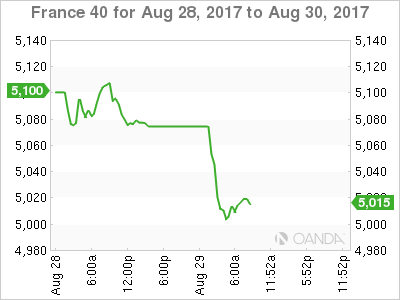

The CAC index has posted strong losses in the Tuesday session. Currently, the index is at 5,079.75, down 1.23% on the day. On the release front, French Consumer Spending came in at 0.7%, matching the forecast. French Preliminary GDP improved to 0.5%, also matching the forecast. On Wednesday, the US releases Preliminary GDP, which is expected to post a strong gain of 2.7%.

Geopolitical tensions are back in the headlines this week, as North Korea fired a missile over Japanese territory on Tuesday. Japan and the US have sharply condemned the missile launch, and with tensions once again climbing in the Korean peninsula, investors are bracing for more stock market losses, and both gold and the Japanese yen, which are safe-haven assets, have posted strong gains this week.

The euro is enjoying a solid rally, and has climbed an impressive 2.1% since Friday. Earlier on Tuesday, the euro pushed above the 1.20 line, for the first time since January 2015. A stronger euro has weighed on exporters, and the CAC dipped below the 5,000 level earlier on Tuesday. On Friday, ECB President Mario Draghi took a page out of Janet Yellen’s page book, opting to steer away from any discussion about ECB monetary policy in a speech at a meeting of central bankers in Jackson Hole. Draghi seems to have learned a lesson from a meeting of central bankers in Portugal in June, when the markets seized on his comments that the euro zone was undergoing a broad recovery, and the euro soared. With the euro zone enjoying solid growth in 2017, analysts expect the ECB to address its plans for its asset purchases program (QE), which is expected to terminate in December. The ECB is widely expected to taper its QE program early next year, and the euro has jumped 14% against the dollar in 2017.

At the Jackson Hole meeting, Yellen did not discuss interest rate policy, choosing instead to emphasize that the financial regulations put in place since the financial crisis in 2008 should not be undermined. Her message appeared aim at Donald Trump, who has expressed his intention to relax banking and financial regulations which he has argued are hampering business. The markets remain skeptical about a third and final rate hike this year, as the odds of an increase in December have been falling – currently, the odds a December hike are at 35%, down from 42% a month ago.

Economic Calendar

Tuesday (August 28)

- 2:45 French Consumer Spending. Estimate 0.7%. Actual 0.7%

- 2:45 French Preliminary GDP. Estimate 0.5%. Actual 0.5%

- 9:00 US S&P/CS Composite-20 HPI. Estimate 5.6%

- 10:00 US CB Consumer Confidence. Estimate 120.9

Upcoming Events

Wednesday (August 29)

- All Day – German Preliminary CPI. Estimate 0.1%

- 8:15 US ADP Nonfarm Employment Change. Estimate 186K

- 8:30 US Preliminary GDP. Estimate 2.7%

*All release times are EDT

*Key events are in bold

CAC, Tuesday, August 29 at 7:55 EDT

Open: 5038.00 High: 5042.35 Low: 4994.50 Close: 5079.75