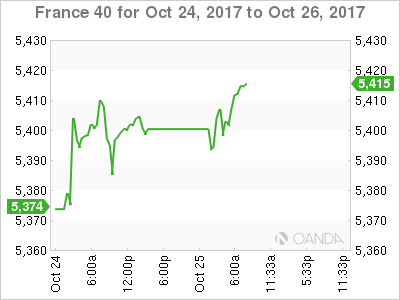

The CAC index has posted slight gains in the Wednesday session. Currently, the CAC is trading at 5,409.80, up 0.35% on the day. On the release front, there are no French or eurozone events on the schedule. On Thursday, the ECB publishes its rate statement.

The CAC continues to move upwards, and on Wednesday, the index climbed to 5413, its highest level since mid-May. Investors are keeping a close on the ECB, which holds a policy meeting on Thursday. Mario Draghi and Co. will have to maneuver carefully, as the ECB decides whether to start unwinding its asset purchases program, which is currently pegged at EUR 60 billion/month. Back in the summer, the ECB said it would trim the program in the “autumn”, but didn’t make any moves at the September meeting. Germany is strongly in favor of quickly removing the stimulus program, but other eurozone members want to see a gradual phase-out of the plan. Expectations of a significant reduction in stimulus, perhaps to EUR 30 billion/mth, has sent bond yields higher this week, which in turn could push European stock markets downwards.

France’s economy has improved in 2017, and service and manufacturing reports on Wednesday suggest that fourth quarter growth will be strong. Manufacturing and Services PMIs came in at 56.7 and 57.4 points respectively, both of which beat expectations. The French government is determined to overhaul the economy and has targeted public spending, with plans to cut 120,000 civil servants. The government also expects that the deficit will drop below 3 percent of GDP in 2017, in keeping with EU guidelines. Last year, the deficit stood at 3.4 percent of GDP.

Economic Calendar

Wednesday (October 25)

- There are no French or Eurozone events

Thursday (October 26)

- 4:00 Eurozone M3 Money Supply. Estimate 5.0%

- 4:00 Eurozone Private Loans. Estimate 2.8%

- 7:45 ECB Minimum Bid Rate. Estimate 0.00%

- 8:30 ECB Press Conference

*All release times are GMT

*Key events are in bold

CAC, Wednesday, October 25 at 7:15 EDT

Open: 5393.80 High: 5412.50 Low: 5391.50 Close: 5413.80