The CAC index has inched lower in the Monday session. Currently, the index is trading at 5124.00, down 0.12% on the day. In economic news, French Manufacturing PMI improved to 55.4, above the estimate of 54.6 points. However, Eurozone Manufacturing PMI dipped to 56.8, short of the estimate of 57.3 points.

The French economy continues to show signs of improvement, and there was positive news as French Manufacturing PMI improved to 55.4, its highest level in three months. Although Eurozone Manufacturing PMI was softer in July, it still pointed to expansion, so the markets are unlikely to fret over this reading. The eurozone and French manufacturing sectors have received a boost from stronger exports as well as increased consumer demand.

As expected, the ECB played it safe last week, as policymakers maintained interest rates at 0.00% and the bank’s asset-purchase scheme (QE) at EUR 60 billion/month. The ECB has said that it will maintain QE until December “or beyond, if necessary”. There had been speculation that the ECB might remove that “wiggle room” phrase, but the bank did not make any changes, perhaps Draghi was being careful not to provide the markets with an excuse to rush on euros, which occurred in June after Draghi left open the door to reducing QE prior to December. The markets seized on Drahgi’s comments, and the cautious ECB had to shift to damage control mode, saying that the markets had misinterpreted his comments.

With no news in the rate statement, the markets focused on the ECB President Mario Draghi’s press conference. Draghi sounded upbeat about the eurozone economy, noting there were signs of “unquestionable improvement” in the eurozone economy. Draghi acknowledged that inflation remains stubbornly low, and said that it was a question of time until the stronger economic conditions pushed inflation to higher levels.

As for monetary policy, Draghi said the bank had not set an exact time for revisiting any changes to the current accommodative policy, but added that the ECB would review policy in September. These comments did not seem to break any new ground, but were perceived as hawkish by the markets and boosted the euro on Thursday.

Economic Calendar

Monday (July 24)

- 3:00 French Flash Manufacturing PMI. Estimate 54.6. Actual 55.4

- 3:00 French Flash Services PMI. Estimate 56.6. Actual 55.9

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 57.3. Actual 56.8

- 4:00 Eurozone Flash Services PMI. Estimate 55.5. Actual 55.4

*All release times are EDT

*Key events are in bold

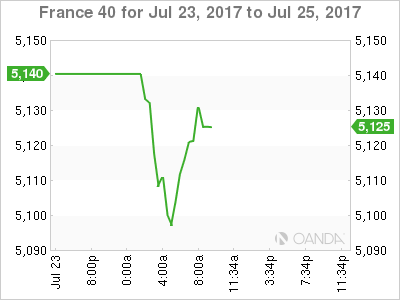

CAC, Monday, July 24 at 8:30 EDT

Open: 5136.80 High: 5139.10 Low: 5094.50 Close: 5131.50