbell remains well-placed for long-term growth.

However, given a tough operating environment, management expects sales growth for fiscal 2018 to range from negative 2% to flat. Adjusted EBIT growth is anticipated in a range of negative 1% to 1% increase. Adjusted earnings per share growth is envisioned in the range of flat to 2% rise, to $3.04-$3.11. The current Zacks Consensus Estimate is pegged way higher at $3.21.

Currency headwinds are expected to have a nominal impact on the company’s fiscal 2018 performance.

Campbell currently carries a Zacks Rank #3 (Hold).

Interested in Consumer Staples? Check these 3 Picks in CPB’s Space

Post Holdings, Inc. (NYSE:POST) has long-term EPS growth rate of 25%, and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingredion Incorporated (NYSE:INGR) has outperformed earnings estimates by an average of nearly 5% in the trailing four quarters. Also, this Zacks Rank #2 (Buy) company has long-term EPS growth rate of 11%.

Nomad Foods Limited (NYSE:NOMD) also carrying a Zacks Rank #2 has delivered back-to-back positive earnings surprises in the last two quarters.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Campbell Soup Company (CPB): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

Post Holdings, Inc. (POST): Free Stock Analysis Report

Nomad Foods Limited (NOMD): Free Stock Analysis Report

Original post

Zacks Investment Research