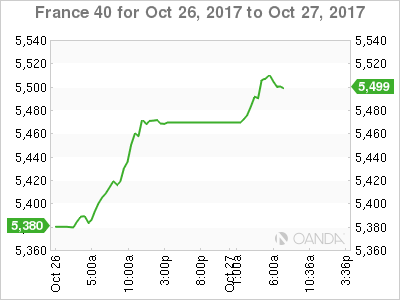

The CAC index has posted strong gains in the Friday session, continuing the upward movement seen on Thursday. Currently, the CAC is trading at 5,498.50, up 0.79% on the day. On the release front, there are no eurozone or French events on the schedule. The US will release Advance GDP, with an estimate of 2.5%.

The ECB decision to implement quantitative tightening has buoyed European stock markets. The CAC has jumped on the bandwagon and has jumped 2.4% this week. Investors gave a thumbs-up as the ECB cut the asset purchase program (QE) from EUR 60 billion to 30 billion/mth. The QE program, which was due to terminate in December, has been extended to September 2018. ECB President Mario Draghi did surprise the markets, however, with dovish comments. Draghi said that the program would remain open-ended, which allows the ECB to extend QE beyond September 2018. As expected, the ECB maintained interest rates at a flat 0.00%, and Draghi provided no hints about the timing of future rate hikes. The ECB appears in no rush to tinker with rate policy, and we’re unlikely to see any rate increases until QE is completed.

Investors are casting a nervous eye on Spain, as the Catalan crisis has reached a fever pitch. Spain’s Senate will convene later on Friday and is expected to authorize the central government to invoke Article 155 of Spain’s constitution and apply direct rule over Catalonia. What steps will Madrid take? It could dismiss the Catalan government and parliament and take control of the regional police and radio and television stations. This drastic clause has never been invoked, and it remains unclear what lies ahead. How will the Catalan parliament respond? On Thursday, the Catalan vice-president warned that if Madrid imposed direct rule, the Catalan government would have no choice but to declare independence. So far, the crisis has not affected the euro, and Caixabank, the third largest bank in the country, does not expect the Catalonia issue to affect Spain’s GDP, which the bank projects will expand 2.7 percent in 2018. Still, if the crisis worsens and Catalans respond with civil disobedience, investors could get nervous and stocks could drop.

Economic Calendar

Friday (October 27)

- 8:30 US Advance GDP. Estimate 2.5%

*All release times are GMT

*Key events are in bold

CAC, Friday, October 27 at 7:55 EDT

Open: 5473.80 High: 5514.20 Low: 5470.30 Close: 5498.50