Market movers today

Today the voting in the UK Conservative Party leadership contest begins, where the Conservative members of parliament starts the process to narrow down the number of candidates from ten to just two. Boris Johnson is the clear favourite to succeed Theresa May but nothing is certain, as the Conservatives have a long history stabbing each other in the back. Yesterday, Boris Johnson said he wants a deal with the EU amid the House of Commons rejecting to rule out no deal Brexit by a small majority (however, it was a warning shot that the new Prime Minister should not try to bypass the Parliament). Eventually, a majority in the House of Commons can always force the prime minister to resign in a no confidence vote, if necessary.

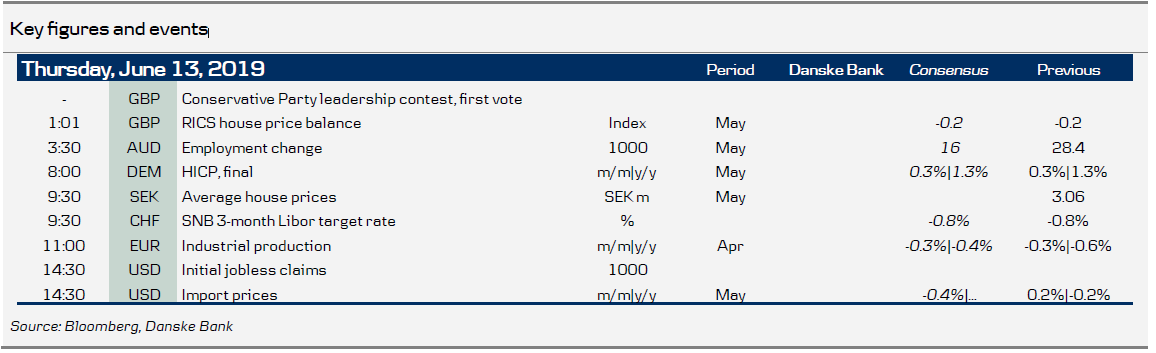

The Swiss central bank (SNB) decides on monetary policy today at 09.30 CET; unchanged rates (at -0.75% for both the Libor target and sight-deposit rate) are widely expected. More in FX section overleaf.

Italy's fiscal stance on the agenda at the euro-zone finance ministers meeting in Luxembourg today.

In light of the weak nonfarm payrolls on Friday, we will monitor the initial jobless claims more closely than usually. Jobless claims have in general remained low.

Selected market news

The call on central banks to ease continues to intensify by the day. Yesterday a s oft US inflation report which saw US CPI come in at 1.8% y/y (vs consensus 1.9%) fuelled expectations for further Fed cuts. Further, a rise in Australian u nemployment rose to 5.2% (from 5.1%), and albeit partly higher by a higher participation rate, this fuelled RBA easing bets further. AUD/USD weakened and USD/JPY dipped close to 108. Today, the SNB holds its quarterly policy meeting and while inflation prospects also call for easing there, it will be challenging to deliver as the SNB - opposed to the Fed and the RBA - are severely constrained on its toolbox; more in FX section.

In the same vein, central bank credibility continues to be challenged with notably Euro area (market-based) inflation expectations taking a nose-dive yesterday. The 5y5y inflation swap rate declined to 1.18%, setting another all-time low print. While there was no particular catalyst for the drop yesterday, such moves should be much concerning to the ECB: this essentially suggests that markets do not believe in the narrative Draghi conveyed last week at the press conference that ECB has the necessary tools to deal with a downturn. Draghi's welcome address at the Sintra conference next week will be closely watched for any clues about future ECB policy actions.

Separately, while the trade woes are lurking still, the US president opened a new front - this time against Germany criticising Merkel's support for the NordStream2 gas pipeline from Russia and threatened with new sanctions. Equity markets were generally weaker in both the US and Asia with Nikkei down close to 0.5% at the time of writing. US Treasury yields lower to 2.11%. Oil also on a weak footing with Brent just above the USD60/bbl mark.

Fixed income markets

We continue to favour spread tighteners (core versus periphery) as well as curve flatteners as the pressure is mounting on the ECB to ease monetary policy. Yesterday, the old ‘favourite’ 5y5y inflation expectations traded below the historical low of 1.2%, and comments from Coeure indicate that they ready to act on adverse contingencies. This is supportive for the periphery. We prefer to express this view through a spread tightener between Spain and France or flatter PGB curve between 5Y and 10Y.

Today, Ireland is in the market tapping in the 10Y, while Italy is tapping up to EUR 6.5bn in the 3Y, 7Y/10Y and 15Y segments. The tap in Italy came after the Italian Debt Office yesterday sold EUR 6bn in 20Y benchmark with a spread of 12bp to BTPS 2.95% 09/38. Bid-to-cover was 4 and the Italian Debt Office tightened the spread some 4bp relative to the initial price guidance.

There was also a strong demand for both Spain at yesterday’s syndicated deals given the hunt for yield and expectations for more ECB support. Spain sold EUR 6bn in a new 10Y benchmark. Bid-to-cover was 4.8, and Spain tightened the spread with some 4bp from the initial price guidance, and the bond was sold at +33bp to mid-swaps or some 87bp above 10Y Germany.

FX markets

Yesterday was a mixed bag for EUR/USD. On the one hand, weaker than expected US CPI figures supported the case for near-term Fed rate cuts and a relative monetary policy driven upwards trend in EUR/USD over the coming months. In this regard, note that EUR inflation expectations continue to make new lows – a EUR positive in our view. On the other hand, US President Trump’s attack on Germany’s support for a gas pipeline from Russia highlights that tail risks are on the downside for EUR/USD. If Trump moves the trade war to Europe, that will – all other things equal – be EUR/USD negative.

The NOK rally following the strong Regional Network Survey Tuesday faded slightly in yesterday’s session amid the stronger USD and lower oil. This highlights that NOK is more than the domestic story even if our call remains that relative rates increasingly will become a NOK positive as the mainland Norwegian economy stands out to peers. We expect Norges Bank to not only hike rates next week, but also maintain its tightening bias as the sole central bank in G10 space.

We expect the SNB to sound as dovish as possible but still deliver no major policy shift at its quarterly meeting today. With European growth prospects challenged and an ECB on hold and a Fed that is looking to ease, there is significant strain on the SNB which still fight ultra-low inflation (CPI growth around 0.5-0.6% y/y lately). A weaker CHF (both vs EUR and USD) is in essence the only sure way to fix this. The SNB will almost certainly keep its key policy rates unchanged at 0.75% today, and we believe it is likely the SNB will continue to say the CHF is ‘highly valued’ and reserve its right to intervene to curb CHF strength. This is a risk though that this language could be strengthened which would be EUR/CHF positive. But a rally could be short lived unless the SNB manages to reassure markets of its presence. And we still think is a risk of downside pressure on EUR/CHF near term as the market may want to test of the SNB on its willingness to intervene.