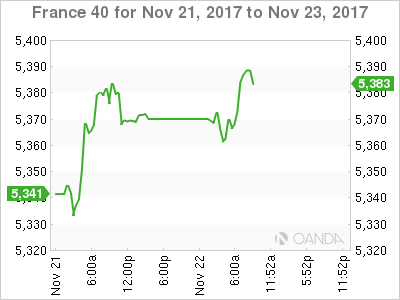

The CAC continues to gain ground this week. Currently, the CAC is at 5389.30 up 0.39% on the day. On the release front, the sole eurozone indicator is Consumer Confidence, which is expected to remain unchanged at -1 point. On Thursday, France and the Eurozone release manufacturing PMI reports. As well, the ECB will release the summary from its October policy meeting.

All eyes are on Germany, which is currently facing one of its biggest political crises in decades, as President Angela Merkel has been unable to form a coalition. Talks to form a government have been ongoing for a month, but the Free Democratic Party (FDP) pulled the plug on Sunday, saying there was no “basis of trust” to enter a government with Angela Merkel’s CDU-CSU alliance and the Greens. The parties have been holding negotiations for a month, but have failed to bridge the gaps on issues such as immigration. Merkel has said she is not interested in running a minority government, whereby the opposition could topple the government at any time. President Frank-Walter Steinmeier has urged the parties to redouble their efforts in order to reach an agreement, warning that another election would cause uncertainty in German as well as Europe.

The crisis in the eurozone’s largest economy could paralyze the European Union, as Angela Merkel has become the unofficial leader of the bloc. Euro-supporters such as French President Emmanuel Macron have ambitious plans to strengthen European integration, but this will have to wait until Merkel can straighten out her domestic challenges. Macron wants to to take advantage of Britain leaving the EU and solidify France’s position in the bloc. His proposals include a budget and a finance minister for the eurozone.

Economic Calendar

Wednesday (November 22)

- 10:00 Eurozone Consumer Confidence. Estimate -1

- 14:00 US FOMC Meeting Minutes

Thursday (November 23)

- 3:00 French Flash Manufacturing PMI. Estimate 55.9

- 3:00 French Flash Services PMI. Estimate 57.1

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 58.3

- 4;00 Eurozone Flash Services PMI. Estimate 57.1

- 7:30 ECB Monetary Policy Meeting Accounts

*All release times are GMT

*Key events are in bold

CAC, Wednesday, November 22 at 8:45 EDT

Open: 5368.45 High: 5391.25 Low: 5357.50 Close: 5389.30