Key Points:

- Ranging phase is becoming likely for oil prices moving forward.

- OPEC deals can keep prices buoyant but the $50 handle remains an important impasse.

- US Shale and Iran remain stumbling blocks to OPEC supply manipulations.

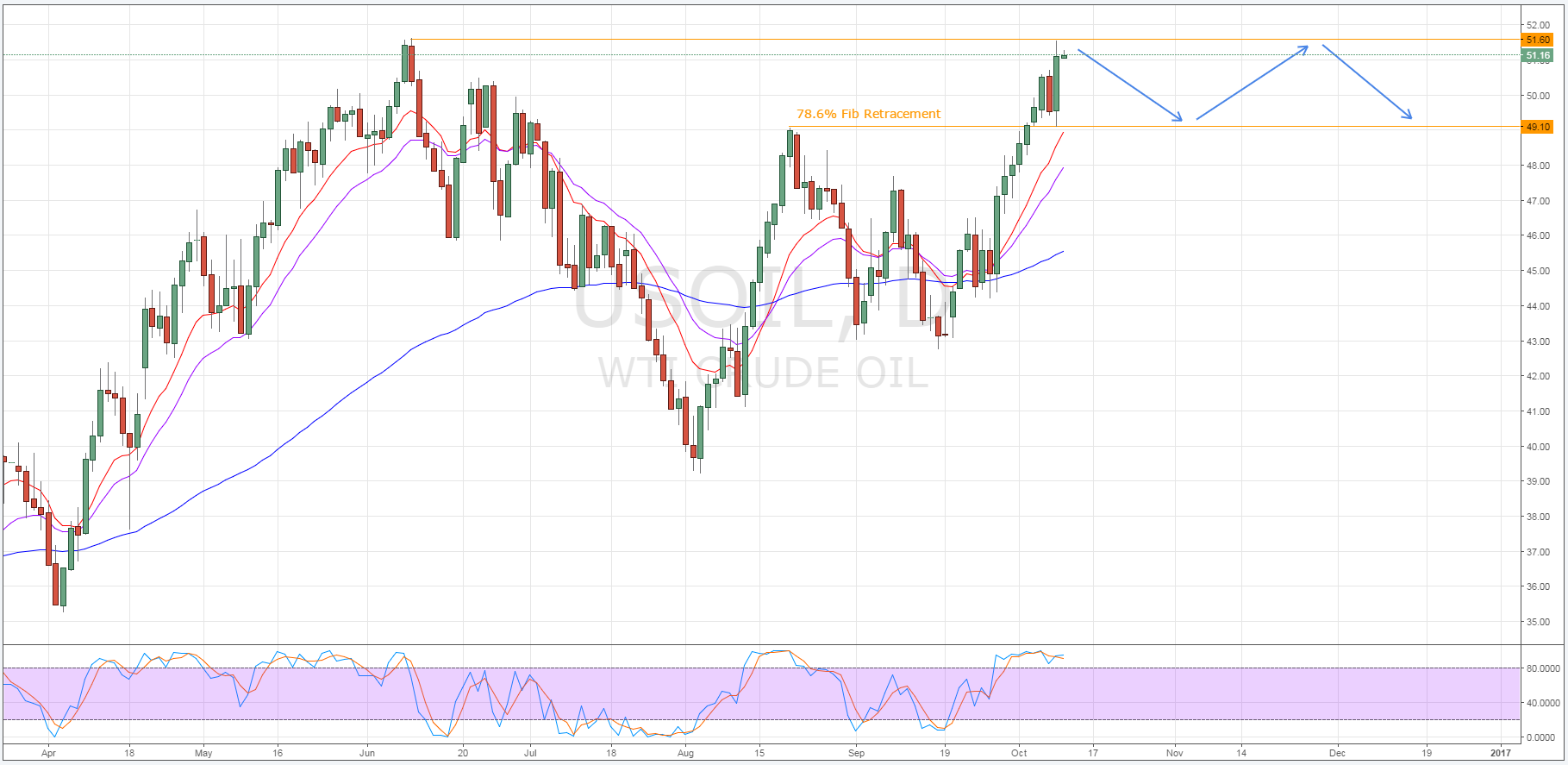

Russia’s recent endorsement of OPEC production freeze talks has brought a glimmer of hope to the oil bulls out there and, if a freeze is successfully implemented, they may actually have cause to be hopeful. However, whilst it’s likely higher prices may be seen going forward, it remains decidedly unlikely that we see oil significantly above the $50 mark in the medium-term. Consequently, we could see a ranging phase develop between the 51.60 and 49.10 levels as we move forward.

From a technical perceptive, the evidence signalling that the aforementioned levels should form the upper and lower bounds of a ranging phase is fairly straightforward. Firstly, having an upper constraint around the 51.60 mark is largely a result of this price being a historical zone of resistance.

However, overbought stochastics are also indicating that this price should prove to be turning point yet again. As for the lower constraint, the 49.10 mark coincides with a recent support zone and also the 78.6% Fibonacci retracement.

