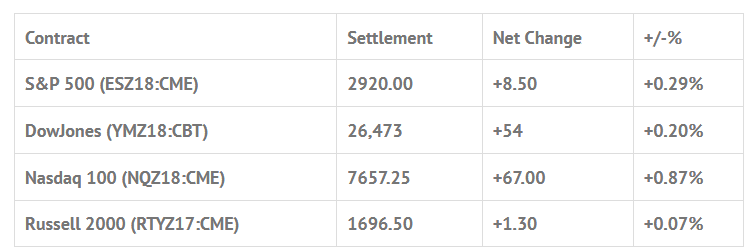

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +1.06%, Hang Seng +0.26%, Nikkei +1.36%

- In Europe 13 out of 13 markets are trading lower: CAC -1.40%, DAX -1.83%, FTSE -0.90%

- Fair Value: S&P +4.68, NASDAQ +26.85, Dow +13.11

- Total Volume: 1.19mil ESZ & 278 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the Personal Income and Outlays 8:30 AM ET, Chicago PMI 9:45 AM ET, Consumer Sentiment 10:00 AM ET, Baker-Hughes Rig Count 1:00 PM ET, and John Williams Speaks 4:45 PM ET.

S&P 500 Futures: Another Two Sided Day

After hitting a new low down to 2907.50 in the quiet overnight session, the S&P 500 futures opened yesterday’s regular session at 2917.50. The first move after the bell was a break down to an early low at 2914.00, before a rally, assisted by 9:00 and 9:30 buy programs, pushed the ES up to a mid morning high of 2929.00. After that there was a small pullback before the ES traveled up to the late morning high of day at 2932.00 just before noon.

The afternoon saw a slow drip lower which was helped by the MiM building up to $500 million to sell. As the final hour opened, the ES had dropped to a single tick shy of a 12 handle pullback, down to 2920.25. From there the ES drifted lower, printing 2917.00, as the final MOC came out $1.7 billion to sell. The benchmark future went on to print 2919.75 on the 3:00 cash close, before settling the day at 2920.00, up +8.50 handles, or +0.29%.

In the end it was a tale of two sides. The bulls controlled the open, and it looked like it was going to be a trend day higher, but the bears controlled the afternoon as the ES travelled back to the day’s 8:30 open.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.