The CAC index has paused on Monday, after recording strong gains last week. Currently, the CAC is trading at 5,494.50, up 0.01% on the day. On the release front, there are no eurozone or French events on the schedule. On Tuesday, France releases GDP, Consumer Spending, and Preliminary CPI. The eurozone will publish CPI Flash Estimate and Preliminary Flash GDP.

The CAC gained 2.1% last week, as the index continues to rack up gains. On Friday, the CAC punched above the 5500 level for the first time since January 2008. European stock markets were in green territory on Thursday, as the ECB chopped its asset purchase program (QE) from EUR 60 billion to 30 billion/mth. It was a case of “smaller but longer” for the QE program. The ECB extended the program, which was scheduled to terminate in December, to September 2018. At the same time, ECB President Mario Draghi’s announced that QE would remain open-ended. There were expectations that the ECB would announce a date when the program would end. ECB President Mario Draghi has given himself plenty of wiggle room, as he can simply extend QE beyond next September. As for monetary policy, the ECB maintained interest rates at a flat 0.00%, and Draghi provided no hints about the timing of future rate hikes. The ECB appears in no rush to tinker with rate policy, and we’re unlikely to see any rate increases until QE is completed.

European stock markets have been muted in their response to the crisis in Spain, but investors continue to monitor events in the eurozone’s fourth largest economy. On Friday, the central government pressed the trigger and imposed direct rule on Catalonia. Just prior this move, the Catalonian government pre-empted Madrid and declared independence. There have been huge demonstrations in Barcelona, both in favor and against secession from Spain. Madrid and Barcelona have been a collision course for weeks, so what happens now? The answer may lie with Catalonia’s 200,000 civil servants, who must decide whether to follow orders from Madrid, or join a civil disobedience campaign which is being organized by the Catalan government. So far, the Spanish government has taken a hard line against the independence movement, dismissing Catalan President Carles Puigdemont and his government, and threatening to file rebellion charges against Puigdemont. Prime Minister Mariano Rajoy has called new elections in Catalonia for December 21, but the situation remains volatile.

Economic Calendar

Monday (October 30)

- There are no Eurozone or French events

Tuesday (October 31)

- 2:30 French Flash GDP. Estimate 0.5%

- 3:45 French Consumer Spending. Estimate 0.6%

- 3:45 French Preliminary CPI. Estimate 0.1%

- 6:00 Eurozone CPI Flash Estimate. Estimate 1.5%

- 6:00 Eurozone Core CPI Flash Estimate. Estimate 1.1%

- 6:00 Eurozone Preliminary Flash GDP. Estimate 0.5%

*All release times are GMT

*Key events are in bold

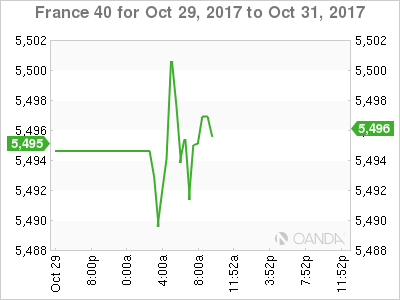

CAC, Monday, October 30 at 7:50 EDT

Open: 5489.95 High: 5487.50 Low: 5503.80 Close: 5494.00