Market Brief

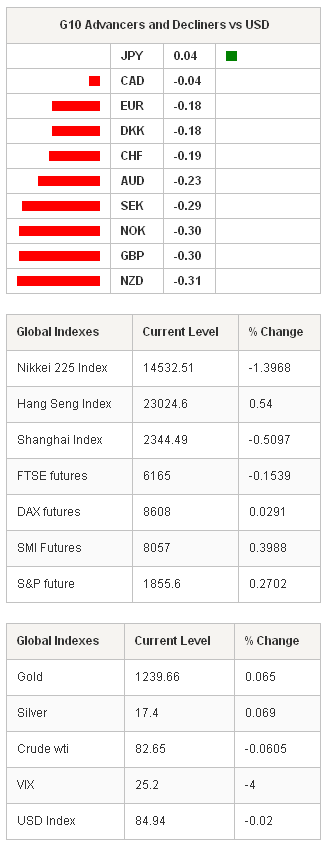

The foreign interest in Japanese stocks turned negative in week to October, the total demand for Japanese bonds increased; 600 billion yen decrease in foreign demand has been well compensated by 796 billion yen demand from Japanese investors. USD/JPY and JPY crosses were mostly offered in Tokyo as Nikkei 225 stocks closed the day 1.40% lower. USD/JPY remained capped at 106.50. Trend and momentum indicators are comfortably negative, suggesting deeper downside correction. Resistance is eyed at 106.64/107.00 (Fib 61.8% on Jul-Oct rally /optionality). Large vanilla calls at 104.50/105.50 should anchor the downside pre-weekend. From next week, option related offers trail down to 105.00, with large expiry at 106.25 due on Monday. EUR/JPY spiked down to 134.14, lowest since Nov 20th, 2013.

EUR/USD hit the 1.2845 resistance yesterday, yet failed to extend gains as top seller strategies prevailed after data confirmed the continuing softness in Euro-zone CPI. The sell-off in peripheral bonds continue with Greek 10-year yields at 9%. The strong positive correlation between core/periphery spread and EUR/USD seems limiting the downside in EUR/USD. Option bids for today expiry are placed at 1.2750/1.2850/1.2900+, offers abound below 1.2740.

AUD/USD finds some support above 0.8643/60 (year low levels) as short-term technicals continue pointing at correction. NZD/USD continues testing 0.8000-offers. Large call expiries at 0.7900/40 should give some upside support before the closing bell.

USD/CAD consolidates gains at 5-year highs as oil prices slightly recover after WTI active contracts traded below $80 yesterday, first time since mid-2012. Canada publishes CPI data today (12:30 GMT). Markets expect slight cool-off in inflation (from 2.1% to 2.0% y/y). The BoC needs softer inflation to keep its policy accommodative. Especially at times the international oil prices threaten country’s largest export business. Therefore, a strong read should lead to some appreciation in CAD-complex. The key short-term support is seen at 1.1200/05 (optionality, MACD pivot and Fib 23.6% on Jul-Oct rise). A close below this level should signal a short-term bearish reversal.

In Brazil, USD/BRL hits 2.5061 amid two sessions of aggressive BRL sell-off. The trigger has been the Datafolha survey suggesting that Neves would be left behind Rousseff with 38% chance (vs. 34% a week ago). The volatilities escalate as poll results inject important price action walking into October 26th runoff. The 1-month implied volatility advances over 25%.

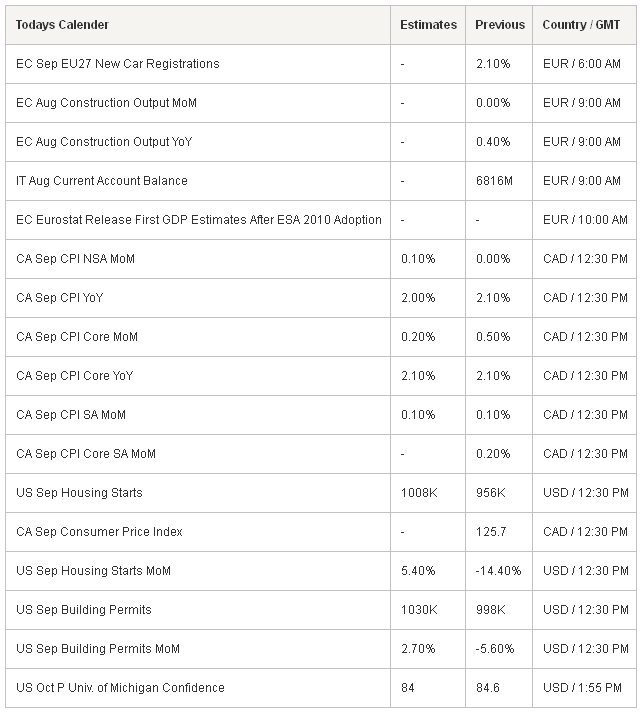

The economic calendar of the day: EU27 September New Car Registrations, Euro-Zone August Construction Output m/m & y/y, Italian August Current Account Balance, Canadian September CPI m/m & y/y, US September Housing Starts and Building Permits m/m, University of Michigan Confidence for October (Prelim).

Currency Tech

EUR/USD

R 2: 1.2901

R 1: 1.2845

CURRENT: 1.2789

S 1: 1.2740

S 2: 1.2606

GBP/USD

R 2: 1.6240

R 1: 1.6182

CURRENT: 1.6040

S 1: 1.5855

S 2: 1.5738

USD/JPY

R 2: 107.75

R 1: 106.64

CURRENT: 106.26

S 1: 105.23

S 2: 104.50

USD/CHF

R 2: 0.9598

R 1: 0.9491

CURRENT: 0.9440

S 1: 0.9405

S 2: 0.9368