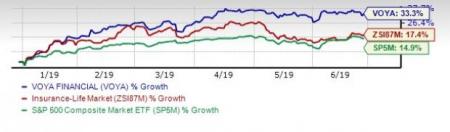

Voya Financial Inc.’s (NYSE:VOYA) shares have surged 33.3% year to date, outperforming the industry's rise of 17.1% and Zacks S&P 500 composite’s increase of 15.1%. With market capitalization of $7.7 billion, average volume of shares traded in the last three months was 1.4 million.

Voya Financial has been benefiting from its focus on high-growth, high-return, capital-light businesses, solid market presence and cost-savings initiatives. The company remains committed to its goal of annual EPS growth of at least 10% in each of the next three years (2019-2021). The company has a favorable Growth Score of B. This style score analyzes the growth prospects of a company.

Voya’s core businesses — Retirement, Investment Management and Employee Benefits — are expected to drive the company’s earnings. While industry experts estimate retirement industry assets to grow 3-4% on average over the next three years, Voya expects its Retirement business to boost earnings by 4% to 7% (over the three year period ending 2021). Expansion of distribution network and achievement of efficiencies through automation should help the company outperform the industry.

Further, Investment Management earnings are expected to grow 5% to 8% (over the 3-year period ending with 2021.) while Employee Benefits earnings are expected to increase in the range of 7% to 10% (from 2019-2021).

Voya is also on track to achieve $230 million to $250 million in annual rate cost savings by the end of 2020.

Return on equity — a measure of profitability — is 8.5%, better than the industry average of 8.3%. This reflects the company’s prudent usage of its shareholders’ funds.

Voya Financial boasts a solid capital position with risk-based capital ratio of 475%, above the new target of 400%. Its free cash flow conversion is currently 85% to 95%, supporting the projected free cash flow yield of nearly 10%.

The company has a solid capital management that helps it enhance shareholders value. While the company has a $500 million share buyback authorization, its dividend currently yields 0.1%. Voya targets a dividend yield of at least 1% in third quarter of 2019.

Voya Financial delivered positive earnings surprise in three of the last four reported quarters with the average beat being 5.03%. It currently has a Zacks Rank #3 (Hold).

The consensus mark for earnings translates into year-over-year improvement of 36.1% for 2019 and 15.3% for 2020.

Voya Financial has a favorable VGM Score of B. This style score analyzes the growth prospects of a company. This style score helps identify stocks with the most attractive value, best growth, and most promising momentum.

Stocks to Consider

Some better-ranked stocks in the life insurance industry are American Equity Investment Life Holding Company (NYSE:AEL) , Lincoln National Corporation (NYSE:LNC) and FGL Holdings (NYSE:FG) . Each of these stocks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

American Equity provides life insurance products and services in the United States. The company delivered positive surprise of 6.59% in the last reported quarter.

Lincoln National operates multiple insurance and retirement businesses in the United States.. The company delivered positive surprise of 2.88% in the last reported quarter.

FGL Holdings sells individual life insurance products and annuities in the United States. The company delivered positive surprise of 23.33% in the last reported quarter.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Lincoln National Corporation (LNC): Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL): Free Stock Analysis Report

Voya Financial, Inc. (VOYA): Free Stock Analysis Report

FGL Holdings (FG): Free Stock Analysis Report

Original post

Zacks Investment Research