The CAC index has posted sharp losses in the Friday session. The CAC is currently at 12,116.00, down 1.33% on the day. On the release front, it’s a busy day for French indicators. Consumer spending came in at -0.8%, missing the estimate of -0.3%. On the inflation front, Preliminary CPI declined 0.3%, just above the forecast of -0.4%. This marked the indicator’s weakest reading since January. There was better news from Flash GDP, which improved to 0.5% in the second quarter, matching the forecast. This was the strongest quarter of growth since Q1 in 2016. Later in the day, the US releases Advance GDP, with the estimate standing at 2.5%. If GDP is not within expectations, we could see some volatility from French stock markets.

It’s become an all-too-familiar pattern out of Washington – trouble for the White House has translated into losses on global stock markets, as higher political risk has made investors jittery. It was déjà vu on Thursday, as President’s struggling healthcare bill gasped its final breath as the bill was defeated in the Senate after three Republican lawmakers joined the Democrats and voted against the bill. This is another setback for President Trump, who has been unable to get Congress to pass any significant legislation, despite the Republicans controlling both the House and the Senate. Trump will now be able to focus on other issues such as tax reform, but investors are skeptical as to whether the President will have the support he needs in Congress to pass major legislation.

With the Federal Reserve holding rates at 1.25% at this week’s policy meeting, the markets focused on the rate statement, as investors looked for clues about future rate moves. The statement was cautiously optimistic in tone, with policymakers saying that the economy was growing at a moderate pace and that the labor market remained strong. The statement made note of low inflation, but said that the Fed expected the economy to continue to expand. Another key issue on the Fed’s plate is the $4.2 trillion balance sheet. The rate statement said that the Fed plans to taper asset purchases “relatively soon”, which is a likely nod at September as the start date. This would involve the Fed tapering its purchases of Treasury bonds and mortgage securities, with an initial taper likely of $10 billion/month. Although the Fed continues to talk about another rate hike in 2017, investors remain skeptical. The rate statement did not change many minds, as the odds of rate increase in December stand at 47%, according to the CME Group (NASDAQ:CME).

Economic Calendar

Friday (July 28)

- 1:30 French Flash GDP. Estimate 0.5%. Actual 0.5%

- 2:45 French Consumer Spending. Estimate -0.3%. Actual -0.8%

- 2:45 French Preliminary CPI. Estimate -0.4%. Actual -0.3%

- 8:30 US Advance GDP. Estimate 2.5%

*All release times are EDT

*Key events are in bold

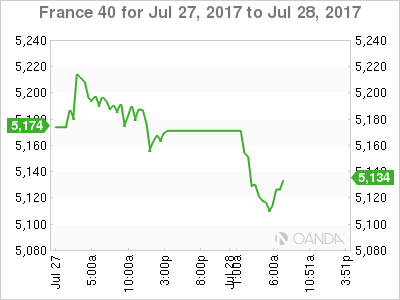

CAC, Friday, July 28 at 7:00 EDT

Open: 5145.00 High: 5145.00 Low: 5105.50 Close: 5117.30