The CAC has bounced back after starting the week with losses. In the Tuesday session, the CAC is at 5387.25 up 0.51% on the day. On the release front, there are no major eurozone events on the calendar. Later in the day, Fed Chair Designate Jerome Powell will testify at his confirmation hearing before the Senate Banking Committee. On Wednesday, France releases Consumer Spending and Preliminary GDP. The US will also publish Preliminary GDP and Janet Yellen will testify before a congressional committee.

European stock markets are in green territory on Tuesday, as German coalition talks have been revived, after collapsing last week. The SPD (socialist democrats), a junior partner in the last government, have agreed to hold coalition talks with Angela Merkel’s CDU. The SPD is expected to demand a bigger role in a new government if it agrees to a “grand” coalition. Talks between the CDU, the Greens and the Free Democrats imploded when the Free Democrats bolted, saying there was not enough common ground to continue talks. Merkel is reluctant to run a weak minority government, and if talks with the SPD don’t make progress, the likely result would be another election. For its part SPD lawmakers are split on whether to join up with the CDU, but Merkel may choose to make her former coalition partner an offer it can’t refuse, such as the powerful finance ministry.

All eyes will be on Jerome Powell, who testifies before the Senate Banking Committee on Tuesday for his confirmation hearing. Will Powell be a clone of outgoing chair Janet Yellen? Powell inherits an economy that is in excellent shape, but persistently low inflation remains a nagging problem. Fed policymakers have differing views on what to do about inflation, with some members proposing that the Fed drop its 2 percent target, in favor of a “gradually rising path” for prices. The Fed remains confounded by low inflation and wage growth, despite a labor market that is at full capacity. Still, the Fed will likely pull the rate trigger next month, and could raise rates up to 3 more times in 2018 if the economy continues to expand at its current pace.

Economic Calendar

Tuesday (November 28)

- 4:00 Eurozone M3 Money Supply. Estimate 5.1%. Actual 5.0%

- 4:00 Eurozone Private Loans. Estimate 2.8%. Actual 2.7%

- 9:45 US Fed Chair Designate Jerome Powell Speaks

Wednesday (November 29)

- 2:45 French Consumer Spending. Estimate 0.0%

- 2:45 French Preliminary GDP. Estimate 0.5%

- 8:30 US Preliminary GDP. Estimate 3.3%

- 10:00 US Fed Chair Janet Yellen Testifies

*All release times are GMT

*Key events are in bold

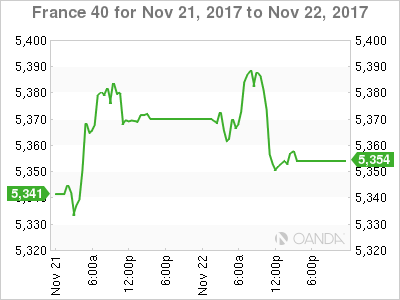

CAC, Monday, November 28 at 7:20 EDT

Open: 5373.50 High: 5397.50 Low: 5357.50 Close: 5387.25