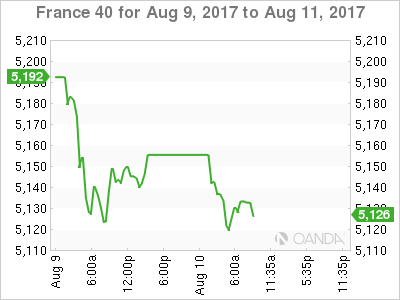

The CAC has posted losses for a second straight day. In the Thursday session, the index is at 5,126.30, down 0.35% on the day. On the release front, French Industrial Production suffered a sharp decline of 1.1%, worse than the estimate of -0.6%. On Friday, France releases Final CPI and Preliminary Nonfarm Payrolls.

With a quiet week for European indicators, investors have shifted their attention to Southeast Asia, where tensions continue to ratchet higher between North Korea and the US. With the war of words escalating between the two countries, global markets are down, as investors have dumped shares in favor of safe-haven assets, such as gold. North Korea has vowed to retaliate over new sanctions imposed by Washington and has threatened to attack Guam, which is a major US military base. President Trump and North Korean President Kim Jong-un are on a possible collision course, which has caused alarm in South Korea and Japan, strong allies of the US.

Low inflation levels remain a major headache for ECB policymakers. Inflation in the eurozone stood at 1.3% year-on-year in July, well below the bank’s inflation target of 2%.

Even Germany, whose economy is very strong, is grappling with weak inflation. The ECB’s ultra-accommodative policy, which includes interest rates of 0.00% and asset purchases (QE) of 60 billion euros/month, has failed to push inflation upwards.The QE program, which is scheduled to terminate in December, is coming under closer scrutiny.

However, December should not be treated as a drop-dead date – the ECB has been careful to state that QE could be extended “if necessary”. The ECB holds its next policy meeting in September 7, and there is a strong possibility that the bank will make an announcement regarding tapering QE, which could start in early 2018.

The dilemma facing policymakers is that despite a stronger labor market and improved growth, which would suggest that a tighter monetary might be appropriate, inflation levels remain stubbornly low, as the ECB’s inflation target of 2% has proven overly optimistic. The ECB is well aware that any talk of tighter policy could send the euro higher, as was the case in June, when investors snapped up euros after Mario Draghi made some hawkish comments at a meeting of central bankers. As far as interest rate moves, the ECB is unlikely to raise rates until its tapering process is well under way, meaning we’re unlikely to see any rate moves before the second half of 2018.

Economic Calendar

Thursday (August 10)

- 2:45 French Industrial Production. Estimate -0.6%. Actual -1.1%

Friday (August 11)

- 2:45 French Final CPI. Estimate -0.3%

- 2:45 French Preliminary Nonfarm Payrolls. Estimate 0.4%

*All release times are EDT

*Key events are in bold

CAC, Thursday, August 10 at 7:30 EDT

Open: 5136.80 High: 5150.80 Low: 5110.15 Close: 5126.30