The CAC index has posted slight losses in the Monday session. Currently, the CAC is trading at 5,505.50, down 0.22% on the day. On the release front, French Final Services PMI improved to 57.4, edging above the forecast of 57.3 points. Eurozone Services PMI softened in October, but the reading of 55.0 was just above the estimate of 54.9 points. As well, eurozone investor confidence and inflation reports beat the forecasts. On Tuesday, ECB President Mario Draghi speaks at an ECB forum in Frankfurt. France releases the budget deficit, and the eurozone will publish Retail PMI and retail sales.

The manufacturing sector has been an important factor in the improved eurozone economy, and October Manufacturing PMIs continue to point to expansion early in the fourth quarter. Eurozone Manufacturing PMI came in at 58.6, accelerating for a third straight month. French Manufacturing PMI remained steady at 56.1 points. Although the reading missed the estimate of 56.7, it pointed to ongoing expansion in the manufacturing sector. The French services sector also remains strong, as Services PMI improved to 57.3, its highest level since March.

Late last week, President Trump nominated Federal Reserve Governor Jerome Powell on Thursday to head the Federal Reserve. Powell will take over in February 2018, when Yellen’s term expires. The new chair is expected to hold the course with monetary policy, which has been marked by incremental and small rate hikes since December 2015. It’s all but a given that the Fed will raise interest rates in December, but the forecast for 2018 is less clear. If the US economy continues to grow at current levels, we could see up to three rate hikes next year. Powell will also be tasked with continuing to trim the Fed’s huge balance sheet of $4.2 billion. Last month, the Fed has started trimming the balance sheet by $10 billion/mth, but these cuts are expected to increase in size next year.

Economic Calendar

Monday (November 6)

- 3:50 French Final Services PMI. Estimate 57.4. Actual 57.3

- 4:00 Eurozone Final Services PMI. Estimate 54.9. Actual 55.0

- 4:30 Eurozone Sentix Investor Confidence. Estimate 31.2. Actual 34.0

- 5:00 Eurozone PPI. Estimate 0.4%. Actual 0.6%

- All Day – Eurogroup Meetings

Tuesday (November 7)

- 2:45 French Government Budget Balance

- 4:00 ECB President Mario Draghi Speaks

- 4:10 Eurozone Retail PMI

- 5:00 Eurozone Retail Sales. Estimate 0.6%

- All Day – ECOFIN Meetings

*All release times are GMT

*Key events are in bold

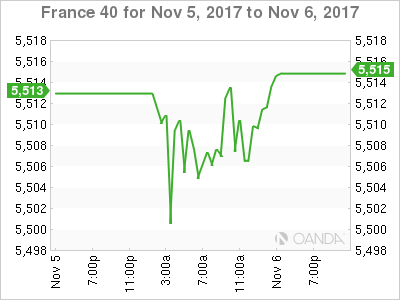

CAC, Monday, November 6 at 8:25 EDT

Open: 5510.50 High: 5513.00 Low: 5492.50 Close: 5505.00