The Household Appliances industry covers companies that manufacture and market home appliances and other related products. Household or domestic appliances include electrical and mechanical devices that support household functions like cooking, laundry or food preservation.

Companies in this industry manufacture refrigerators, washing machines, water coolers and heaters, microwave ovens, toasters and coffee makers, to name a few. These companies sell products through a network of mass merchandisers, retailers, distributors, dealers, and other retail outlets.

Let’s take a look at the industry’s three major themes:

• Higher spending on technology and innovation dents margins of companies operating in this space. Raw material cost inflation is another concern. Volatility in prices of raw materials, particularly steel, oil, plastic, resin, aluminum among others, is affecting the companies’ performances. Additionally, higher tariffs on steel, which is a key raw material, have been bumping up operational costs. These factors have been eating into margins and overall profitability. For instance, leading home appliances maker, Whirlpool Corporation (NYSE:WHR) expects 2019 results to be hurt by lower industry demand coupled with raw material and tariff inflation.

• In addition, softness in housing and construction activities might lead to lower demand for home appliances. Apparently, sales of new single-family homes in the United States dropped 6.9% in April from the prior month. Moreover, sales of existing homes fell in the same period. However, analysts expect the Household Appliances Market to reach a worth of $763.45 billion globally by 2025, representing a CAGR of 5.4% in the 2018-2025 period.

• On the positive front, household appliances are gradually becoming more high-tech, embedded with smart sensors and the Internet of things (IoT)-enabled technology. In fact, technology is playing a major role in the field of electronics. As a result, industry players are largely investing in product innovation and Research & Development (R&D) to make differentiated and convenient products. These companies are also committed toward manufacturing appliances that are a one-stop solution for major household tasks. Additionally, appliance makers are installing smart grids, thermostats, digital inverter compressors and other monitoring sensors to make devices more energy-efficient. These innovations can contribute significantly in boosting the top lines of these companies. Meanwhile, companies are resorting to higher pricing actions and cost-productivity programs to boost margins and profitability.

Zacks Industry Rank Indicates Gloomy Prospects

The Household Appliances industry is housed within the broader Zacks Consumer Discretionary sector. It carries a Zacks Industry Rank #223, which places it at the bottom 13% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates gloomy prospects in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s earnings growth potential. In the past year, the industry’s earnings estimate for the current year has gone down 16.5%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags in Terms of Shareholder Returns

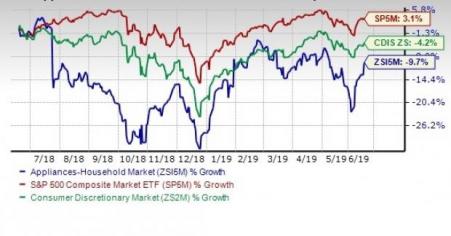

The Zacks Household Appliances industry has underperformed the broader Consumer Discretionary sector and the S&P 500 index over the past year.

Stocks in this industry have collectively lost 9.7%, compared with the Consumer Discretionary sector’s 4.2% decline. On the contrary, the S&P 500 Composite has registered growth of 3.1% in the same period.

One-Year Price Performance

Household Appliances Industry’s Valuation

On the basis of forward 12-month price-to-earnings (P/E) ratio, a commonly used multiple for valuing Consumer Discretionary stocks, the industry is currently trading at 8.37X compared with the S&P 500’s 16.67X. Further, the sector’s forward-12-month P/E ratio stands at 18.61X.

Over the last five years, the industry has traded as high as 13.34X, as low as 6.37X and at the median of 10.38X as the chart below shows.

Price-to-Earnings Ratio (Past 5 Years)

Bottom Line

While product launches and innovation along with upgraded technologies act as key catalysts for the industry, higher raw material costs are a major deterrent. Moreover, higher investments and tariff inflation might show on companies’ margins and profitability. Furthermore, a slowdown in housing and construction activities will probably affect demand for household appliances. An unimpressive Zacks Industry Rank also signifies bleak prospects.

While none of the stocks in the Household Appliances industry currently sports a Zacks Rank #1 (Strong Buy), we suggest holding on to the following stocks with a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

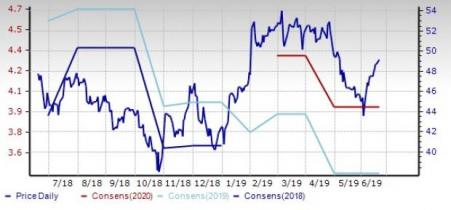

Whirlpool Corporation (WHR): This Benton Harbor, MI-based home appliances’ leader has gained 25.4% in the past six months. Further, the Zacks Consensus Estimate for its current-year earnings per share has been revised 0.7% upward in the past 60 days.

Price and Consensus: WHR

Howden Joinery Group Plc (HWDJY): The consensus earnings estimate for this London-based company has been stable for the current year in the past 30 days. The company has advanced 23.4% in the past six months.

Price and Consensus: HWDJY

AB Electrolux (ELUXY): This Swedish home appliance manufacturer has gained 17.8% in the past three months. The Zacks Consensus Estimate for 2019 earnings has been steady over the past 30 days.

Price and Consensus: ELUXY

Whirlpool Corporation (WHR): Free Stock Analysis Report

HOWDEN JOINERY (HWDJY): Free Stock Analysis Report

Electrolux AB (ELUXY): Free Stock Analysis Report

Original post