The CAC index has recorded considerable gains in the Thursday session. Currently, the index is at 5,060.30, up 0.75% on the day. On the release front, French Preliminary CPI rebounded in August, posting a gain of 0.5%. This matched the estimate, and was a sharp improvement on the July reading of -0.4%. Euro zone CPI Flash Estimate accelerated to 1.5%, edging above the forecast of 1.4%.

On Friday, the US releases Nonfarm Employment Change, with the markets braced for a drop to 180 thousand.

It’s been a busy week for European stock markets, which have been responding to tensions in the Korean peninsula. The CAC lost ground on Tuesday, after North Korea fired a ballistic missile which flew over northern Japan before crashing into the ocean. Japan and the US sharply condemned the missile launch, with President Trump saying that “all options remain on the table”. However, investors have put the incident behind them, and stronger risk appetite has pushed the CAC higher.

There was positive news out of the US on Wednesday, as Preliminary GDP (second estimate) for the second quarter was revised to 3.0%, a marked improvement from the first estimate of 2.6%. Consumer confidence and spending remain strong and helped contribute to the strong GDP report, as the economy posted its strongest gain since the first quarter of 2015. However, solid consumer spending has failed to boost inflation, which continues to hover at low levels. The lack of inflation could hamper the Federal Reserve’s plans to raise interest rates, with the likelihood of a rate hike in December standing at just 35%.

The euro continues to gain ground against the US dollar. The currency has soared 12.0% since April 1, and on Tuesday, the euro pushed above the 1.20 level for the first time since January 2017. The euro has benefited from stronger growth in the eurozone in 2017, led by robust growth in Germany. However, the euro’s streak has weighed on the shares of automobile makers and other exporters, as a stronger euro has made exports more expensive.

Investors are anticipating that the ECB will provide some guidance on plans regarding its asset purchase program (QE), which is scheduled to terminate in December. The ECB is widely expected to taper its QE program early next year, but so far has been mum about its plans. Analysts expect the ECB to address its stimulus package at the next policy meeting on September 7.

Economic Calendar

Thursday (August 31)

- 2:45 French Preliminary CPI. Estimate 0.5%. Actual 0.5%

- 5:00 Euro zone CPI Flash Estimate. Estimate 1.5%. Actual 1.4%

- 5:00 Euro zone Core CPI Flash Estimate. Estimate 1.2%. Actual 1.2%

- 5:00 Euro zone Unemployment Rate. Estimate 9.1%. Actual 9.1%

Upcoming Key Events

Friday (September 1)

- 8:30 US Nonfarm Employment Change. Estimate 180K

*All release times are EDT

*Key events are in bold

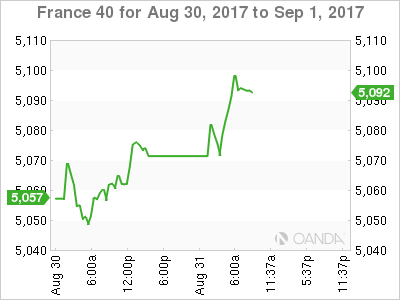

CAC, Thursday, August 31 at 8:20 EDT

Open: 5081.50 High: 5101.30 Low: 5068.50 Close: 5093.30