- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

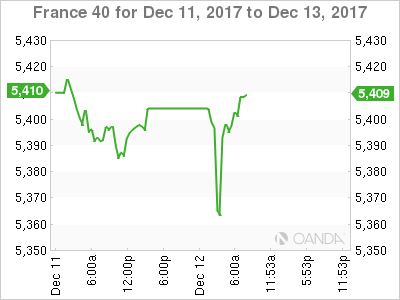

CAC Gains Ground As French Payrolls Beats Estimate

The CAC has posted gains in the Tuesday session. Currently, the index is at 5409.00, up 0.45% on the day. On the release front, French Final Private Payrolls edged down to 0.3%, but beat the forecast of 0.2%. Eurozone ZEW Economic Sentiment also softened, with a reading of 29.0. This was short of the 30.2 points. Later in the day, ECB President Mario Draghi speaks at an event in Frankfurt. The Federal Reserve is expected to raise the benchmark rate to a range between 1.25% to 1.50%.

Later this week, we’ll get a good look at economic activity in France, with the release of services and manufacturing PMIs, as well as Final CPI. The PMI reports are expected to indicate expansion, continuing the trend we’ve seen throughout 2017. The French economy has been marked by stronger growth and lower unemployment, and investor and business confidence has been boosted by the election of pro-business Emmanuel Macron as president. Still, inflation remains a sore point, as levels remain well short of the ECB target of around 2.0%. French Final CPI is expected to post a negligible gain of 0.1%, unchanged from the previous reading.

All eyes are on the Federal Reserve, with the markets are expecting a quarter-point rate hike from the Fed on Wednesday. Even though this move has been priced in, rate hikes tend to trigger a surge of confidence among investors, and could trigger gains in global stock markets. Another rate hike is expected in January, with fed futures pricing a rate hike at 87%. The Fed has hinted that it could raise rates up to three times in 2018, and this upward movement in rates will likely propel the US dollar upwards. The US labor market remains at full capacity and various sectors in the economy are reporting a lack of workers. Still, this has not translated into stronger wage growth, despite predictions from Janet Yellen and other Fed policymakers that a lack of workers is bound to push up wages.

Economic Calendar

Tuesday (December 12)

- 1:30 French Final Private Payrolls. Estimate 0.2%. Actual 0.3%

- 5:00 Eurozone ZEW Economic Sentiment. Estimate 30.2. Actual 29.0

- 14:00 ECB President Mario Draghi Speaks

Wednesday (December 13)

- 5:00 Eurozone Employment Change. Estimate 0.4%

- 5:00 Eurozone Industrial Production. Estimate -0.2%

- 14:00 US Federal Funds Rate. Estimate

*All release times are GMT

*Key events are in bold

CAC, Tuesday, December 12 at 7:35 EDT

Open: 5393.95 High: 5410.50 Low: 5358.50 Close: 5411.00

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.