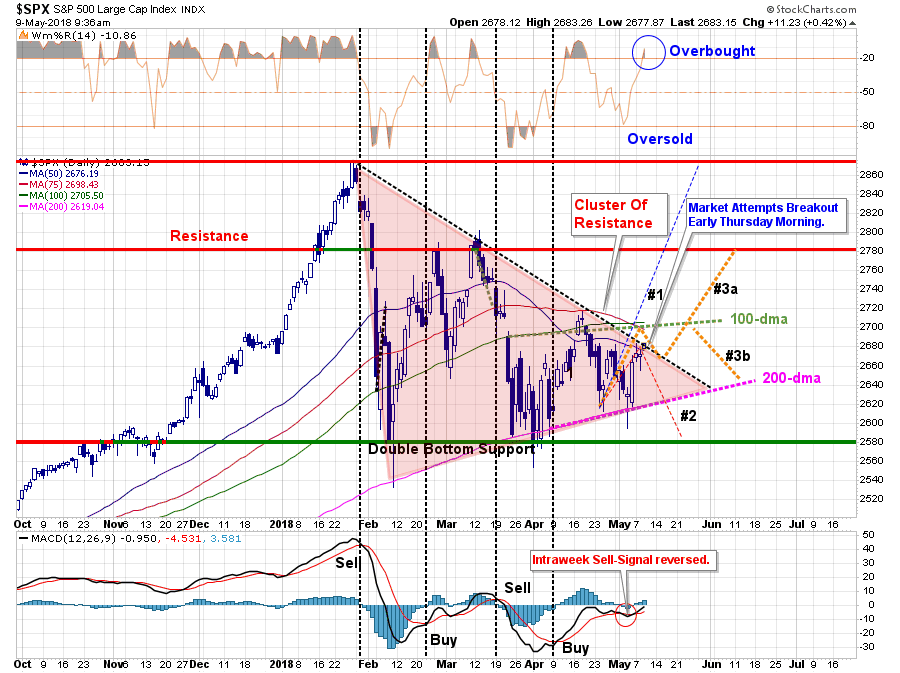

On Tuesday I discussed the “compression” of the market being akin to a “coiled spring” that when released could lead to a fairly decent move in one direction or another. To wit:

As you can see in the ‘reddish triangle,’ prices have been continually compressed into an ever smaller trading range. This ‘compression’ is akin to coiling a spring. The more tightly the spring is wound, the more energy it has when it is released.

As shown, the bulls are attempting a jailbreak of the compression that has pressured markets over the last two months. While the breakout is certainly encouraging, there isn’t much room before it runs into a more formidable resistance of the 100-day moving average. Furthermore, with interest rates closing in on 3% again, which has previously been a stumbling point for stock prices, it is too soon to significantly increase equity risk in portfolios.

This is just one day.

As I stated previously, as a portfolio manager I am not too concerned with what happens during the middle of the trading week, but rather where the market closes on Friday. This reduces the potential for “head fakes” as we saw last week with the break of the of the 200-dma on Thursday which was quickly reversed on Friday. The weekly close was one of the two outcomes as noted in our previous Quick-Take:

If the market closes ABOVE the 200-dma by the close of the market on Friday, we will simply be retesting support at the 200-dma for the fourth time. This will continue to keep the market trend intact and is bullish for stocks.

This breakout will provide a reasonable short-term trading opportunity for portfolios as I still think the most probable paths for the market currently are the #3a or #3b pathways shown above.

If we get a confirmed break out of this “compression range” we have been in, we will likely add some equity risk exposure to portfolios from a “trading” perspective. That means each position will carry both a very tight “stop price” where it will be sold if we are wrong as well as a “profit taking” objective if we are right.

Longer-term investments are made when there is more clarity about future returns. Currently, clarity is lacking as there are numerous “taxes” currently weighing on the markets which will eventually have to be paid.

- Rising oil and gasoline prices (Tax on consumers)

- Fed bent on hiking rates and reducing their balance sheet. (Tax on the markets)

- Potential trade wars (Tax on manufacturers)

- Geopolitical tensions with North Korea, Russia, China and Iran (Tax on sentiment)

- Traders all stacked up on the same side of the boat. (Tax on positioning)

We continue to hold higher levels of cash, but have closed out most of our market hedges for now as we giving the markets a bit more room to operate.

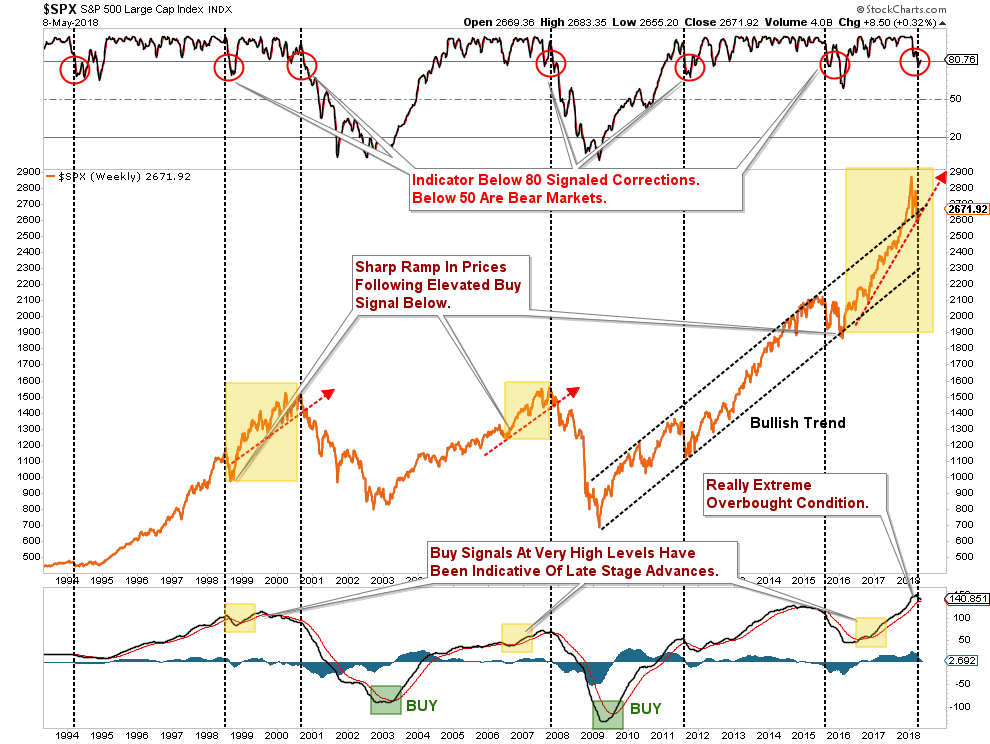

With longer-term indicators at very high levels and turning lower, we remain cautious longer-term. However, in the short-term markets can “defy rationality” longer than anyone can imagine. But it is in that defiance that investors consistently make the mistake of thinking “this time is different.”

It’s not. Valuations matter and they matter a lot in the long-term. Valuations coupled with rising interest rates, inflationary pressures, and weak economic growth are a toxic brew to long-term returns. It is also why it is quite possible we have seen the peak of the market for this year.