Looking at the fundamental side of things, one has to start with the OPEC talks and exactly what sort of agreement the group is attempting to achieve. Currently, OPEC is seeking to cut its current 33.6 million barrel per day rate of output to a more modest 32.5-33.0 million barrel per day rate. Naturally, cutting back—or even talking of cutting back—will see oil prices rally in response and will be seen by many as a signal that we are finally going to see oil prices hike back to 2014 levels.

Unfortunately, this neglects a number of key factors that ensures any rally in price will ultimately be self-defeating. As is widely known, when oil reaches the $50 mark, North American Shale becomes profitable and these producers begin to ramp up output. In fact, this is already happening as is demonstrated by the most recent Baker-Hughes rig count data. September’s global rig count of 1584 was up 2.39% on August, the vast majority of which was from Canadian and US rigs coming online. Additionally, this latest global rig count is now appreciably higher than this year’s average figure of 1561.

Moreover, even in the absence of increased supply from shale producers, a major stumbling block to any OPEC driven supply manipulations is Iran. Even as the global supply glut worsens, the now sanction-free nation continues to push towards its 5 million barrel a day production target. Consequently, the proposed OPEC cuts will be barely able to counteract the increased supply generated by the Iranians and will, therefore, have limited ability to push prices above the $50 mark.

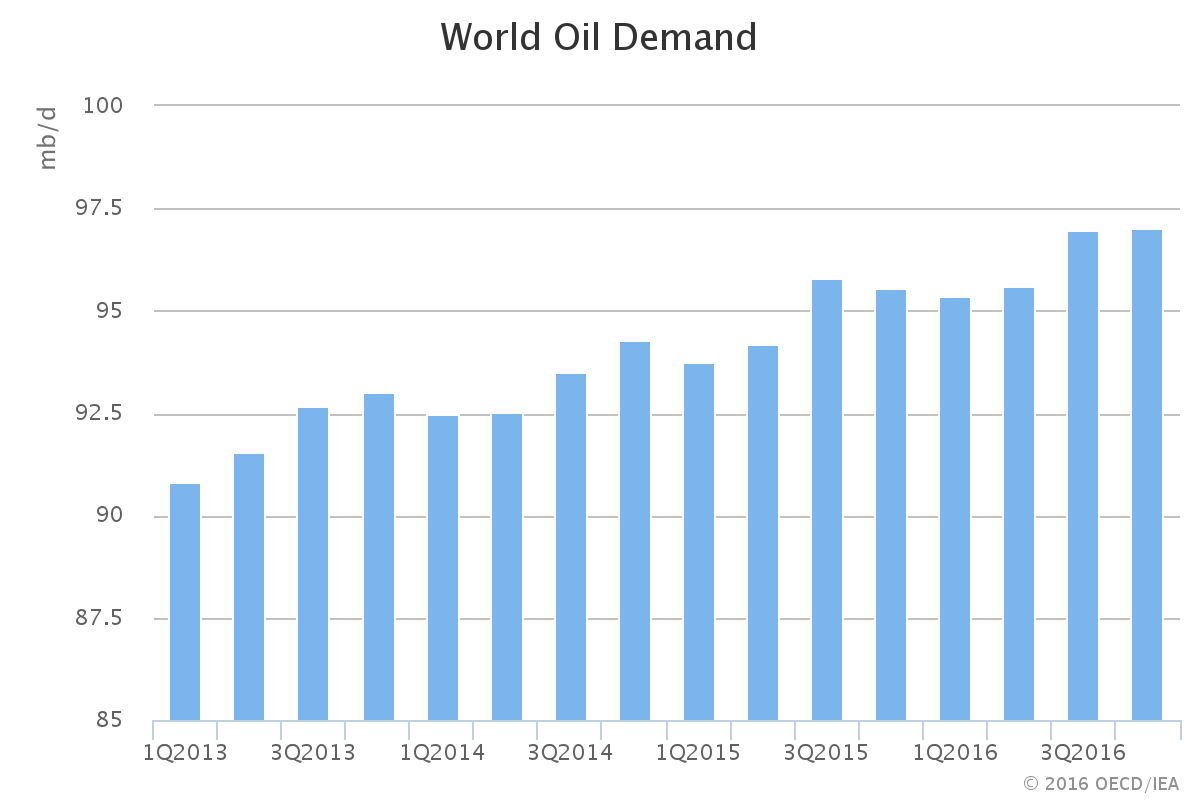

However, all is not doom and gloom for oil prices as even though we may not see prices above the $50 mark, we are less likely to see the commodity slip back far below the downside constraint mentioned above. This is largely a result of the growth in demand for oil that has been seen over the past number of quarters. As is shown in the above IEA data, demand has been increasing steadily and whilst it has been unable to keep pace with the increased supply, it is at least trending up again.

Ultimately, oil prices are still some way off from achieving previous highs and hopes that this is the break the oil bulls have been waiting for may be slightly overblown. As a result of the fundamental factors impacting the commodity, the $50-52 handle will remain an important zone of resistance. However, recent developments in these fundamentals could also keep oil somewhat more buoyant than recent months. Consequently, we can expect to see oil charts move into a ranging phase in the near to medium-term if OPEC, and now Russia, can finally implement a production freeze.