Investing.com’s stocks of the week

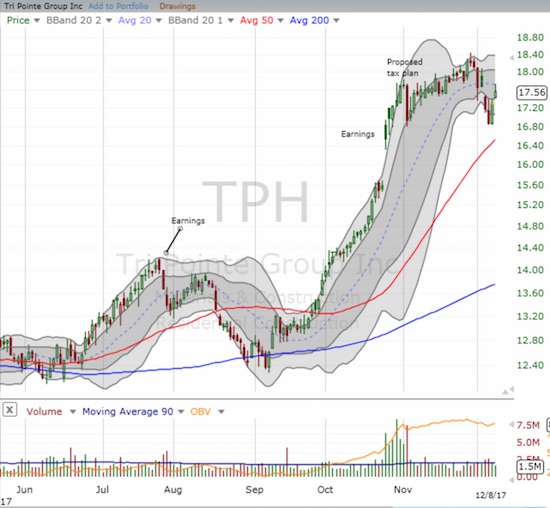

Tri Pointe Group (NYSE:TPH) was the last home builder stock I sold as a part of my last cycle of home builder investments. It was also my longest-standing holding; I only exited after the sell-off inspired by the first release of details for tax reform stopped me out of the stock. The stock had a great run, so I had no regrets. TPH bounced right back along with most other home builders. Yet, starting in December, TPH swooned all over again and now trades around where it did during the one-day angst over tax reform.

The sharp and impressive rally in Tri Pointe Group (TPH) came to a halt after angst over tax reform. A test of the 50DMA uptrend looms ahead.

Given the relative underperformance to iShares US Home Construction ETF (NYSE:ITB) I took great interest in an interview Jim Cramer conducted with CEO Doug Bauer on CNBC’s Mad Money.

Homebuilding CEO says ‘California is really in a housing crisis’ in terms of supply from CNBC.

In this interview, Cramer asked Bauer about the impact of tax reform on TPH’s business, especially in California where a triple-whammy of reductions in mortgage interest, property tax, and state/local tax deductions could put the clamps on the housing market – perhaps even the entire economy. California delivers 48% of TPH’s revenues. The next biggest state is Arizona at just 11%.

Bauer does not think the impact of tax reform will be meaningful on the housing market in California. He claimed that housing is in such short supply that taxes will not deter demand or depress prices. Bauer pointed out that demand is currently very good and broad-based from entry level, to move-up, to luxury. Bauer’s biggest concerns are land, labor, and regulations.

Cramer noted that TPH should be a large beneficiary of a corporate tax cut given the company’s particularly high tax rate of 37%. Bauer chose not to affirm that observation and instead deflected a bit to point out that he wants a more balanced approach to tax reform. He said he did not think that doctors and lawyers in California, New Jersey, and New York should have to pay for a corporate tax break for Apple (NASDAQ:AAPL). I found the choice of AAPL to be an interesting target since highly paid AAPL employees are helping to drive real estate prices sky high in the San Francisco Bay Area.

Regardless, Bauer’s assessments help explain how and why home builders as a group were able to rebound so quickly from the day of angst over tax reform. So while the industry groups continue to agonize and advocate, some home builders CEOs like Bauer are apparently too busy to worry as they scramble to meet demand for their homes.

Be careful out there!

Full disclosure: no positions