Stocks keep pushing higher after a day of indecision yesterday, and the signals are largely still very constructively aligned behind another upswing. Yes, stocks, overall, are moving up as we approach the Fed statement and press conference. It's the precious metals that are on the defensive.

Let's talk about today's moves and charts (all courtesy of www.stockcharts.com).

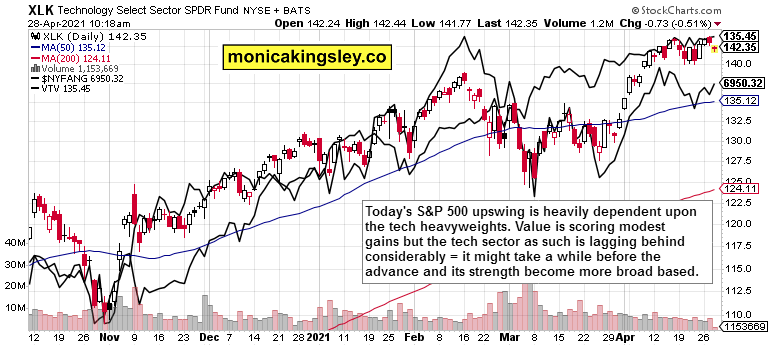

S&P 500 Outlook

The sectoral composition of the S&P 500 upswing isn't exactly strong, but that's not an obstacle to the unfolding move higher, which is measured and prone to brief and shallow intraday pullbacks. That's the path of least resistance.

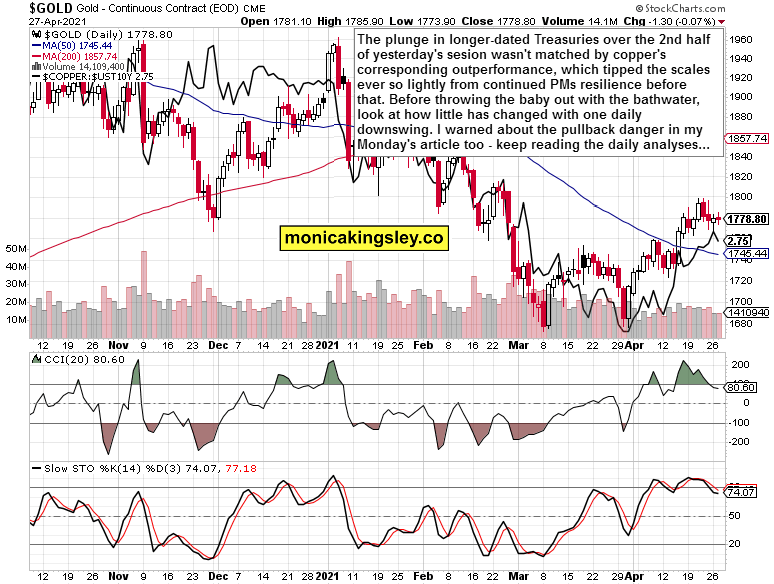

Gold Before The Opening Bell

The outlook for gold deteriorated during the second half of yesterday's trading as copper gave up some of its gains while long-dated Treasuries plunged. And overnight, gold felt obliged to fill the void, and went $10 down.

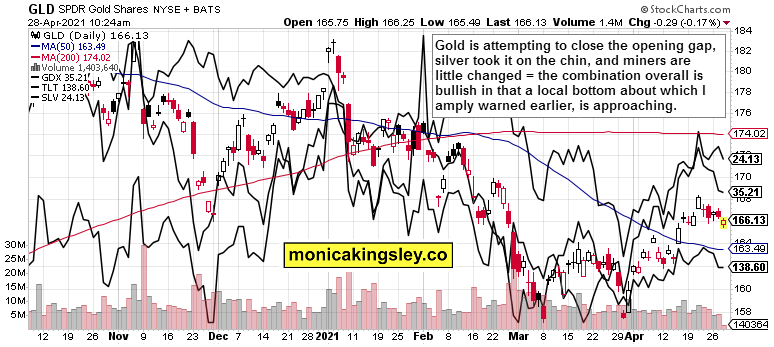

Precious Metals

The situation is far from bleak – gold is nibbling at the bearish gap, but it's the miners that are providing more than a glimmer of hope. And as silver is losing altitude, we're witnessing short-term rebalancing in the precious metals sector.

Summary

The S&P 500 keeps pushing for new all-time highs, and today's Fed isn't likely to change that materially. No, I'm not looking for them to make any noise about taking away the punch bowl.

Gold's downswing will likely prove short-lived, and miners will be pulling the precious metals sector ahead again. Once the sector stabilizes in both time and price, silver will catch up again. Let's see how successful the Fed is today in selling the transitory inflation story and defending Treasuries.