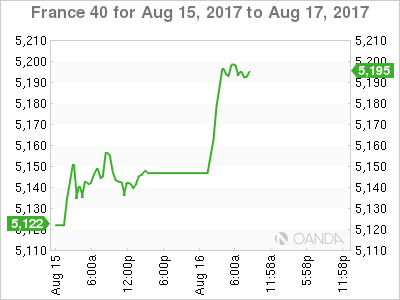

The CAC has posted strong gains in the Wednesday session. Currently, the index is at 5,195.75, up 1.07% on the day. On the release front, euro zone Flash GDP edged up to 0.6% in the second quarter, matching the estimate. In the US, the Federal Reserve will release the minutes of its July policy meeting. On Thursday, the euro zone releases Final CPI and the ECB publishes the minutes of its July policy meeting.

The euro zone economy continues to improve in 2017, so there were no surprises as euro zone Flash GDP posted a strong gain of 0.6% in the second quarter, edging above the 0.5% gain in Q1.

The euro zone economy has now picked up speed over three consecutive quarters. Much of the credit for improved growth in the euro zone goes to Germany, whose economy continues to fire on all four cylinders. Germany has been the locomotive of the euro zone.

France, the second largest economy in the bloc, reported economic growth of 0.5% in the second quarter, with a strong export sector boosting economic growth. Despite the positive GDP numbers, inflation remains well below the ECB target of 2%. In July, French Final CPI declined 0.3%, after two readings of 0.0%. Euro zone Final CPI slowed to 1.3% in July, its weakest gain this year. Weak inflation levels have hampered ECB plans to wind down its asset purchases program, although the markets are prepared for a statement from the ECB concerning the scheme in September or October.

Global stock markets have been on a roller coaster, as tensions between the US and North Korea reached a fever pitch last week, only to recede this week. The CAC declined 2.9% last week, but has rebounded, recording gains of 2.0% so far this week. At the same time, although a military conflict remains unlikely in the Korean peninsula, tensions remain high, and if the war of words ratchets higher, investors could head for safer pastures and dump shares in favor of the Japanese yen and gold, which was the case last week.

The markets will be all ears as the Federal Reserve releases its July minutes. At that policy meeting, the Fed outlined plans to reduce its bloated balance sheet of $4.2 trillion. The Fed hasn’t given any details about when it will commence trimming the balance sheet. Analysts expect September will be the start date, and the Fed could start the process by slowing its asset purchases by modest amount, such as $10 billion/mth.

Economic Calendar

Wednesday (August 16)

- 5:00 Euro zone Flash GDP. Estimate 0.6%. Actual 0.6%

- 14:00 US FOMC Meeting Minutes

Thursday (August 17)

- 5:00 Euro zone Final CPI. Estimate 1.3%

- 7:30 ECB Monetary Policy Meeting Accounts

*All release times are EDT

*Key events are in bold

CAC, Wednesday, August 16 at 7:55 EDT

Open: 5163.75 High: 5202.80 Low: 5159.80 Close: 5195.75