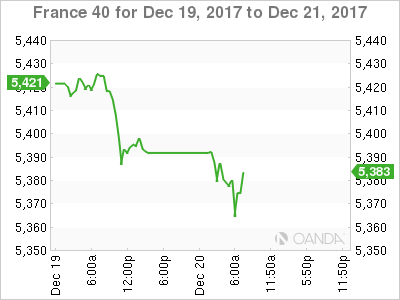

The CAC index has recorded slight losses in the Wednesday session. Currently, the index is at 5370.30, down 0.23% on the day. On the release front, eurozone current account surplus dropped sharply to EUR 30.8 billion, well short of the estimate of EUR 33.4 billion. This was the smallest surplus since July. On Thursday, the US releases third quarter Final GDP.

President Trump will end 2017 on a high note, as his election pledge to implement major tax reform is on the verge of becoming law. The tax bill was passed in the House of Representatives and the Senate on Tuesday, but the bill is being sent back to the House for another vote on Wednesday due to a procedural requirement. The legislation is expected to be ratified by the House and will then be sent to Trump to be signed into law. As expected, the congressional votes went along party lines, with the Senate narrowly approving the bill by a count of 51-48. This marks the first major overhaul of the US tax code in 30 years, and reduces corporate taxes from 35% to 21%. After failing to overturn Obamacare, the Republicans can finally chalk up their first legislative victory in the Trump administration, ahead of Congressional elections in 2018.

It’s a quiet week for economic indicators, and currency markets are generally quiet in the period ahead of Christmas. Still, investors should keep a close eye on French consumer spending, which will be released on Friday. Consumer spending was dismal in October, with a sharp decline of 1.9%, compared to the forecast of 0.0%. However, the markets are expecting a strong rebound for November, with an estimate of a 1.4% gain. Christmas shopping will likely translate into strong consumer spending numbers for December, which could boost fourth quarter economic growth and send the CAC to higher levels early in the New Year.

A strong US economy in 2017 has been good news for global stock markets, and the markets expect a thumbs-up report card on Thursday, with the release of Final GDP for Q3. Preliminary GDP posted an impressive 3.3% gain, and although Final GDP is forecast to be revised downwards to 3.1%, this would still indicate strong economic expansion. The Federal Reserve wrapped up 2018 with a quarter-point hike, and another increase is widely expected at the January meeting. Strong economic numbers and this accelerated pace of rate increases could send stock markets higher.

Economic Calendar

Wednesday (December 20)

- 4:00 Eurozone Current Account. Estimate 33.4B. Actual 30.8B

Thursday (December 21)

- 8:30 US Final GDP. Estimate 3.3%

*All release times are GMT

*Key events are in bold

CAC, Wednesday, December 20 at 7:05 EDT

Open: 5375.00 High: 5383.30 Low: 5350.30 Close: 5370.30